Travel and expense reimbursement policy (Massachusetts): Free template

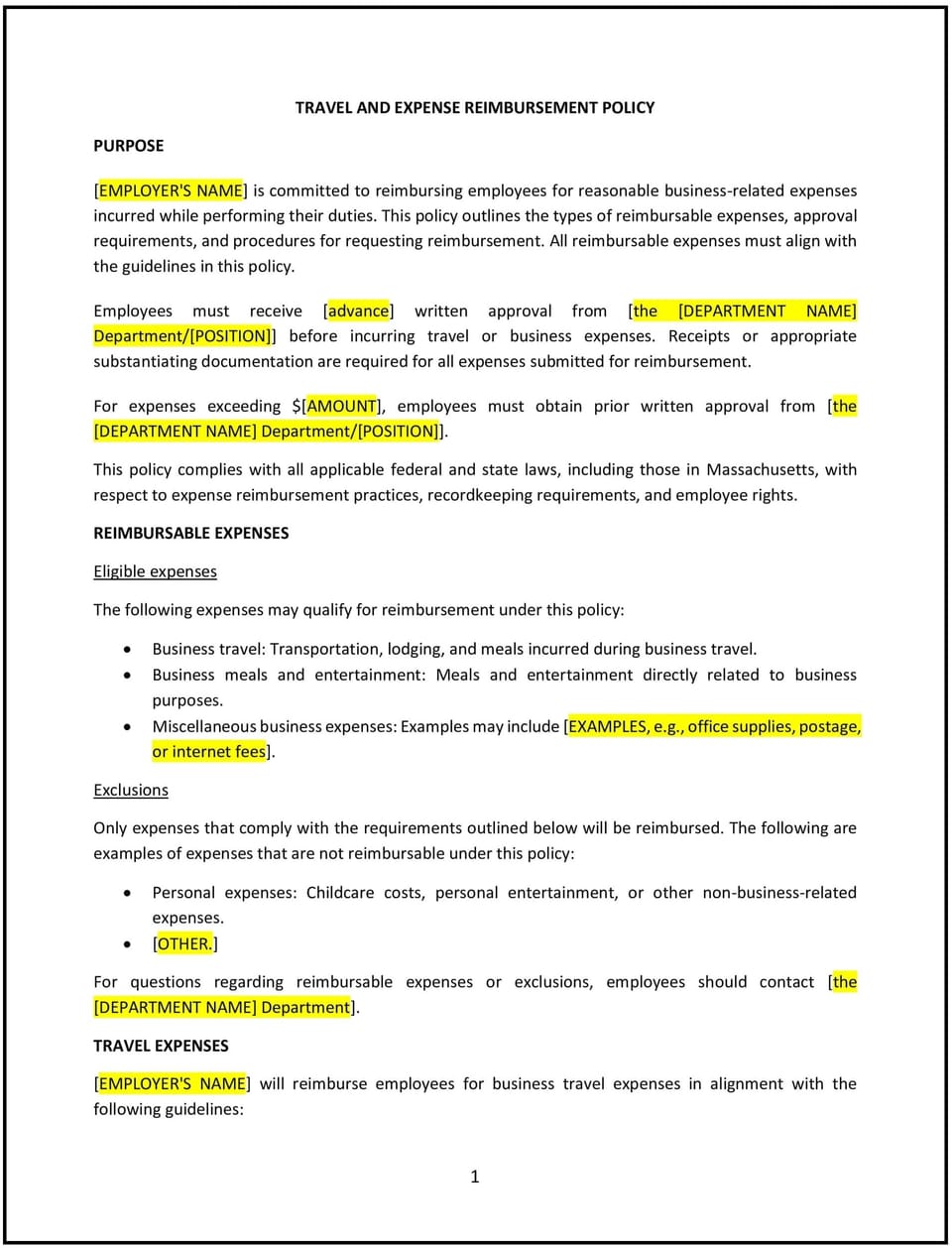

This travel and expense reimbursement policy is designed to help Massachusetts businesses manage employee travel and associated expenses in a fair and consistent manner. The policy outlines the types of expenses that are eligible for reimbursement, the process employees must follow to request reimbursement, and any limitations or guidelines that apply. The goal is to ensure that both the company and employees adhere to clear standards for travel-related expenditures while maintaining compliance with Massachusetts state laws and federal regulations.

By adopting this policy, businesses can streamline the reimbursement process, avoid misunderstandings, and ensure that employees are reimbursed for legitimate business expenses while promoting financial accountability.

How to use this travel and expense reimbursement policy (Massachusetts)

- Define eligible expenses: Specify which types of expenses are eligible for reimbursement, such as transportation (flights, mileage, taxis), lodging, meals, and other business-related expenses. The policy should make it clear that only reasonable and necessary expenses will be reimbursed.

- Set spending limits: Outline any limits or guidelines on spending for travel-related expenses. This could include caps on meal allowances, hotel rates, or transportation costs. The policy should also include guidelines for choosing cost-effective options while traveling.

- Provide a clear reimbursement process: Establish the steps employees should follow to request reimbursement, including submitting receipts, completing reimbursement forms, and adhering to deadlines. The policy should clarify how and when employees can expect to be reimbursed.

- Specify documentation requirements: Require employees to provide detailed documentation for reimbursement requests, such as itemized receipts, proof of payment, and a brief explanation of the business purpose for each expense. The policy should also clarify what documentation is required for different types of expenses (e.g., hotel stay, meals, mileage).

- Address travel approval: Define the approval process for travel. Employees should be informed about any pre-approval requirements for travel and associated expenses. This could include managerial approval for travel arrangements, flight bookings, or hotel reservations.

- Clarify reimbursement for mileage: If employees are reimbursed for the use of their personal vehicles, the policy should specify the mileage rate and how it will be calculated. The policy should also address whether fuel and other car-related expenses are reimbursed.

- Ensure compliance with Massachusetts and federal laws: Ensure that the policy complies with Massachusetts state laws and federal regulations regarding travel expenses, including the federal per diem rates for meals and lodging and tax-related issues associated with reimbursements.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with changes in Massachusetts state laws, federal regulations, and company needs. Regular reviews will help ensure the policy remains relevant and effective.

Benefits of using this travel and expense reimbursement policy (Massachusetts)

This policy offers several benefits for Massachusetts businesses:

- Promotes fairness and transparency: A clear and consistent reimbursement policy ensures that all employees are treated fairly and that the reimbursement process is transparent. This reduces the risk of disputes over reimbursements.

- Supports cost control: By setting limits on travel-related expenses, businesses can control costs and ensure that employees make reasonable decisions when traveling for work.

- Enhances financial accountability: The policy helps businesses track and control travel expenses, reducing the risk of overspending or misuse of company funds.

- Increases employee satisfaction: Employees are more likely to be satisfied with the reimbursement process when the policy is straightforward, easy to follow, and consistently applied.

- Strengthens compliance with tax regulations: By following federal and state guidelines for travel reimbursement, businesses can avoid tax-related issues and ensure that reimbursements are processed correctly.

- Improves budgeting and forecasting: By having a structured travel and expense reimbursement policy, businesses can better predict and plan for travel-related costs, making budgeting and financial forecasting more accurate.

Tips for using this travel and expense reimbursement policy (Massachusetts)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy and understand how to submit reimbursement requests. Provide the policy in the employee handbook and discuss it during onboarding or regular training sessions.

- Set clear approval processes: Establish clear guidelines for obtaining pre-approval for travel and expenses. Managers should be aware of the approval process to avoid delays in booking or reimbursements.

- Provide tools for tracking expenses: Consider providing employees with tools (such as an expense reporting system) to help them track and submit expenses easily. This can simplify the reimbursement process and ensure that all necessary information is included.

- Review receipts and documentation thoroughly: Ensure that employees submit detailed receipts and appropriate documentation for all expenses. This helps avoid misunderstandings and ensures that only legitimate expenses are reimbursed.

- Encourage cost-effective travel: Encourage employees to make cost-effective travel decisions by providing guidelines for choosing affordable options while maintaining comfort and efficiency.

- Review and update regularly: Periodically review the policy to ensure it reflects any changes in Massachusetts state laws, federal regulations, and the company’s evolving business needs. Update the policy as necessary to ensure that it remains relevant and compliant.

Q: What expenses are eligible for reimbursement under this policy?

A: Eligible expenses include transportation (flights, mileage, taxis), lodging, meals, and any other reasonable business-related expenses incurred while traveling for work. The policy specifies any restrictions or guidelines for different types of expenses.

Q: Do employees need pre-approval for their travel expenses?

A: Yes, employees should seek pre-approval from their manager for any travel arrangements, including flight bookings, hotel reservations, and other significant expenses. The policy outlines the approval process and timelines for submitting requests.

Q: How do employees request reimbursement for travel expenses?

A: Employees must submit itemized receipts and complete an expense report, following the company’s reimbursement process. The policy outlines the documentation required and the deadlines for submitting reimbursement requests.

Q: Can employees be reimbursed for meals while traveling?

A: Yes, the policy provides guidelines on meal reimbursements, including daily meal limits and allowable expenses. The policy may also specify per diem rates or offer guidance on how to track meal expenses while traveling.

Q: How will employees be reimbursed for mileage?

A: Employees who use their personal vehicles for business travel are reimbursed based on the company’s mileage rate. The policy outlines how mileage is calculated and whether fuel or other car-related expenses are eligible for reimbursement.

Q: How often should this policy be reviewed?

A: The policy should be reviewed at least annually to ensure it is compliant with Massachusetts state laws, federal regulations, and any changes in the company’s travel and reimbursement practices. Regular reviews will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.