Travel and expense reimbursement policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (New York)

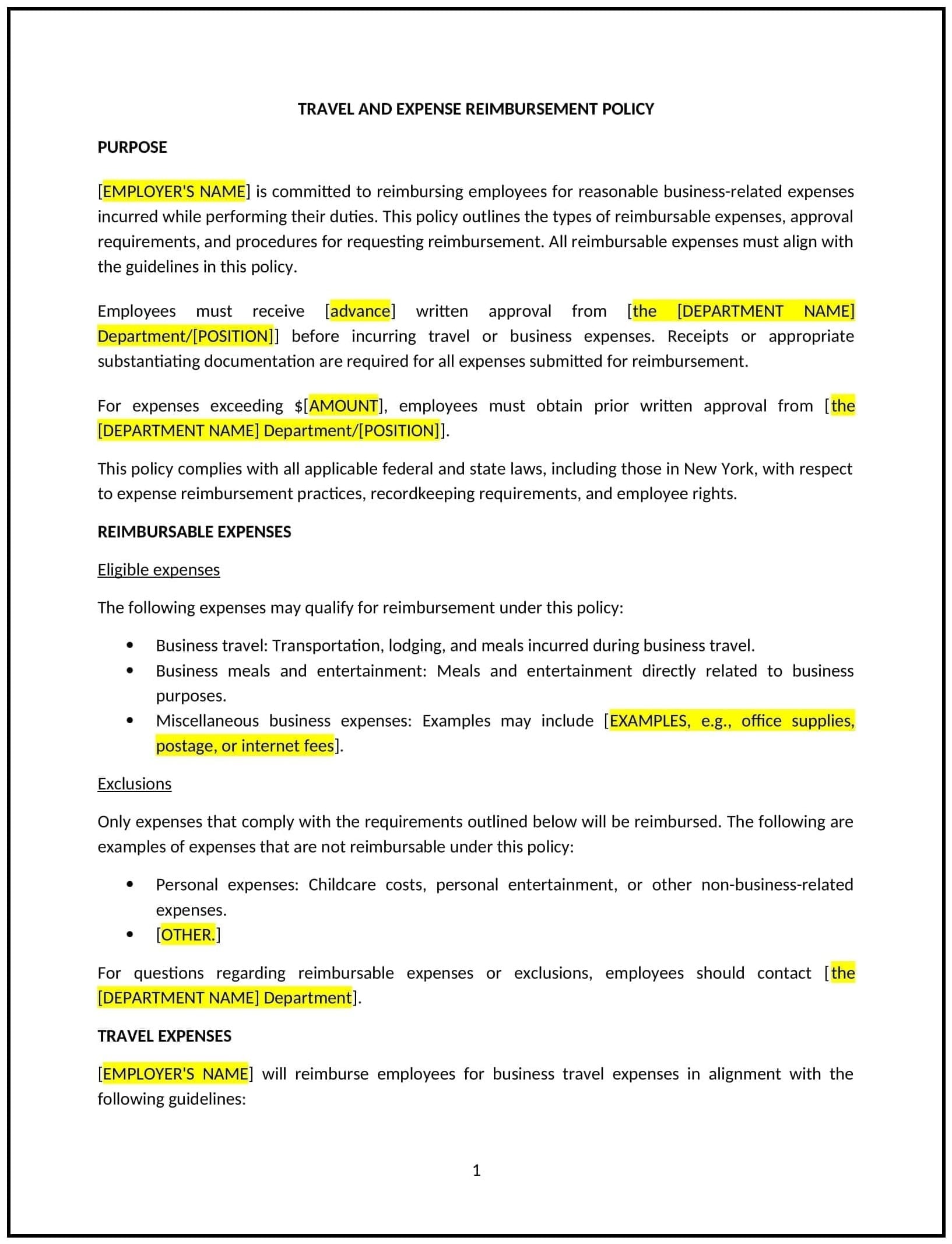

This travel and expense reimbursement policy is designed to help New York businesses establish clear guidelines for reimbursing employees for travel and other business-related expenses. Whether businesses are managing transportation, lodging, meals, or other costs, this template provides a structured approach to ensure that all reimbursements are handled fairly and efficiently.

By adopting this template, businesses can streamline the reimbursement process, maintain financial control, and ensure that employees are reimbursed in accordance with company policies.

How to use this travel and expense reimbursement policy (New York)

- Define eligible expenses: Clearly outline which expenses are eligible for reimbursement, such as transportation (flights, trains, taxis), lodging, meals, and business-related incidentals.

- Set approval processes: Specify how employees should submit expense reports, including required documentation such as receipts, travel itineraries, and proof of payments.

- Establish spending limits: Set reasonable spending limits for different categories of expenses (e.g., daily meal allowance, maximum hotel rate), ensuring expenses remain within company budget constraints.

- Outline reimbursement timelines: Specify how soon after the trip employees must submit their expense reports, and how quickly reimbursements will be processed.

- Provide guidelines for non-reimbursable expenses: Clearly define any expenses that will not be reimbursed, such as personal expenses, luxury items, or unauthorized upgrades.

Benefits of using this travel and expense reimbursement policy (New York)

This policy offers several benefits for New York businesses:

- Promotes financial control: Clear guidelines and approval processes help businesses stay within budget and avoid unnecessary or excessive spending on travel and related expenses.

- Enhances transparency: Transparent reimbursement procedures help avoid confusion and ensure employees know exactly what is eligible for reimbursement.

- Reduces administrative burden: Streamlining the reimbursement process reduces the time and effort required for employees and finance departments to manage and process expenses.

- Supports employee satisfaction: Timely and fair reimbursement demonstrates the business’s commitment to supporting employees’ travel needs, improving morale and reducing frustrations.

- Ensures consistency: A standardized approach ensures that all employees are treated equally when it comes to reimbursed expenses, fostering a sense of fairness.

Tips for using this travel and expense reimbursement policy (New York)

- Communicate clearly: Ensure employees understand the reimbursement process, including the types of expenses that are eligible for reimbursement and how to submit reports.

- Use a streamlined reporting system: Implement an expense management system or software to make it easier for employees to submit expenses and for managers to approve them.

- Monitor compliance: Regularly review submitted expense reports to ensure they align with the policy and stay within company guidelines.

- Offer training: Provide employees with training on the policy and the proper documentation needed for reimbursement to avoid delays or misunderstandings.

- Review regularly: Update the policy as necessary to reflect changes in travel practices, business needs, or New York state regulations.