Travel and expense reimbursement policy (California)

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (California)

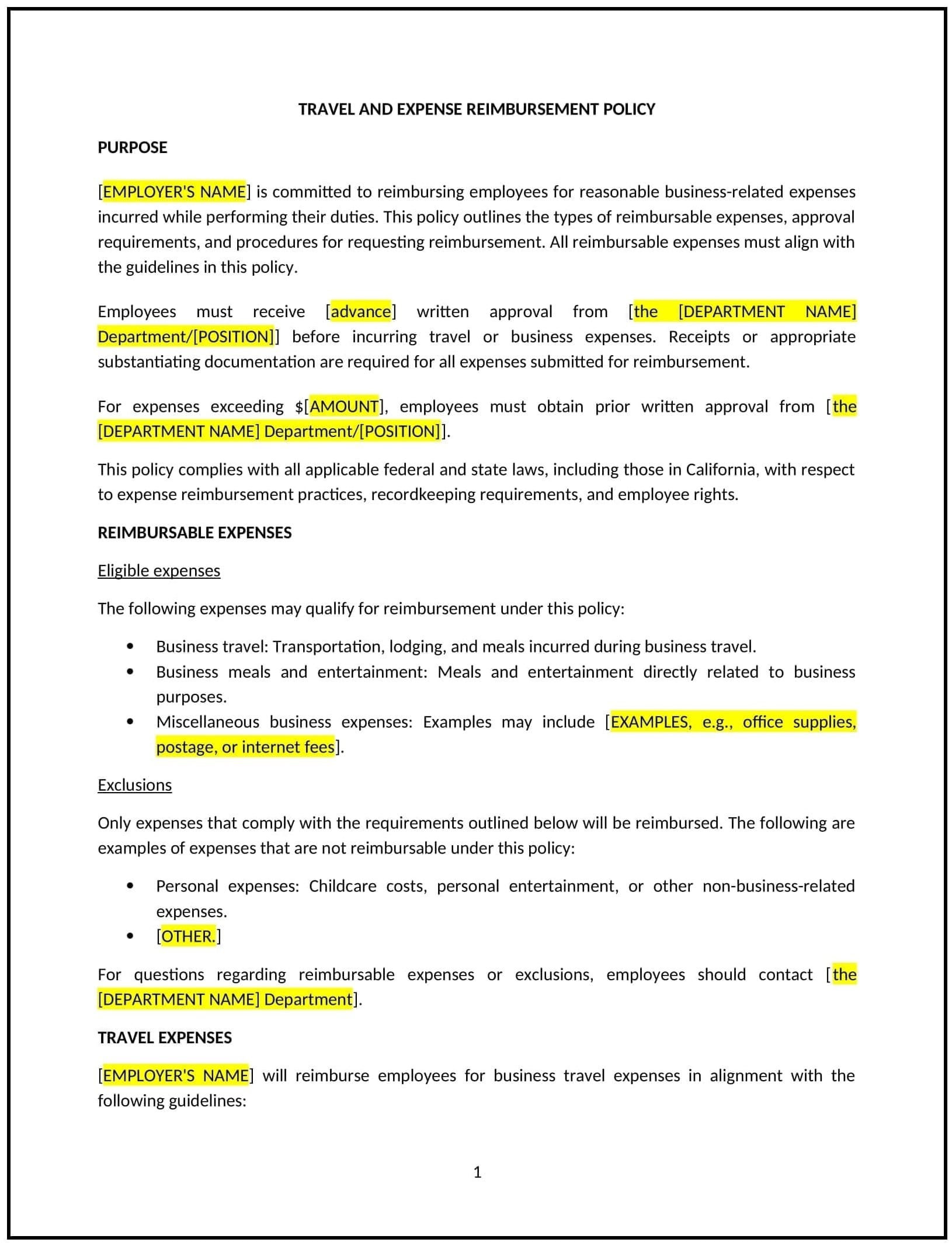

In California, a travel and expense reimbursement policy provides businesses with guidelines for reimbursing employees for reasonable and necessary expenses incurred while performing work-related duties. This policy supports compliance with California Labor Code Section 2802, which requires employers to reimburse employees for all necessary business expenses.

This policy outlines eligible expenses, reimbursement procedures, and documentation requirements. By implementing this policy, California businesses can ensure transparency, promote fairness, and maintain legal compliance.

How to use this travel and expense reimbursement policy (California)

- Define eligible expenses: Specify reimbursable expenses, such as transportation, lodging, meals, and work-related supplies, ensuring alignment with California law.

- Establish limits: Set clear limits or guidelines for reimbursable amounts, such as per diem rates for meals or maximum lodging costs.

- Outline reimbursement procedures: Provide steps for employees to submit expense claims, including deadlines, forms, and required documentation like receipts.

- Address unauthorized expenses: Clarify which expenses are not covered and the process for handling disputes over reimbursement claims.

- Maintain records: Require thorough documentation of expense claims and approvals to ensure transparency and compliance.

Benefits of using this travel and expense reimbursement policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Ensures adherence to California Labor Code Section 2802, protecting the business from legal disputes.

- Promotes fairness: Provides consistent reimbursement guidelines for all employees, minimizing misunderstandings.

- Enhances transparency: Clarifies reimbursement processes, fostering trust and accountability.

- Improves efficiency: Streamlines expense management and reduces administrative burden through clear procedures.

- Protects employee trust: Demonstrates the business’s commitment to reimbursing employees for necessary business-related costs.

Tips for using this travel and expense reimbursement policy (California)

- Reflect California-specific laws: Ensure compliance with Labor Code Section 2802, which mandates reimbursement for necessary business expenses.

- Train managers: Educate supervisors on the policy and how to handle employee expense claims fairly and consistently.

- Use expense tracking systems: Implement digital tools to streamline the submission and approval of expense claims.

- Encourage timely submissions: Set clear deadlines for submitting expense claims to avoid delays in reimbursement.

- Review regularly: Update the policy to reflect changes in California laws or business practices.