Travel and expense reimbursement policy (New Mexico): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (New Mexico)

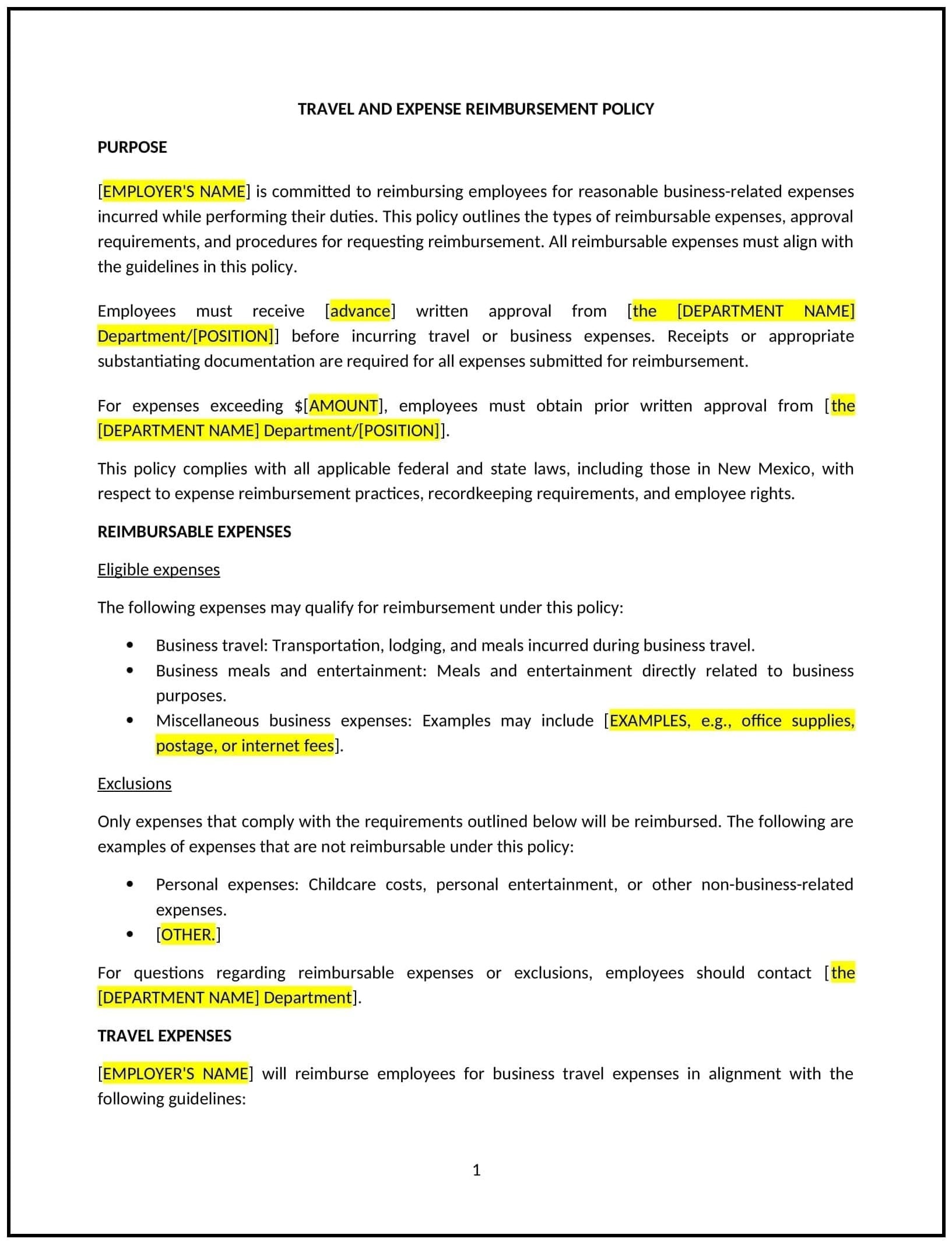

A travel and expense reimbursement policy helps New Mexico businesses manage the process of reimbursing employees for travel and business-related expenses. This policy outlines what expenses are eligible for reimbursement, the approval process, and the documentation required. It is designed to ensure consistency and fairness in handling employee expenses while supporting business needs and promoting responsible financial practices.

By adopting this policy, businesses in New Mexico can improve financial transparency, manage travel costs effectively, and maintain a clear process for reimbursement requests.

How to use this travel and expense reimbursement policy (New Mexico)

- Define eligible expenses: Clearly specify the types of expenses that are eligible for reimbursement, such as transportation, meals, lodging, and other business-related costs.

- Set approval procedures: Outline the steps employees must follow to obtain approval for travel-related expenses, including the process for submitting requests before the trip.

- Establish documentation requirements: Detail the documentation employees need to provide when submitting expenses for reimbursement, such as receipts, invoices, and itemized expense reports.

- Set spending limits: Establish reasonable limits or per diem rates for common expenses, ensuring they are in line with New Mexico’s cost of living and industry standards.

- Outline non-reimbursable expenses: Clearly define what expenses will not be reimbursed, such as personal expenses or costs unrelated to business activities.

- Communicate the policy: Make employees aware of the reimbursement policy during onboarding and through regular updates or training to ensure they understand the process.

- Review the policy: Regularly review and update the policy to reflect changes in New Mexico law, business priorities, or any new industry standards.

Benefits of using this travel and expense reimbursement policy (New Mexico)

This policy provides several advantages for New Mexico businesses:

- Promotes transparency: A clear and defined process ensures that expenses are handled consistently and fairly across the business.

- Controls costs: By setting limits and guidelines for reimbursements, businesses can better control travel-related spending.

- Supports employee satisfaction: A straightforward and timely reimbursement process helps employees feel valued and reduces any confusion around their expenses.

- Reduces errors: With clear documentation requirements, businesses can minimize errors in processing reimbursements and ensure accurate records.

- Aligns with local standards: Setting per diem rates and reimbursement limits that reflect New Mexico’s cost-of-living factors ensures that employees’ travel expenses are reasonable and in line with industry expectations.

Tips for using this travel and expense reimbursement policy (New Mexico)

- Communicate the policy clearly: Ensure all employees are aware of the policy, understand the requirements, and know how to submit their reimbursement requests.

- Set clear approval timelines: Businesses should establish deadlines for submitting reimbursement requests and processing payments to maintain a smooth workflow.

- Use expense management tools: Implementing digital tools or platforms can streamline the expense submission and approval process, making it more efficient.

- Regularly review expenses: Track and monitor travel expenses to ensure the policy is being followed and that the business stays within budget.

- Stay current with local rates: Adjust the policy periodically to reflect any changes in New Mexico’s cost of living or business travel standards.