Travel and expense reimbursement policy (Arizona): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Arizona)

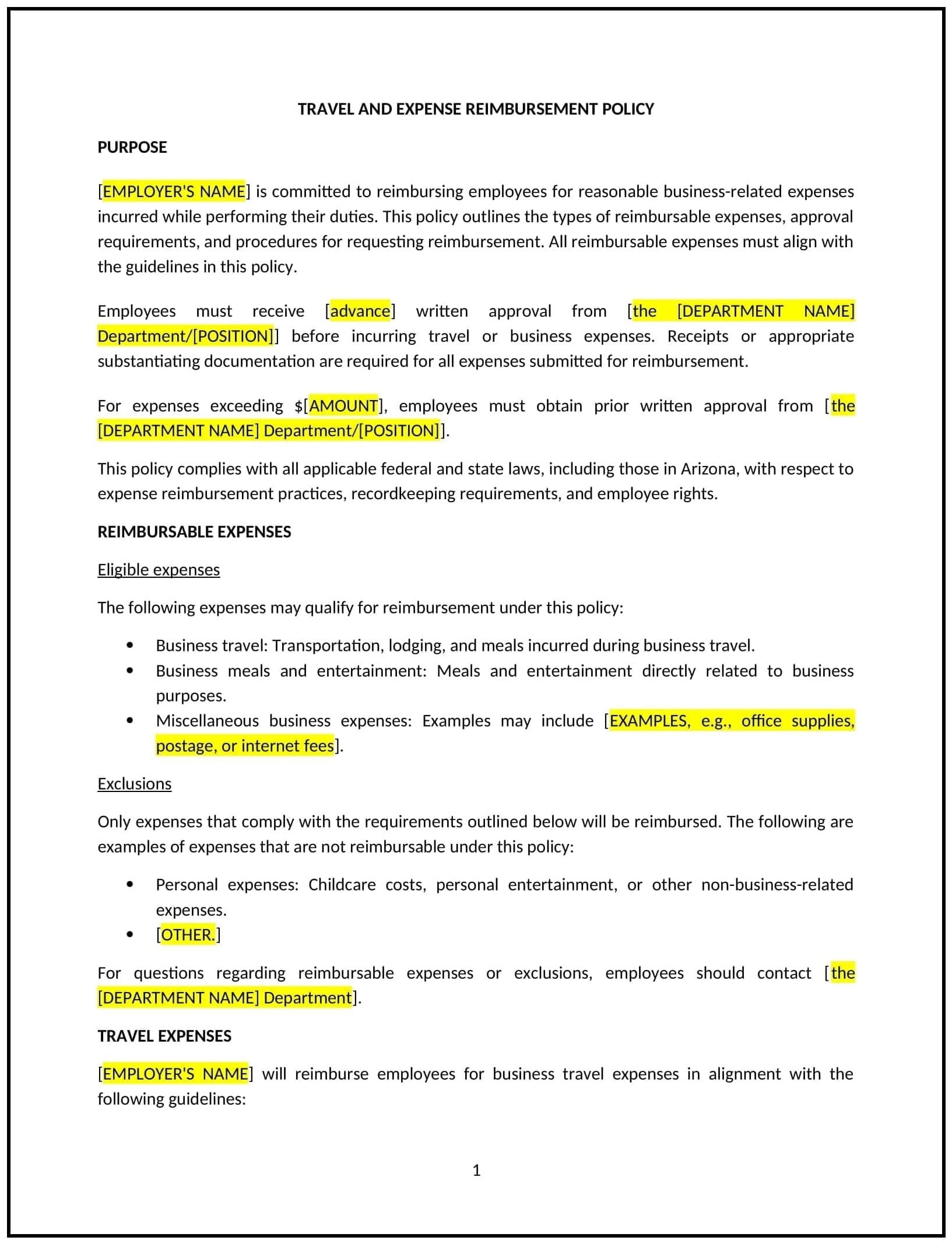

In Arizona, a travel and expense reimbursement policy provides employees with guidelines for reimbursable business-related expenses, ensuring that travel, lodging, meals, and other work-related costs are managed fairly and consistently. This policy helps businesses control costs while ensuring employees are fairly compensated for work-related expenses.

This policy outlines the types of expenses that are eligible for reimbursement, the process for submitting claims, and the documentation required.

By implementing this policy, Arizona businesses can maintain financial control, ensure transparency, and comply with tax regulations regarding employee reimbursements.

How to use this travel and expense reimbursement policy (Arizona)

- Define reimbursable expenses: Clearly outline which expenses are eligible for reimbursement, including transportation, lodging, meals, and incidental costs incurred during business travel.

- Set approval procedures: Establish a process for employees to obtain pre-approval for major expenses or travel before they incur them.

- Outline submission guidelines: Specify how employees should submit reimbursement requests, including the necessary forms, receipts, and documentation.

- Set limits on spending: Provide guidelines for reasonable expense limits, such as per diem rates or caps on specific categories of expenses (e.g., meals or hotel stays).

- Address timely submission: Require employees to submit reimbursement requests within a specified period after the travel, ensuring efficient processing of claims.

Benefits of using a travel and expense reimbursement policy (Arizona)

This policy offers several advantages for Arizona businesses:

- Controls costs: By setting clear spending limits and guidelines, the policy helps the business manage travel-related expenses within budget.

- Increases consistency: Provides employees with a standard process for submitting and approving expenses, reducing confusion and ensuring fairness.

- Supports compliance: Aligns with Arizona tax regulations and federal guidelines, ensuring proper documentation and reporting of expenses.

- Improves transparency: Clearly outlines the reimbursement process, helping prevent misunderstandings or disputes over eligible expenses.

- Enhances employee satisfaction: Ensures employees are reimbursed promptly for legitimate work-related expenses, promoting a positive work environment.

Tips for using this travel and expense reimbursement policy (Arizona)

- Address Arizona-specific considerations: Reflect any state-specific regulations related to travel and expense reimbursement, including state per diem rates or specific rules on tax-exempt expenses.

- Use technology: Leverage expense management software or tools to streamline the submission, approval, and tracking of expenses.

- Educate employees: Provide clear communication during onboarding and throughout employment regarding the process for submitting expenses and what is considered reimbursable.

- Monitor and audit: Regularly review expense reports to ensure compliance with the policy and identify opportunities for cost-saving measures.

- Update periodically: Revise the policy as needed to reflect changes in business practices, employee needs, or changes in regulations.