Travel and expense reimbursement policy (Montana): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Montana)

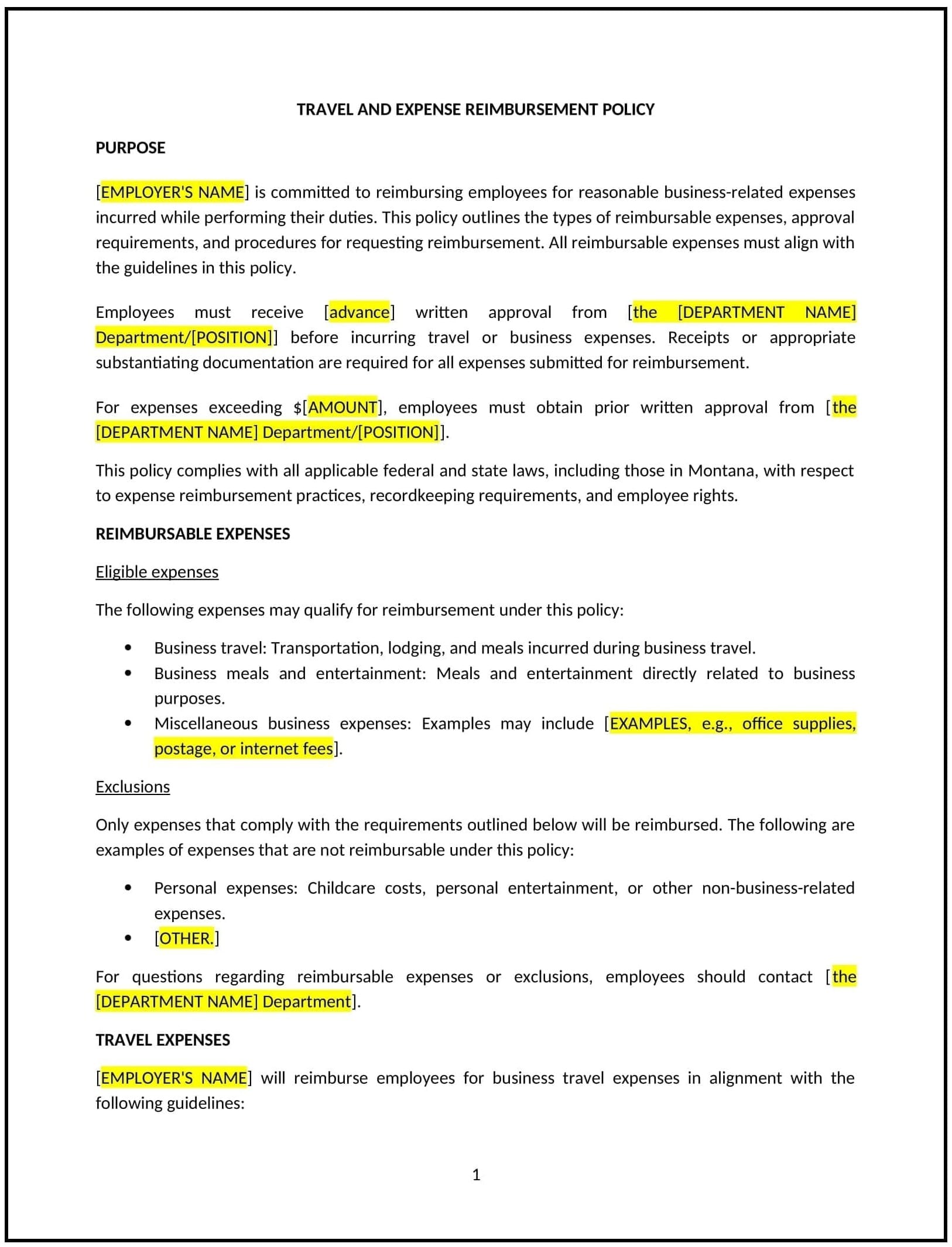

A travel and expense reimbursement policy helps Montana businesses define the guidelines and procedures for reimbursing employees for work-related travel and expenses incurred during business activities. This policy ensures that employees understand what types of expenses are eligible for reimbursement, the process for submitting claims, and the documentation required to process reimbursements efficiently.

By implementing this policy, businesses can maintain financial accountability, ensure consistent handling of employee expenses, and promote transparency in managing business-related travel and expenses.

How to use this travel and expense reimbursement policy (Montana)

- Define eligible expenses: The policy should specify which expenses are eligible for reimbursement, including transportation (e.g., airfare, mileage, rental cars), lodging, meals, and other business-related costs incurred during travel.

- Set approval procedures: The policy should outline the process for obtaining pre-approval for travel and expenses, including which employees or departments must approve travel arrangements and expense reports before they are incurred.

- Outline reimbursement procedures: The policy should define the process for submitting expense claims, including the necessary documentation (e.g., receipts, invoices, travel itineraries), the format for submitting claims, and the timeline for reimbursement.

- Clarify allowable spending limits: The policy should establish spending limits for various categories of expenses, such as per diem meal allowances, hotel room rates, or mileage reimbursement rates, to control costs and maintain budget adherence.

- Address personal expenses: The policy should specify which expenses are not eligible for reimbursement, such as personal travel, entertainment, or other non-business-related costs. Employees should be instructed to keep personal and business expenses separate.

- Reimbursement timelines: The policy should clarify when employees can expect reimbursement and how long they have to submit their expense reports after travel or expenditure.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains aligned with the company’s financial practices, business needs, and any changes in state or federal reimbursement regulations.

Benefits of using this travel and expense reimbursement policy (Montana)

This policy provides several key benefits for Montana businesses:

- Promotes financial accountability: A clear travel and expense reimbursement policy helps businesses maintain control over travel spending by establishing guidelines for what is reimbursable and ensuring that employees follow the rules for submitting expenses.

- Ensures fairness and consistency: By applying a standard reimbursement process and guidelines for all employees, businesses can ensure that expenses are treated fairly and consistently, avoiding any confusion or misunderstandings.

- Reduces fraud risk: The policy helps minimize the risk of fraudulent claims by requiring documentation for expenses, establishing clear rules for what is reimbursable, and setting spending limits.

- Enhances budgeting accuracy: By outlining spending limits and requiring approval before expenses are incurred, businesses can more accurately estimate and control travel and expense costs.

- Streamlines administrative processes: A well-defined reimbursement process reduces administrative work, allowing employees to submit expenses more efficiently and reducing the time needed to process reimbursement claims.

- Supports employee satisfaction: A clear and straightforward reimbursement process ensures that employees are reimbursed promptly and fairly for legitimate business expenses, contributing to job satisfaction and trust in the company’s financial practices.

Tips for using this travel and expense reimbursement policy (Montana)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy and understand what expenses are eligible for reimbursement, how to submit claims, and the documentation required.

- Approve expenses in advance: Encourage employees to seek approval for travel and expenses before they are incurred to avoid misunderstandings or unnecessary costs.

- Maintain clear records: Ensure that all receipts and supporting documents are kept for each expense, and encourage employees to submit their claims promptly to ensure timely reimbursement.

- Set realistic limits: Establish reasonable spending limits for travel-related expenses to ensure that costs remain within budget and that employees have clear guidelines for what constitutes acceptable spending.

- Track expenses regularly: Monitor travel and expense claims to ensure that spending is on track with the company’s budget and make adjustments as necessary.

- Review the policy regularly: Periodically review the travel and expense reimbursement policy to ensure it remains relevant to the business’s needs, legal requirements, and industry standards.