Travel and expense reimbursement policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Michigan)

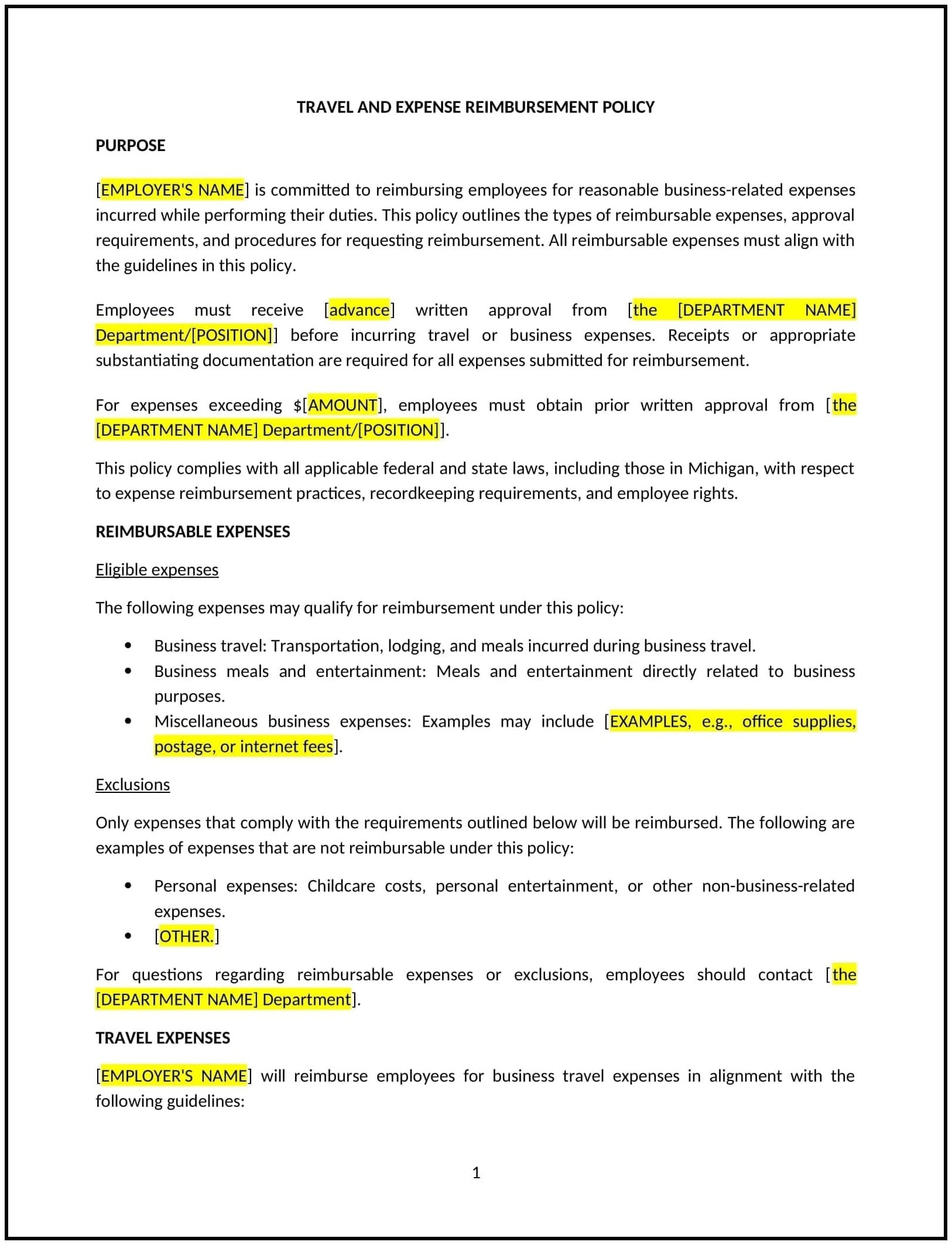

A travel and expense reimbursement policy provides Michigan businesses with guidelines for reimbursing employees for business-related travel and expenses. This policy outlines which expenses are eligible for reimbursement, the documentation required for reimbursement, and the process for submitting and approving claims. It helps ensure that employees are compensated for expenses incurred while traveling for work while maintaining control over business expenditures and ensuring compliance with applicable laws.

By implementing this policy, businesses can manage travel and expenses effectively, streamline the reimbursement process, and reduce the risk of misunderstandings or disputes over expenses.

How to use this travel and expense reimbursement policy (Michigan)

- Define eligible expenses: Clearly specify which expenses are eligible for reimbursement, such as transportation (airfare, mileage, taxis), lodging, meals, and incidentals (parking, tolls, etc.). The policy should outline the specific categories of expenses that will be reimbursed and any exclusions.

- Set spending limits: Establish guidelines on reasonable limits for expenses, such as maximum hotel rates, per diem meal allowances, and mileage reimbursement rates. The policy should specify how these limits are determined, whether based on company standards, industry averages, or federal guidelines.

- Outline the approval process: Define the steps for obtaining approval for business-related travel and expenses, including who must approve travel before it occurs and how employees should submit expense reports for reimbursement.

- Specify documentation requirements: Require employees to submit detailed receipts, invoices, or other supporting documents when requesting reimbursement. The policy should specify which documents are acceptable and the required level of detail, such as dates, locations, and descriptions of expenses.

- Set timeframes for reimbursement: Clearly outline the timeframes within which employees should submit their expense reports, as well as how long they can expect to receive reimbursement after submitting their claims. This ensures that employees are reimbursed promptly and reduces delays in processing claims.

- Address non-reimbursable expenses: List common expenses that are not eligible for reimbursement, such as personal expenses, entertainment, or alcohol. Clarify any gray areas to prevent confusion and ensure consistency in reimbursement practices.

- Provide guidelines for international travel: If applicable, provide additional guidelines for international travel, such as currency conversion, documentation requirements, and approval processes for out-of-country trips.

- Comply with Michigan state and federal laws: Ensure that the policy complies with Michigan state laws, federal tax regulations, and industry-specific guidelines regarding travel and expense reimbursements.

- Review and update regularly: Periodically review and update the policy to reflect changes in business practices, legal requirements, or industry standards, ensuring it remains relevant and effective.

Benefits of using this travel and expense reimbursement policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Streamlines reimbursement processes: By setting clear guidelines and procedures, businesses can simplify the reimbursement process for employees, ensuring that claims are processed quickly and accurately.

- Promotes transparency and consistency: The policy ensures that all employees are treated equally and that expenses are reimbursed based on standardized guidelines, reducing potential conflicts or misunderstandings.

- Reduces administrative burden: A clear and efficient reimbursement process helps reduce the administrative workload associated with managing travel and expenses, freeing up time for HR and finance departments.

- Ensures legal and tax compliance: By adhering to Michigan state laws and federal tax regulations, businesses can avoid potential legal issues or penalties related to improper reimbursement practices.

- Controls costs: By setting spending limits and approving travel in advance, businesses can maintain control over travel-related expenses, ensuring that spending stays within budget.

- Enhances employee satisfaction: Timely and accurate reimbursement for business-related expenses contributes to employee satisfaction and can help attract and retain top talent by demonstrating fairness and support for employees.

Tips for using this travel and expense reimbursement policy (Michigan)

- Communicate the policy clearly: Ensure all employees are aware of the travel and expense reimbursement policy by including it in the employee handbook, during onboarding, and in regular reminders about business travel guidelines.

- Simplify the reimbursement process: Provide employees with clear instructions on how to submit expense reports and the required documentation. Consider using expense management software or tools to streamline the submission and approval process.

- Monitor adherence to spending limits: Regularly review submitted expense reports to ensure compliance with the business’s spending limits and the policy’s guidelines. Consider conducting audits to check for excessive or non-compliant expenses.

- Encourage employees to book cost-effective options: Encourage employees to book travel and accommodations within budget, such as using discount travel websites, choosing economical lodging options, and using shared transportation when possible.

- Provide ongoing training: Ensure employees are trained on the policy, including how to request approval for travel, what expenses are eligible for reimbursement, and how to submit claims. Training helps ensure employees understand the guidelines and avoid errors when submitting reimbursement requests.

- Review the policy regularly: Periodically assess the policy to ensure it remains relevant to the business’s evolving needs, complies with changes in Michigan state laws or federal regulations, and aligns with best practices for travel and expense management.