Travel and expense reimbursement policy (Delaware): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

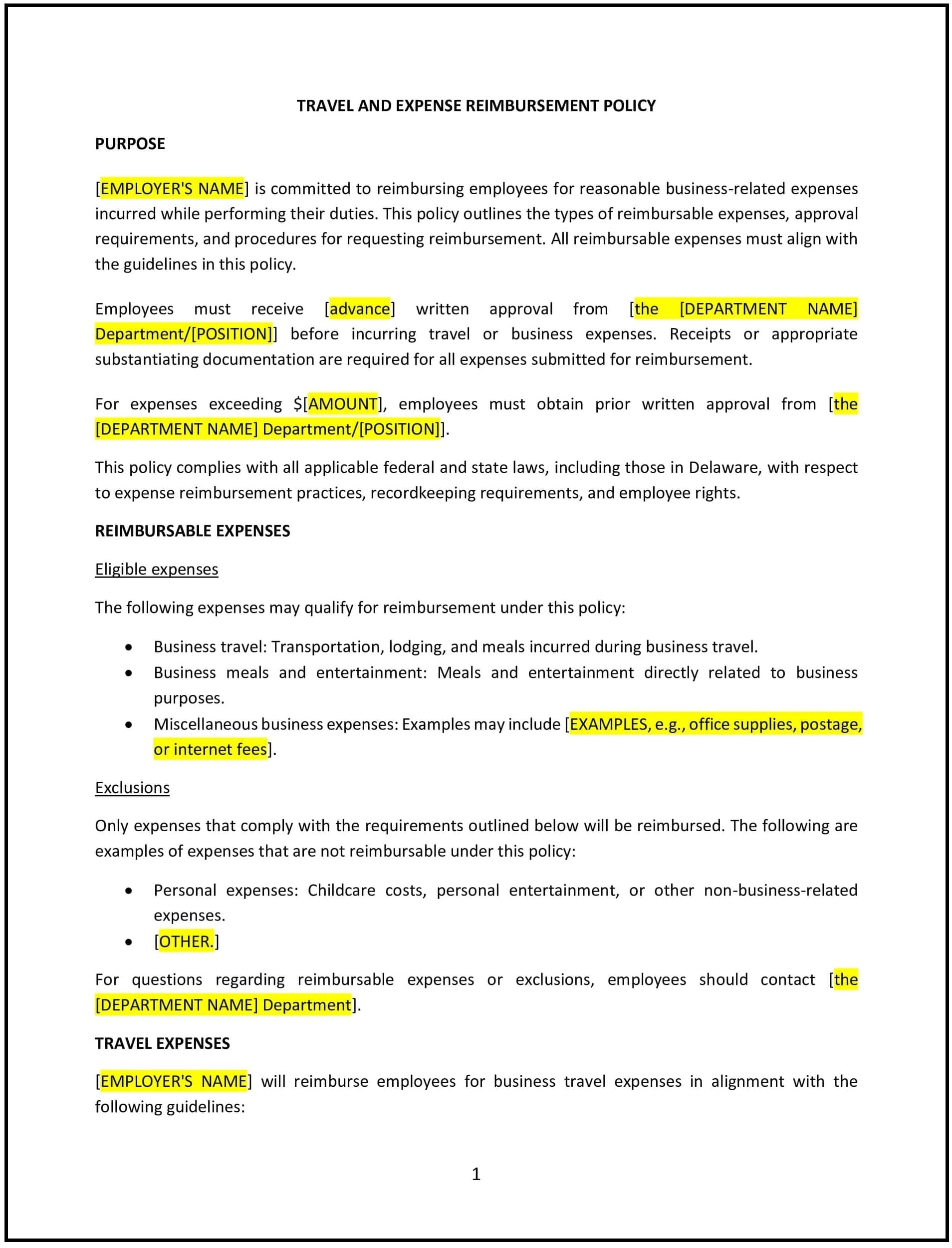

Travel and expense reimbursement policy (Delaware)

A travel and expense reimbursement policy helps Delaware businesses define procedures for reimbursing employees for expenses incurred during business-related travel. This policy ensures consistency, transparency, and compliance with Delaware and federal tax regulations while promoting fiscal responsibility.

By implementing this policy, businesses can streamline expense management, maintain financial accountability, and support employees in fulfilling work-related duties.

How to use this travel and expense reimbursement policy (Delaware)

- Define reimbursable expenses: Specify eligible expenses, such as airfare, lodging, meals, transportation, and business-related supplies, and outline any spending limits or caps.

- Establish pre-approval requirements: Include guidelines for obtaining managerial approval for travel and associated expenses before incurring costs.

- Provide submission procedures: Detail how employees should submit reimbursement requests, including the required documentation such as receipts, invoices, and expense reports.

- Set timelines for submission: Specify deadlines for submitting reimbursement requests to ensure timely processing and payment.

- Outline payment processing: Explain how reimbursements will be issued, such as through direct deposit or payroll adjustments, and provide an estimated timeframe for payment.

- Ensure compliance: Align the policy with Delaware and federal regulations, including IRS guidelines for taxable and non-taxable reimbursements.

Benefits of using this travel and expense reimbursement policy (Delaware)

This policy offers several advantages for Delaware businesses:

- Promotes financial accountability: Encourages employees to manage expenses responsibly by providing clear guidelines and limits.

- Streamlines expense management: Simplifies tracking, reviewing, and reimbursing employee expenses for greater operational efficiency.

- Ensures compliance: Reduces the risk of regulatory penalties by adhering to tax laws and Delaware labor regulations.

- Enhances employee satisfaction: Demonstrates the company’s commitment to supporting employees’ business-related needs and providing timely reimbursements.

- Reduces disputes: Establishes clear expectations, minimizing misunderstandings or disagreements regarding eligible expenses.

Tips for using this travel and expense reimbursement policy (Delaware)

- Communicate the policy clearly: Ensure all employees understand the scope of reimbursable expenses, submission procedures, and approval requirements.

- Use expense management tools: Leverage software solutions to track, review, and process expense reports efficiently.

- Provide training: Offer guidance to employees and managers on adhering to the policy and avoiding common errors in expense reporting.

- Monitor compliance: Regularly review expense claims and auditing processes to ensure alignment with company policies and legal standards.

- Update periodically: Revise the policy to reflect changes in Delaware laws, tax regulations, or company procedures.