Travel and expense reimbursement policy (New Jersey): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (New Jersey)

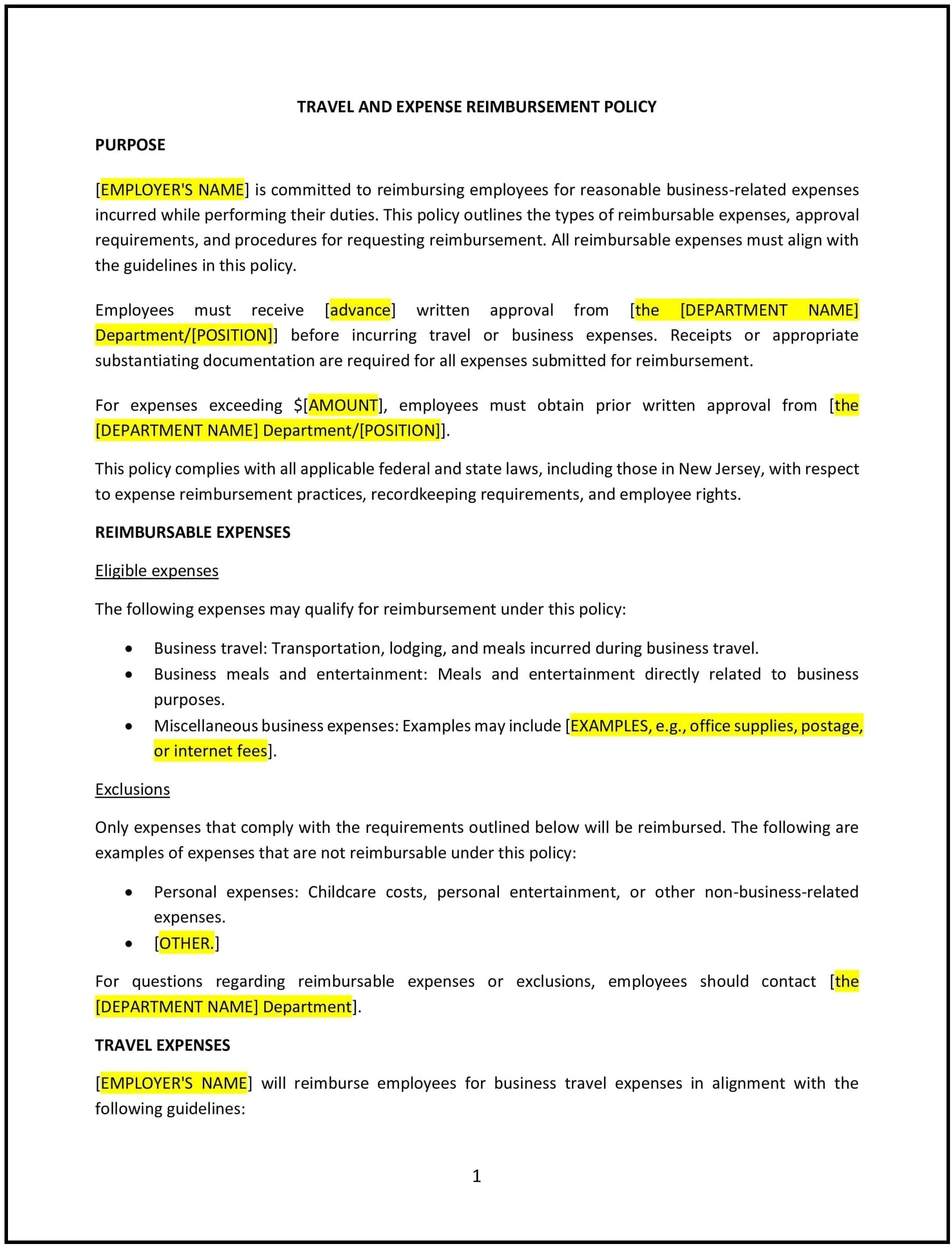

A travel and expense reimbursement policy helps New Jersey businesses set clear guidelines for reimbursing employees for expenses incurred while traveling for work. This policy outlines which expenses are eligible for reimbursement, the process for submitting claims, and the documentation required to support reimbursements.

By adopting this policy, businesses in New Jersey can ensure fair and transparent reimbursement practices while controlling costs associated with business travel.

How to use this travel and expense reimbursement policy (New Jersey)

- Define eligible expenses: Specify which expenses will be reimbursed, such as transportation (airfare, taxis, mileage), lodging, meals, and other business-related costs incurred during travel.

- Set reimbursement limits: Establish reasonable limits for expenses like meals and lodging, in line with New Jersey and federal guidelines or the company’s budget.

- Outline the approval process: Define the procedure for obtaining approval for travel-related expenses before they are incurred, including any required pre-trip approvals from supervisors or managers.

- Set submission guidelines: Specify how employees should submit reimbursement requests, including the timeline for submitting claims and required documentation (receipts, itineraries, etc.).

- Address non-reimbursable expenses: Clarify which expenses will not be reimbursed, such as personal expenses, entertainment, or any costs deemed excessive.

- Provide travel booking guidelines: Define whether the company will handle travel bookings directly or if employees are expected to book travel independently and submit for reimbursement.

- Set payment timelines: Outline the timeframe in which reimbursements will be processed, typically within a set number of days following the submission of claims.

- Review and update: Regularly assess the policy to ensure it aligns with business needs and changes in New Jersey law.

Benefits of using this travel and expense reimbursement policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Promotes transparency: Ensures that employees are aware of which expenses will be reimbursed, reducing confusion and potential disputes.

- Controls costs: Helps businesses manage travel-related expenses by setting clear guidelines and limits for reimbursement.

- Increases efficiency: Streamlines the reimbursement process, ensuring timely and accurate payments to employees.

- Supports business travel: Makes it easier for employees to travel for work, knowing that eligible expenses will be reimbursed.

- Protects the business: Reduces the risk of fraudulent claims and ensures that reimbursements align with company policies and budgetary constraints.

Tips for using this travel and expense reimbursement policy (New Jersey)

- Communicate the policy clearly: Ensure that all employees are aware of the reimbursement process and what expenses are eligible for reimbursement.

- Set realistic reimbursement limits: Establish reasonable expense limits based on industry standards and the company’s budget, ensuring fairness while avoiding unnecessary spending.

- Track expenses carefully: Require employees to provide detailed receipts and documentation for all expenses, and track reimbursements to ensure consistency and prevent errors.

- Encourage pre-trip planning: Have employees seek approval for travel expenses before incurring them, helping the company control costs and ensure necessary budget allocations.

- Review the policy regularly: Update the policy annually to reflect changes in New Jersey laws, business practices, or the company’s financial situation.