Travel and expense reimbursement policy (Ohio): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Ohio)

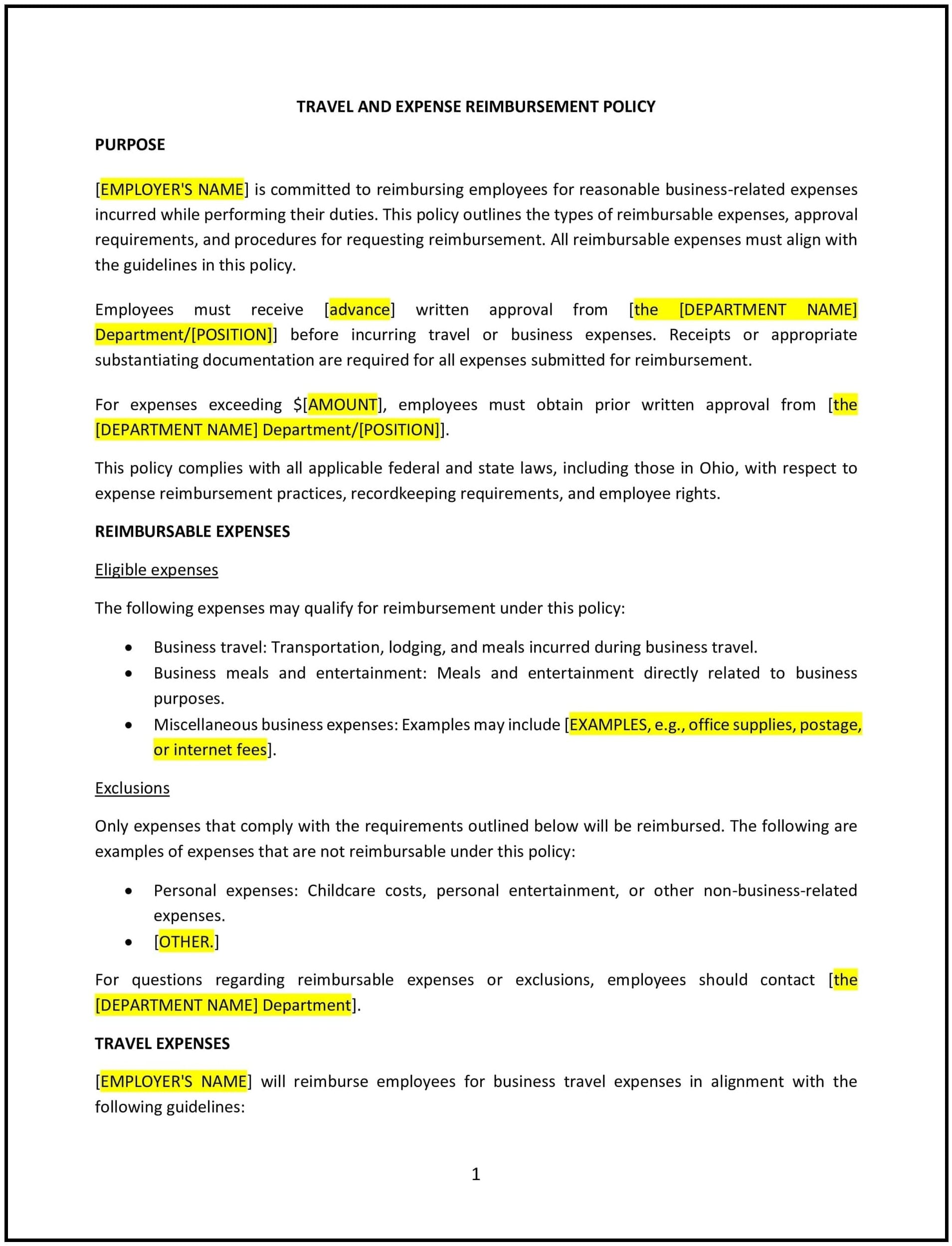

A travel and expense reimbursement policy outlines the guidelines for Ohio businesses to reimburse employees for reasonable and necessary expenses incurred while traveling for work purposes. This policy sets clear expectations on what types of expenses are eligible for reimbursement, the process employees must follow to submit claims, and any limits or restrictions on reimbursable expenses. The goal is to ensure that employees are fairly compensated for work-related travel costs while maintaining fiscal responsibility and compliance with company guidelines.

By implementing this policy, Ohio businesses can streamline the expense reporting process, minimize confusion, and maintain financial control while supporting employees during work-related travel.

How to use this travel and expense reimbursement policy (Ohio)

- Define reimbursable expenses: The policy should specify which expenses are eligible for reimbursement, such as transportation (airfare, taxis, mileage), lodging, meals, parking, tolls, and other incidentals. It should also outline any exclusions, such as personal expenses or entertainment.

- Establish a clear approval process: The policy should explain how employees must obtain prior approval for certain expenses, such as large travel-related purchases or out-of-the-ordinary accommodations. It should specify who is responsible for approving expenses and how approval should be obtained.

- Set expense limits: The policy should set reasonable limits for various types of expenses, such as per diem meal allowances, hotel rates, and mileage reimbursements. These limits ensure that expenses stay within budget and meet company standards.

- Clarify the documentation requirements: Employees should submit detailed expense reports with receipts or supporting documentation for all reimbursable expenses. The policy should specify the type of documentation needed, such as receipts, invoices, or credit card statements, and how to submit the report (e.g., online, paper form).

- Specify reimbursement timelines: The policy should set timelines for submitting expense reports and for processing reimbursements, ensuring that employees are reimbursed promptly.

- Address the use of personal credit cards: The policy should specify whether employees may use personal credit cards for business expenses and how they can submit those expenses for reimbursement. It may also address whether employees should use company-issued credit cards or specific travel providers.

- Ensure compliance with tax laws: The policy should clarify that employees must comply with IRS guidelines regarding taxable and non-taxable expenses. It should also provide guidance on handling any reimbursements that may be subject to tax.

- Review and update regularly: The policy should be reviewed periodically to ensure it stays up-to-date with Ohio state laws, federal regulations, and evolving business needs.

Benefits of using this travel and expense reimbursement policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Streamlines expense management: By setting clear guidelines for eligible expenses and approval processes, the policy simplifies the expense reporting and reimbursement process, reducing confusion and administrative overhead.

- Improves financial control: The policy helps businesses manage travel-related expenses by setting limits and ensuring that reimbursements are within budget and meet company standards.

- Enhances transparency: The policy promotes transparency by outlining clear procedures for submitting and approving expenses, minimizing the potential for misunderstandings or disputes between employees and management.

- Ensures fairness: By defining which expenses are eligible for reimbursement and ensuring that all employees are subject to the same standards, the policy fosters fairness in how travel and expense reimbursements are handled across the business.

- Supports employee satisfaction: Providing a straightforward reimbursement process helps employees feel supported and reduces frustration by ensuring they are promptly reimbursed for legitimate work-related expenses.

- Reduces legal risks: By adhering to IRS guidelines and complying with Ohio state laws regarding reimbursements, the policy helps reduce the risk of tax-related issues or legal challenges related to business expenses.

- Promotes accountability: The policy encourages employees to be mindful of their spending by setting limits and requiring detailed documentation, ensuring that travel and expenses remain within the company’s guidelines.

Tips for using this travel and expense reimbursement policy (Ohio)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy by including it in the employee handbook, discussing it during onboarding, and providing periodic reminders about how to submit expenses.

- Establish clear approval processes: Ensure that managers and employees are aware of who is responsible for approving expenses and the steps required to obtain approval before incurring costs.

- Set reasonable limits: Set clear, reasonable limits for various types of expenses to ensure that travel and expenses are within budget and align with business standards.

- Ensure timely submissions and reimbursements: Establish a clear timeline for employees to submit their expense reports and for processing reimbursements to ensure that employees are reimbursed promptly and efficiently.

- Monitor expense trends: Regularly review expense reports to identify any patterns or areas where costs may be higher than expected. Use this information to adjust travel policies or to offer guidance on cost-effective travel options.

- Use expense management software: Consider implementing expense management software to streamline the expense reporting process, reduce paperwork, and improve tracking and compliance with the policy.

- Review the policy periodically: Review the policy regularly to ensure it remains in line with Ohio state laws, IRS guidelines, and the evolving needs of the business. Update the policy as necessary to reflect changes in business practices or legal requirements.