Travel and expense reimbursement policy (Nebraska): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Nebraska)

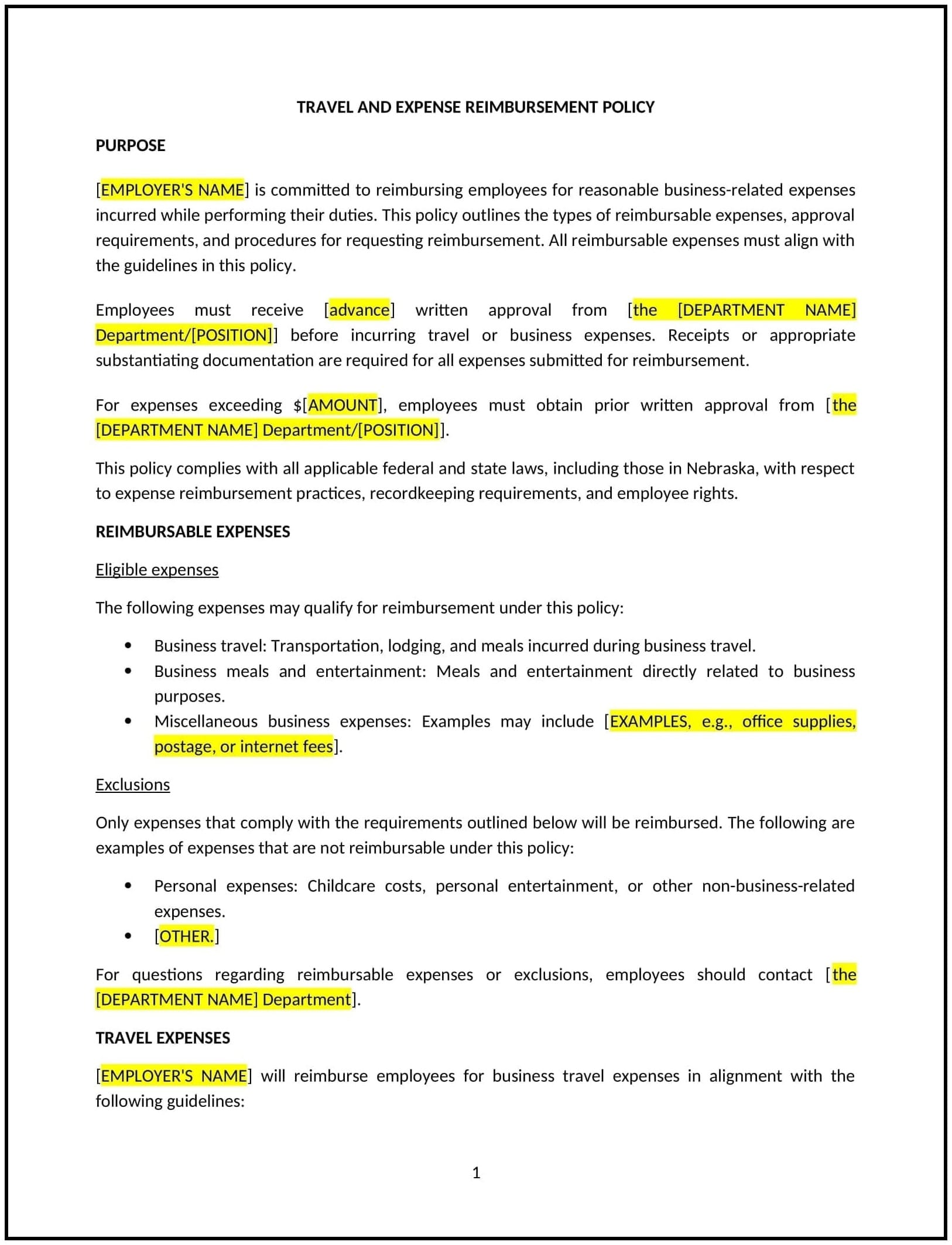

A travel and expense reimbursement policy helps Nebraska businesses manage the process of reimbursing employees for business-related travel and expenses. This policy outlines what types of expenses are eligible for reimbursement, the process for submitting expense reports, and any guidelines regarding spending limits. It is designed to ensure consistency, transparency, and fairness in handling employee reimbursements, while also controlling business costs.

By adopting this policy, businesses in Nebraska can streamline the reimbursement process, maintain budget control, and support employees in performing their duties without financial burden.

How to use this travel and expense reimbursement policy (Nebraska)

- Define eligible expenses: Clearly define what types of expenses are eligible for reimbursement, such as transportation (airfare, car rental, mileage), lodging, meals, and other business-related expenses. Specify any limitations or conditions for each category of expense.

- Set spending limits: Establish reasonable spending limits for different types of expenses, such as daily meal allowances, hotel accommodations, or transportation costs. This helps employees understand what is acceptable and ensures that expenses remain within budget.

- Provide guidelines for booking travel: Specify whether employees are required to book travel through the company’s designated travel agency or whether they can book independently. Outline how travel should be booked (e.g., economy class for flights) and any guidelines for combining personal and business travel.

- Expense report submission process: Detail the process for submitting expense reports, including required documentation (e.g., receipts, invoices), deadlines for submission, and the format for submitting reports. Outline how to handle non-reimbursable expenses, such as personal items or upgrades.

- Approval process: Define the process for approving expenses, including who is responsible for reviewing and approving reports. Specify whether employees need pre-approval for certain types of expenses or if approval can be given after the expenses are incurred.

- Reimbursement timing: Indicate how quickly employees can expect reimbursement after submitting an expense report. Set a standard timeframe for reimbursement, such as within 30 days of submission, to ensure timely payments.

- Policy for non-reimbursable expenses: List expenses that are not eligible for reimbursement, such as personal entertainment, fines (e.g., parking tickets), or luxury upgrades. This helps employees avoid misunderstandings about what is covered.

- Review and update: Regularly review and update the policy to ensure it aligns with company financial needs, industry standards, and Nebraska state regulations.

Benefits of using this travel and expense reimbursement policy (Nebraska)

This policy provides several benefits for Nebraska businesses:

- Streamlines reimbursement processes: A clear and standardized policy helps simplify the expense reimbursement process, reducing administrative time and effort for both employees and management.

- Maintains budget control: Setting spending limits and defining eligible expenses ensures that the company maintains control over travel-related costs and avoids unnecessary expenditures.

- Promotes fairness and transparency: A well-defined policy ensures that all employees are treated fairly and consistently when submitting and receiving reimbursement for business-related expenses.

- Reduces misunderstandings: By specifying what is reimbursable and the procedures for submission, businesses can avoid confusion and disputes over reimbursement requests.

- Supports employee satisfaction: A clear and supportive reimbursement policy ensures that employees are not financially burdened by necessary business travel, promoting a positive work environment.

Tips for using this travel and expense reimbursement policy (Nebraska)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy and understand the process for submitting requests. Include the policy in employee handbooks, onboarding materials, and internal communications.

- Encourage timely submissions: Set clear expectations for when employees should submit expense reports and remind them of deadlines. Timely submissions ensure that reimbursements are processed efficiently.

- Review receipts and documentation carefully: Ensure that all expense reports are accompanied by proper receipts or invoices. Managers or HR should carefully review each submission to verify that expenses are legitimate and within company guidelines.

- Be flexible when needed: While the policy should set clear rules, be open to accommodating reasonable exceptions in special cases, such as emergencies or unusual travel circumstances. Ensure that flexibility does not compromise the integrity of the policy.

- Use technology for easier management: Consider using digital tools or expense management software to streamline the submission, approval, and tracking process. This can help speed up reimbursements and reduce errors.