Travel and expense reimbursement policy (Missouri): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Missouri)

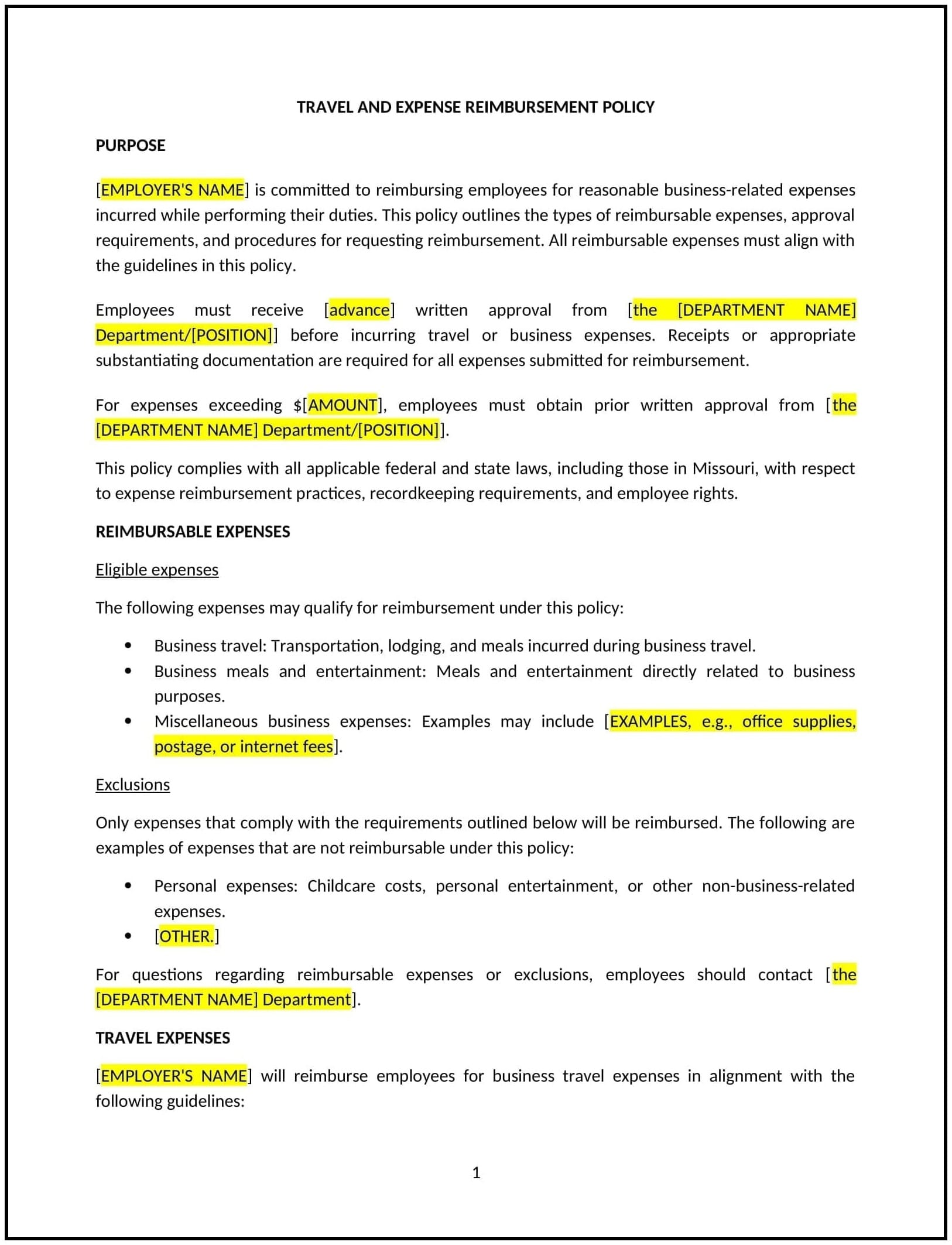

A travel and expense reimbursement policy helps businesses in Missouri manage and control employee travel expenses incurred during work-related trips. This policy outlines the types of expenses that are eligible for reimbursement, the process for submitting expenses, and the documentation required for approval. It is designed to ensure consistency, transparency, and accountability in the reimbursement process.

By adopting this policy, businesses can clearly communicate what expenses will be covered, streamline the reimbursement process, and maintain control over travel costs.

How to use this travel and expense reimbursement policy (Missouri)

- Define eligible expenses: Clearly outline which expenses are eligible for reimbursement, such as transportation (flights, taxis, mileage), lodging, meals, and other necessary business-related costs incurred during travel. Specify any limits or guidelines for each category of expenses.

- Set approval procedures: Establish a process for gaining pre-approval for travel expenses, especially for higher-cost items like flights or hotels. Employees should understand when and how to seek approval for their travel plans.

- Provide submission guidelines: Outline the process for submitting expense reimbursement requests, including the documentation required, such as receipts, travel itineraries, or proof of payment. Specify how soon after travel expenses should be submitted for reimbursement.

- Set reimbursement limits: Specify reasonable limits for certain categories of expenses (e.g., meal costs, hotel rates) to ensure that travel spending remains within company budgetary guidelines.

- Outline reimbursement timelines: Define the timeframe within which employees can expect reimbursement after submitting their expense reports. Businesses should specify how long it typically takes for reimbursement to be processed.

- Address non-compliant expenses: Specify which expenses will not be reimbursed, such as personal expenses or extravagant costs, and outline the steps to be taken if an employee submits non-compliant expenses.

- Review regularly: Periodically review and update the policy to ensure it reflects changes in Missouri state law, company budget constraints, or evolving business travel needs.

Benefits of using this travel and expense reimbursement policy (Missouri)

This policy provides several benefits for businesses in Missouri:

- Promotes financial control: A clear travel and expense reimbursement policy helps businesses control travel-related costs, ensuring that all expenses are reasonable and align with budgetary guidelines.

- Streamlines reimbursement process: A well-defined process for submitting and approving expenses helps speed up the reimbursement process, reducing delays and administrative overhead.

- Increases transparency: By setting clear expectations and limits for reimbursement, businesses can reduce confusion or misunderstandings regarding what is and isn’t covered.

- Encourages compliance: A clear policy promotes adherence to company standards, reducing the likelihood of employees submitting ineligible or unreasonable expenses.

- Supports employee satisfaction: A streamlined, transparent reimbursement process can improve employee satisfaction, as employees know exactly what expenses will be covered and how to submit their claims.

- Ensures consistency: With a defined policy, businesses ensure that all employees are treated fairly and consistently when it comes to travel and expense reimbursements.

Tips for using this travel and expense reimbursement policy (Missouri)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy, including what expenses are eligible, how to request reimbursement, and any documentation that is required.

- Encourage pre-approval for high-cost items: Set clear guidelines for when pre-approval is necessary, especially for travel-related expenses that exceed a set threshold. This can help ensure that expenses are within budget before they are incurred.

- Simplify the submission process: Provide a simple and clear process for employees to submit their expenses, including easy-to-use forms or online tools for tracking and submitting expenses.

- Review expense reports promptly: Review submitted expense reports in a timely manner to avoid delays in processing reimbursements. Ensure that the approval process is clear and efficient.

- Monitor compliance regularly: Ensure that employees are adhering to the policy and make any necessary adjustments to the policy or procedures based on feedback and ongoing analysis of reimbursement claims.

- Review regularly: Periodically review the policy to ensure it remains in line with Missouri state laws, business travel trends, and the company's budgetary needs.