Travel and expense reimbursement policy (Maryland): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Maryland)

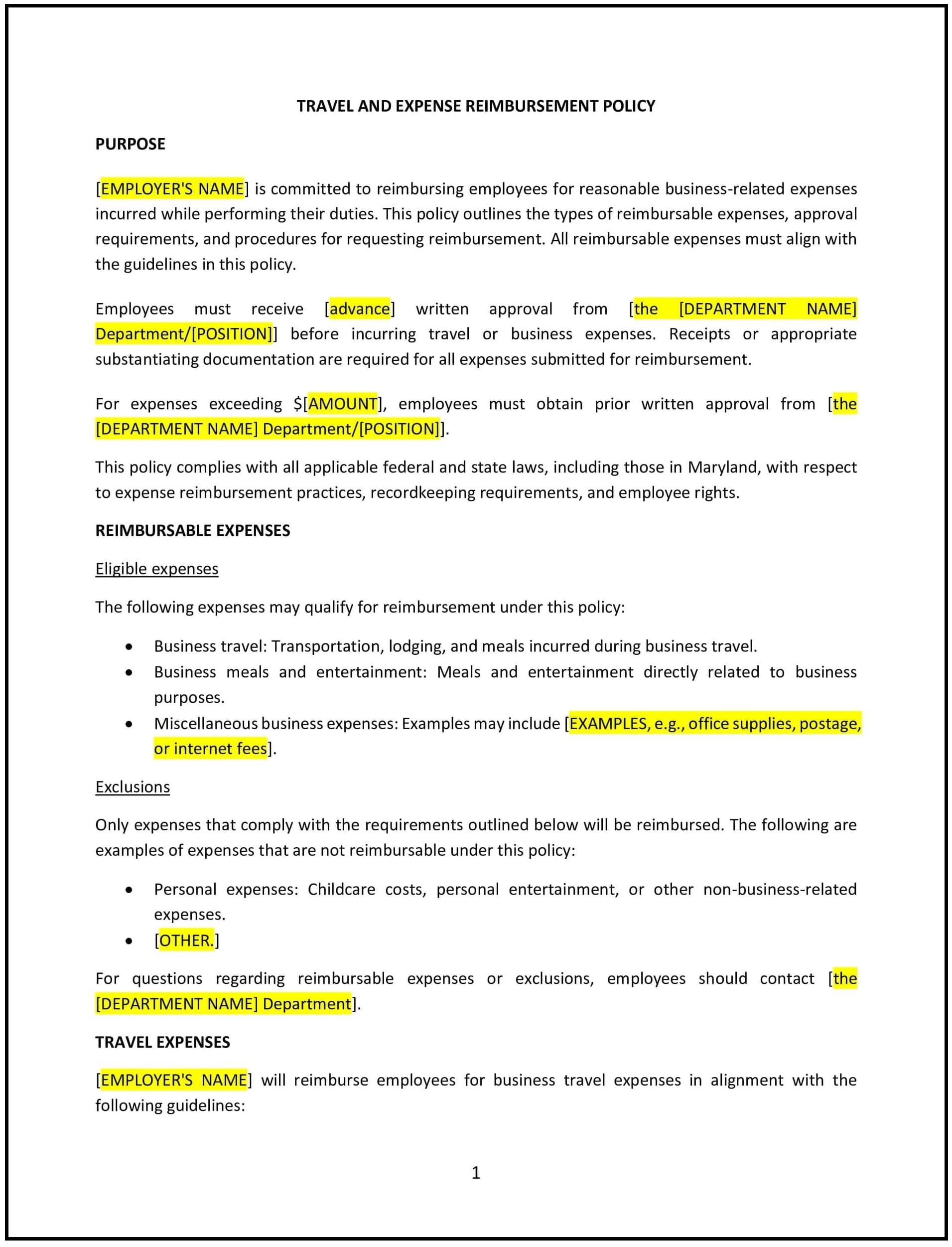

This travel and expense reimbursement policy is designed to help Maryland businesses manage employee expenses incurred during business-related travel and activities. It outlines the process for submitting, approving, and reimbursing travel and other work-related expenses while maintaining transparency and budget control.

By adopting this policy, Maryland businesses can ensure fair and consistent reimbursement practices while controlling costs associated with employee travel and work-related expenditures.

How to use this travel and expense reimbursement policy (Maryland)

- Define reimbursable expenses: Specify which types of expenses are eligible for reimbursement, such as transportation, lodging, meals, and incidentals.

- Set approval procedures: Outline the process for requesting travel and expense reimbursements, including pre-approval requirements for larger expenses or trips.

- Establish reimbursement rates: Set clear limits on reimbursement amounts for specific expenses, such as per diem meal allowances or mileage rates for personal vehicle use.

- Specify documentation requirements: Require employees to submit receipts, invoices, or other supporting documentation for all expenses incurred during business travel.

- Provide timelines for submission: Set deadlines for submitting reimbursement requests after travel or expenses have been incurred, ensuring timely processing.

- Reflect Maryland-specific considerations: Address any state-specific laws or tax considerations regarding employee reimbursements and deductions.

Benefits of using this travel and expense reimbursement policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Controls costs: Helps businesses manage and track travel-related expenses to avoid overspending and ensure budget adherence.

- Promotes fairness: Ensures all employees are reimbursed fairly for legitimate work-related expenses, regardless of position or seniority.

- Enhances transparency: Provides clear guidelines for employees on what is reimbursable, reducing confusion or disputes.

- Streamlines processes: Standardizes the process for requesting and approving reimbursements, improving efficiency and reducing administrative burden.

- Aligns with legal requirements: Ensures compliance with Maryland’s tax and labor laws regarding employee reimbursements.

Tips for using this travel and expense reimbursement policy (Maryland)

- Communicate the policy clearly: Ensure employees are aware of the policy before they incur any travel expenses, ideally through onboarding or company-wide communications.

- Implement tracking systems: Use expense management software or tools to track employee travel and expenses for easier reporting and auditing.

- Monitor compliance: Regularly review submitted expenses to ensure they are in line with company policies and Maryland laws.

- Set clear guidelines: Provide examples of allowable and non-allowable expenses to avoid misunderstandings.

- Review regularly: Periodically review and update the policy to reflect changes in Maryland laws, company budgeting, or travel practices.