Travel and expense reimbursement policy (Pennsylvania): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Pennsylvania)

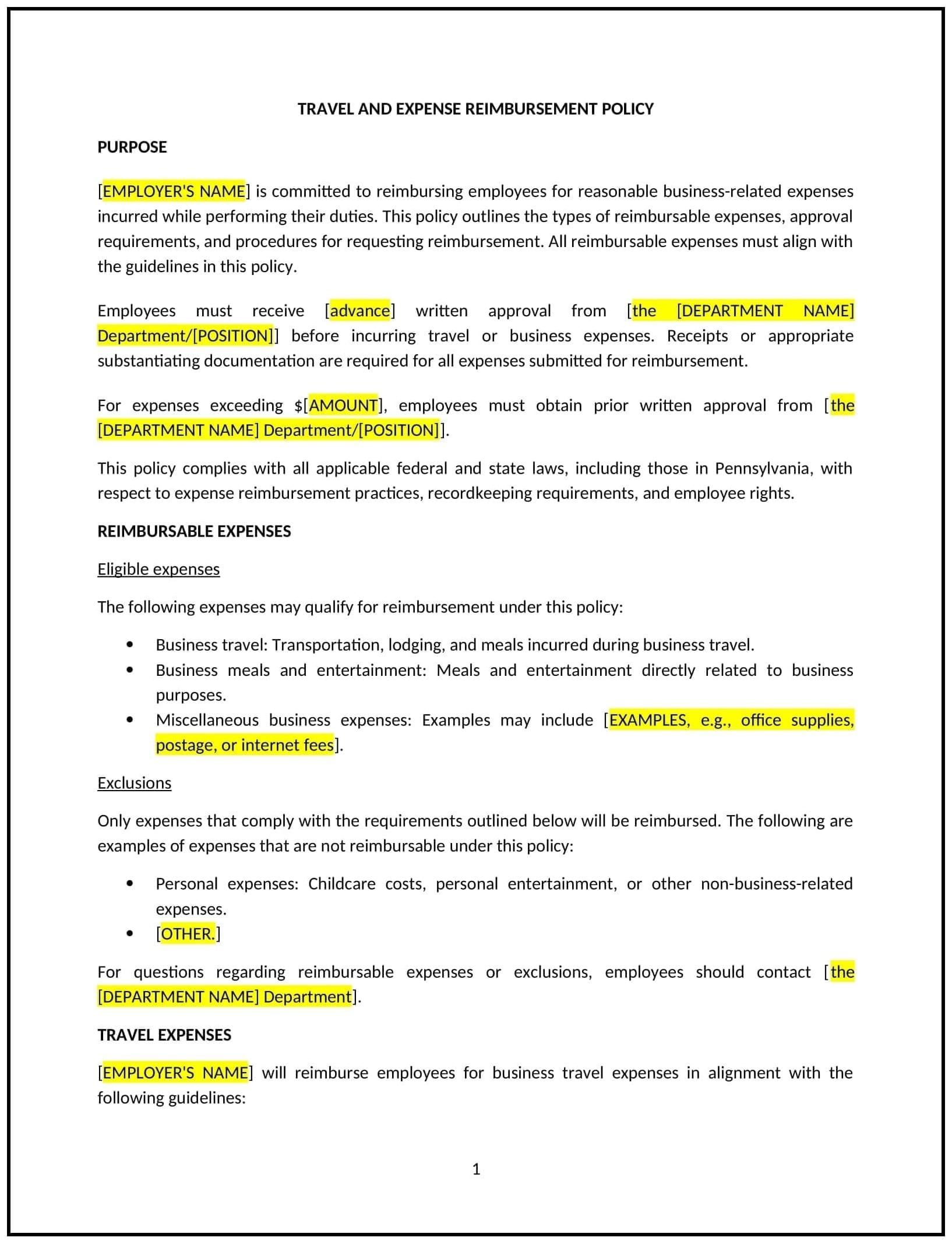

This travel and expense reimbursement policy is designed to help businesses in Pennsylvania establish clear guidelines for reimbursing employees for business-related travel expenses. By defining eligible expenses, reimbursement procedures, and approval processes, this template ensures transparency and accountability while supporting compliance with Pennsylvania labor and tax regulations.

By using this template, businesses can streamline expense management, reduce disputes, and support operational efficiency.

How to use this travel and expense reimbursement policy (Pennsylvania)

- Define eligible expenses: Clearly specify which expenses are eligible for reimbursement, such as transportation, lodging, meals, and incidentals incurred during business travel.

- Include documentation requirements: Outline the required documentation, such as receipts, invoices, or mileage logs, to validate expenses.

- Set reimbursement limits: Provide guidelines for limits on reimbursable expenses, such as daily meal allowances or maximum lodging rates, and address per diem rates if applicable.

- Establish submission procedures: Specify how and when employees should submit reimbursement requests, including timelines and approval processes.

- Reflect Pennsylvania-specific considerations: Tailor the policy to address state-specific tax laws or industry norms related to travel and expense management.

Benefits of using a travel and expense reimbursement policy (Pennsylvania)

A well-structured travel and expense reimbursement policy supports transparency and operational efficiency. Here's how it helps:

- Promotes fairness: Ensures consistent treatment of employee reimbursement requests across the organization.

- Enhances transparency: Provides clear guidelines for employees on eligible expenses and reimbursement procedures.

- Reduces disputes: Minimizes misunderstandings by clearly defining the rules for expense reimbursement.

- Supports compliance: Aligns with Pennsylvania labor laws and tax regulations to avoid financial or legal issues.

- Reflects local needs: Addresses Pennsylvania-specific travel considerations, such as regional tax implications or industry-specific practices.

Tips for using a travel and expense reimbursement policy (Pennsylvania)

- Communicate the policy: Share the policy with employees during onboarding and ensure it is easily accessible for future reference.

- Use expense management tools: Implement digital tools or software to streamline the submission and approval process for travel expenses.

- Monitor compliance: Regularly audit reimbursement requests to ensure adherence to the policy and identify any discrepancies.

- Provide training: Educate employees and managers on the proper procedures for submitting and approving expenses.

- Review periodically: Update the policy to reflect changes in Pennsylvania tax laws, industry trends, or business practices.