Travel and expense reimbursement policy (Georgia): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

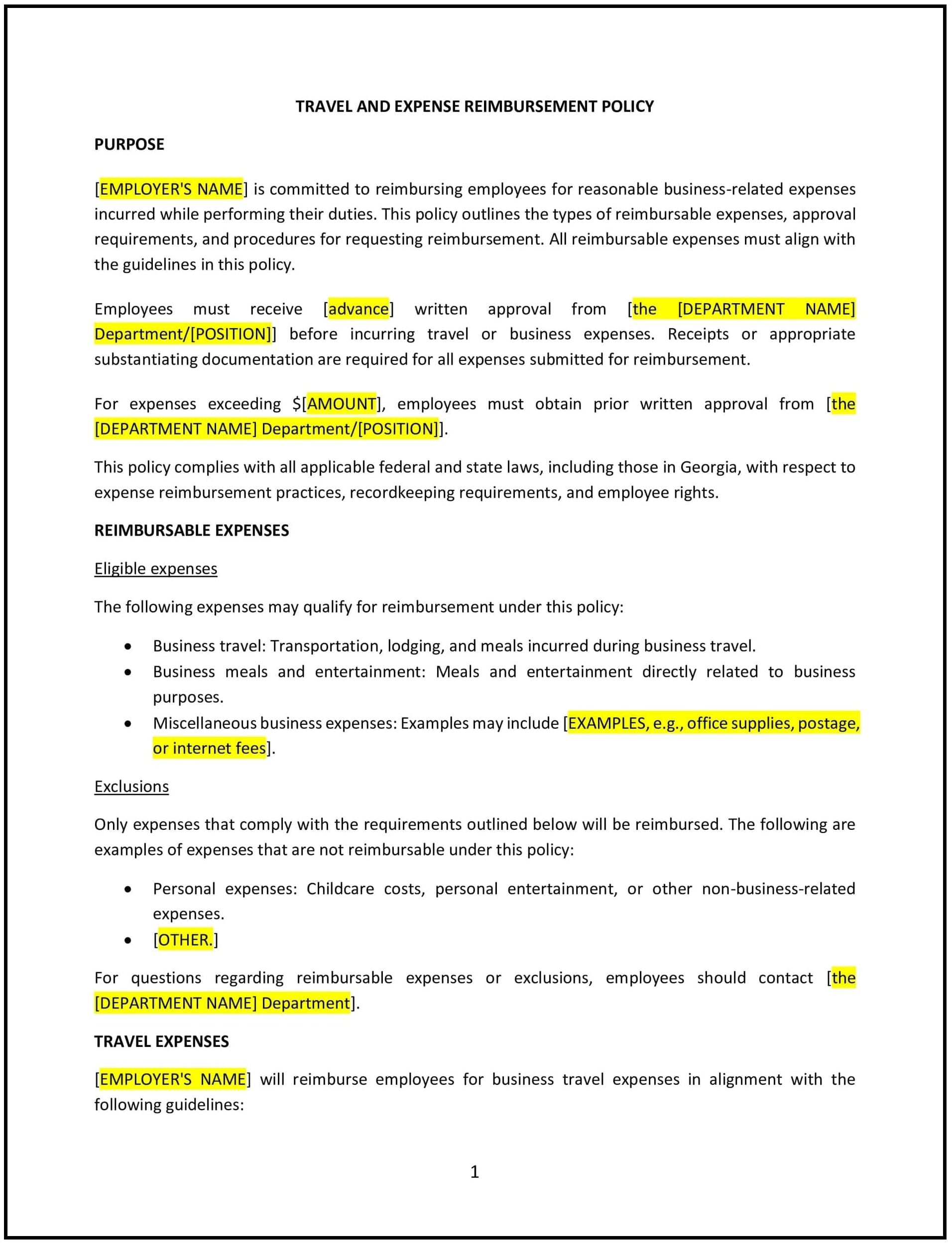

Travel and expense reimbursement policy (Georgia)

This travel and expense reimbursement policy is designed to help Georgia businesses manage employee travel expenses effectively. The policy outlines approved expenses, reimbursement procedures, and documentation requirements to ensure fair and efficient reimbursement for work-related travel.

By implementing this policy, businesses can streamline expense management, maintain transparency, and support employees during work-related travel.

How to use this travel and expense reimbursement policy (Georgia)

- Define approved expenses: Clearly specify which expenses are eligible for reimbursement, such as transportation, lodging, meals, and other business-related costs.

- Establish pre-approval requirements: Require employees to obtain prior approval for travel and major expenses to align with business budgets.

- Outline reimbursement limits: Set clear spending limits for categories like meals, mileage, and accommodations, tailored to Georgia-specific cost considerations.

- Require documentation: Employees should submit detailed receipts, invoices, or other proof of expenses for reimbursement.

- Specify submission timelines: Provide a timeframe within which employees must submit reimbursement requests after travel.

- Offer a reimbursement process: Clearly outline how to submit requests, including forms, required details, and points of contact.

- Monitor and audit: Regularly review expense reports to ensure adherence to the policy and address any discrepancies.

- Review and update regularly: Periodically assess the policy to reflect changes in business needs or Georgia-specific travel costs.

Benefits of using this travel and expense reimbursement policy (Georgia)

Implementing this policy provides several advantages for Georgia businesses:

- Promotes fairness: Standardized guidelines ensure all employees are treated equitably regarding reimbursement.

- Enhances accountability: Clear documentation requirements minimize potential misuse of funds.

- Improves budgeting: Pre-approval and limits help businesses manage travel expenses efficiently.

- Builds trust: Transparent processes foster confidence among employees regarding reimbursements.

- Reflects Georgia-specific practices: Tailoring the policy to local costs and travel needs ensures relevance and practicality.

Tips for using this travel and expense reimbursement policy (Georgia)

- Communicate expectations: Share the policy with employees before they undertake work-related travel.

- Encourage timely submissions: Remind employees to submit expense reports promptly after travel.

- Use technology: Leverage expense management software to streamline submissions and approvals.

- Align with business goals: Ensure travel expenses align with organizational priorities and budgets.

- Provide feedback opportunities: Encourage employees to share insights on the reimbursement process for ongoing improvement.