Travel and expense reimbursement policy (Nevada): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Nevada)

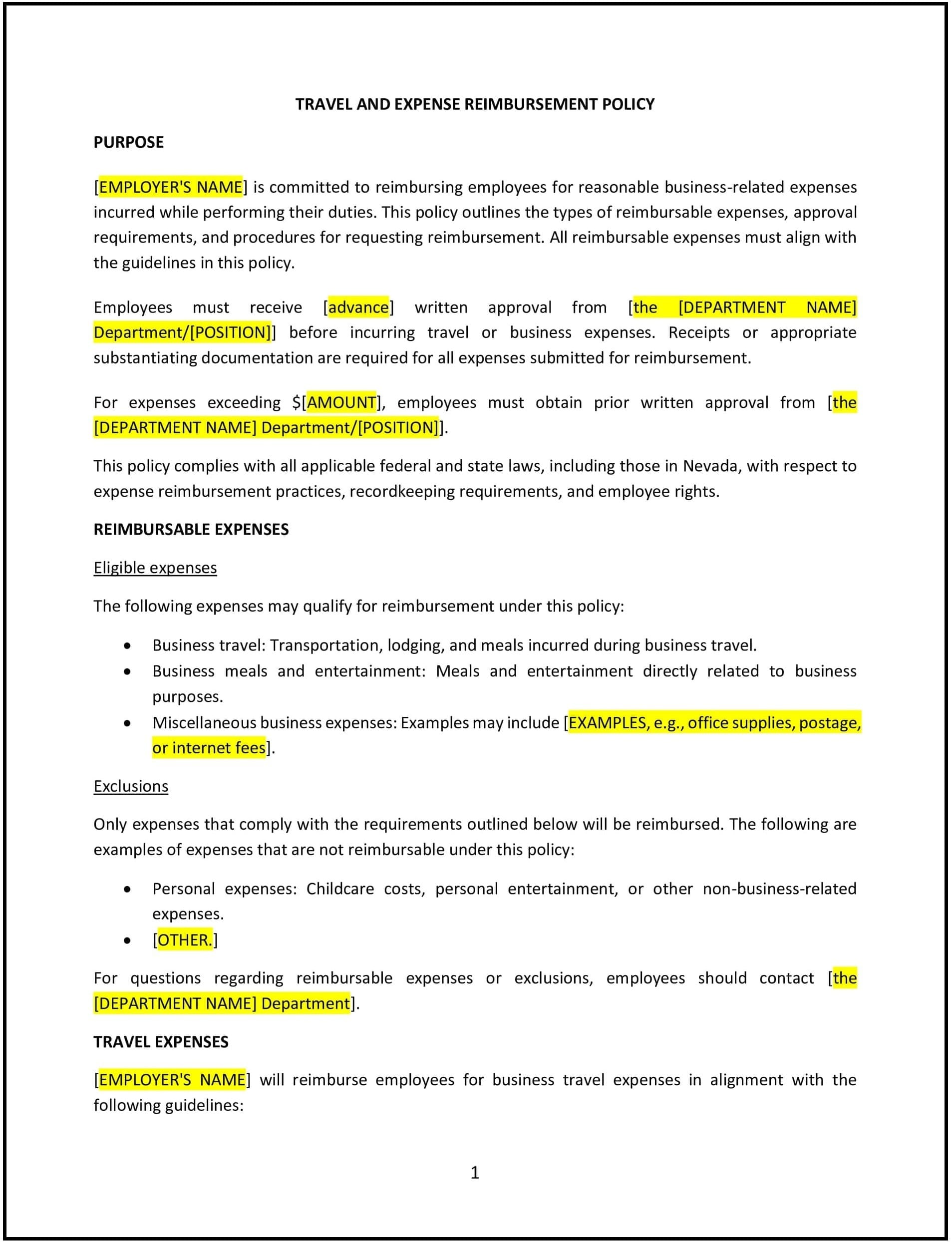

This travel and expense reimbursement policy is designed to help Nevada businesses provide clear guidelines for reimbursing employees for work-related travel and expenses. It outlines eligible expenses, submission procedures, and approval processes to ensure fairness, accountability, and compliance with company policies.

By adopting this policy, businesses can streamline expense management, reduce disputes, and support employees during business travel.

How to use this travel and expense reimbursement policy (Nevada)

- Define eligible expenses: Specify which expenses are reimbursable, such as transportation, lodging, meals, and other business-related costs.

- Establish pre-approval requirements: Require employees to obtain approval for travel or significant expenses before incurring costs.

- Set expense limits: Include guidelines for maximum reimbursable amounts, such as per diem rates for meals or limits on hotel accommodations.

- Provide documentation requirements: Require employees to submit itemized receipts, invoices, or other proof of payment with their reimbursement requests.

- Outline submission procedures: Specify how and when employees should submit expense reports, such as through a designated system or form, within a set timeframe.

- Clarify reimbursement timelines: Include information about how quickly approved reimbursements will be processed and paid.

- Address non-reimbursable expenses: List expenses that are not eligible for reimbursement, such as personal entertainment or alcohol.

- Ensure compliance: Emphasize adherence to Nevada and federal tax laws regarding expense reimbursements.

Benefits of using this travel and expense reimbursement policy (Nevada)

This policy provides several benefits for Nevada businesses:

- Promotes accountability: Ensures employees understand what expenses are reimbursable and how to request reimbursement.

- Reduces disputes: Establishes clear procedures and limits, minimizing misunderstandings about expense approvals.

- Supports employees: Provides financial clarity and consistency for employees required to travel for work.

- Enhances operational efficiency: Streamlines the expense management process, reducing administrative burdens.

- Aligns with legal requirements: Promotes compliance with Nevada and federal tax laws for reimbursements.

Tips for using this travel and expense reimbursement policy (Nevada)

- Communicate the policy: Share the policy with employees during onboarding and make it accessible in employee handbooks or internal systems.

- Train managers: Provide training for managers to handle travel approvals and expense reviews fairly and consistently.

- Use technology: Implement expense management software to streamline submission, approval, and tracking processes.

- Perform audits: Conduct periodic reviews of expense reports to ensure compliance and detect potential misuse.

- Update regularly: Revise the policy as needed to reflect changes in company operations, travel practices, or legal requirements.