Travel and expense reimbursement policy (Mississippi): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

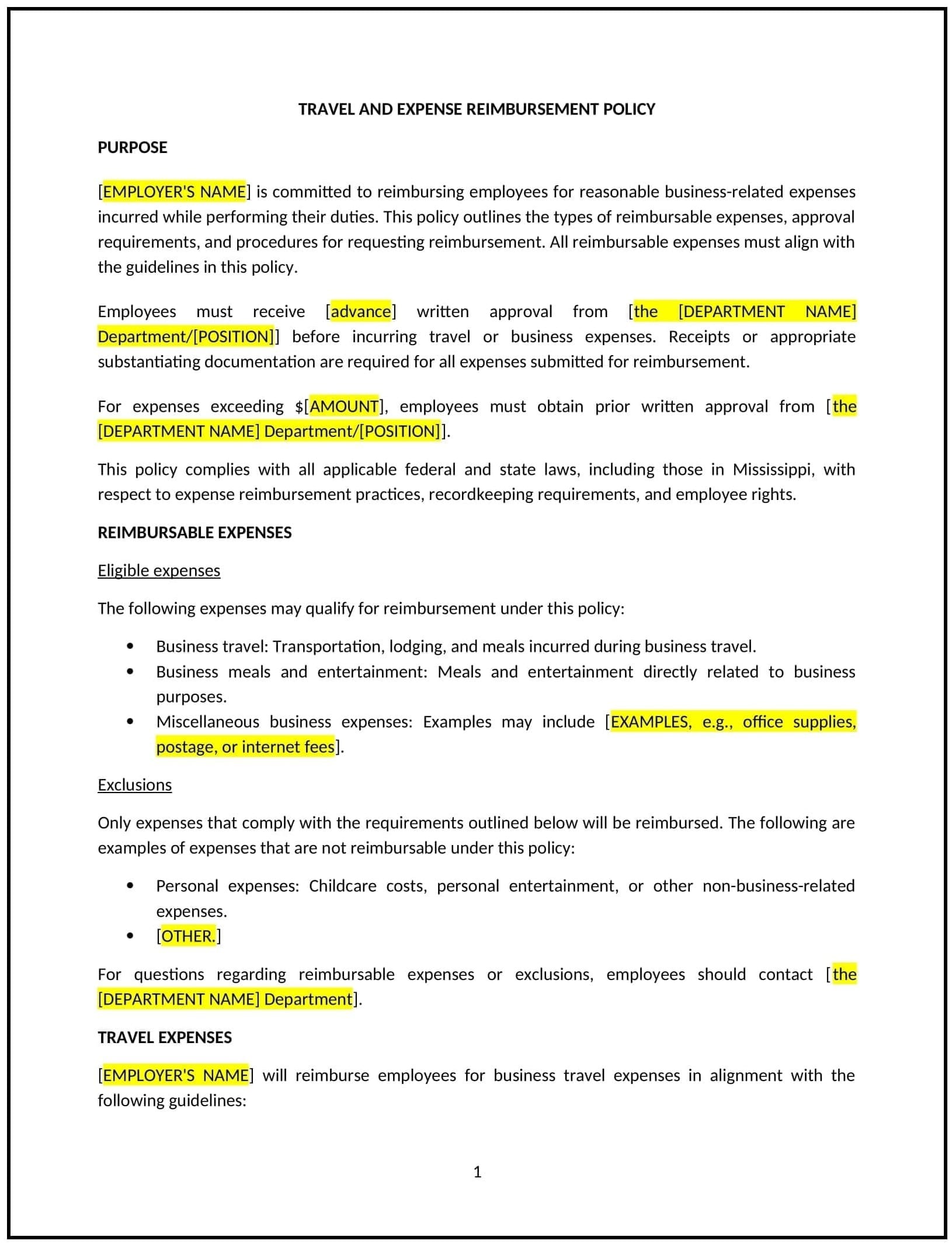

Travel and expense reimbursement policy (Mississippi)

A travel and expense reimbursement policy helps Mississippi businesses establish clear guidelines for managing employee travel and related expenses. This policy outlines procedures for requesting, approving, and reimbursing travel costs, ensuring transparency and fairness in handling business-related expenses. It is designed to promote accountability, reduce misunderstandings, and provide a consistent framework for managing travel expenditures.

By implementing this policy, businesses in Mississippi can streamline expense management, support employees during business travel, and align with the state’s emphasis on efficient and ethical business practices.

How to use this travel and expense reimbursement policy (Mississippi)

- Define eligible expenses: Clearly specify which costs are reimbursable, such as transportation, lodging, meals, and incidental expenses.

- Establish approval processes: Outline how employees should request approval for travel and expenses, including required documentation and timelines.

- Set reimbursement limits: Provide guidelines on maximum allowable amounts for specific expenses, such as per diems for meals or mileage rates for personal vehicles.

- Specify submission requirements: Explain what documentation employees must submit, such as receipts, invoices, or travel itineraries, to qualify for reimbursement.

- Address payment timelines: State how quickly reimbursements will be processed and when employees can expect to receive funds.

- Communicate the policy: Share the policy with employees through handbooks, emails, or training sessions to ensure awareness and understanding.

- Monitor adherence: Regularly review expense reports and address any discrepancies or issues promptly.

- Update the policy: Periodically assess the policy to reflect changes in business needs, travel trends, or regulatory requirements.

Benefits of using this travel and expense reimbursement policy (Mississippi)

This policy offers several advantages for Mississippi businesses:

- Promotes transparency: Clear guidelines help prevent misunderstandings about reimbursable expenses and approval processes.

- Reduces disputes: Defined procedures minimize conflicts over expense claims and reimbursement timelines.

- Encourages accountability: A structured policy ensures employees and managers adhere to consistent standards for travel spending.

- Supports employees: Reimbursing travel costs fairly demonstrates the business’s commitment to supporting employees during work-related trips.

- Aligns with local norms: Reflects Mississippi’s focus on practical and efficient business practices.

- Improves financial management: Standardized processes make it easier to track and manage travel expenses.

- Enhances planning: Clear policies enable better budgeting and forecasting for travel-related costs.

Tips for using this travel and expense reimbursement policy (Mississippi)

- Communicate clearly: Ensure employees understand the policy by providing written materials and discussing it during meetings or training sessions.

- Train managers: Educate supervisors on how to review and approve expense reports consistently and fairly.

- Use technology: Consider adopting expense management software to streamline submissions, approvals, and reimbursements.

- Be flexible: Allow for reasonable exceptions in unique situations, such as emergencies or unforeseen travel challenges.

- Track spending: Maintain records of all travel expenses to identify trends, control costs, and ensure fairness.

- Stay informed: Keep up with changes in tax laws or regulations that may affect travel and expense reimbursement practices.

- Review periodically: Assess the policy’s effectiveness and make updates as needed to reflect changes in business needs or travel trends.