Travel and expense reimbursement policy (South Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

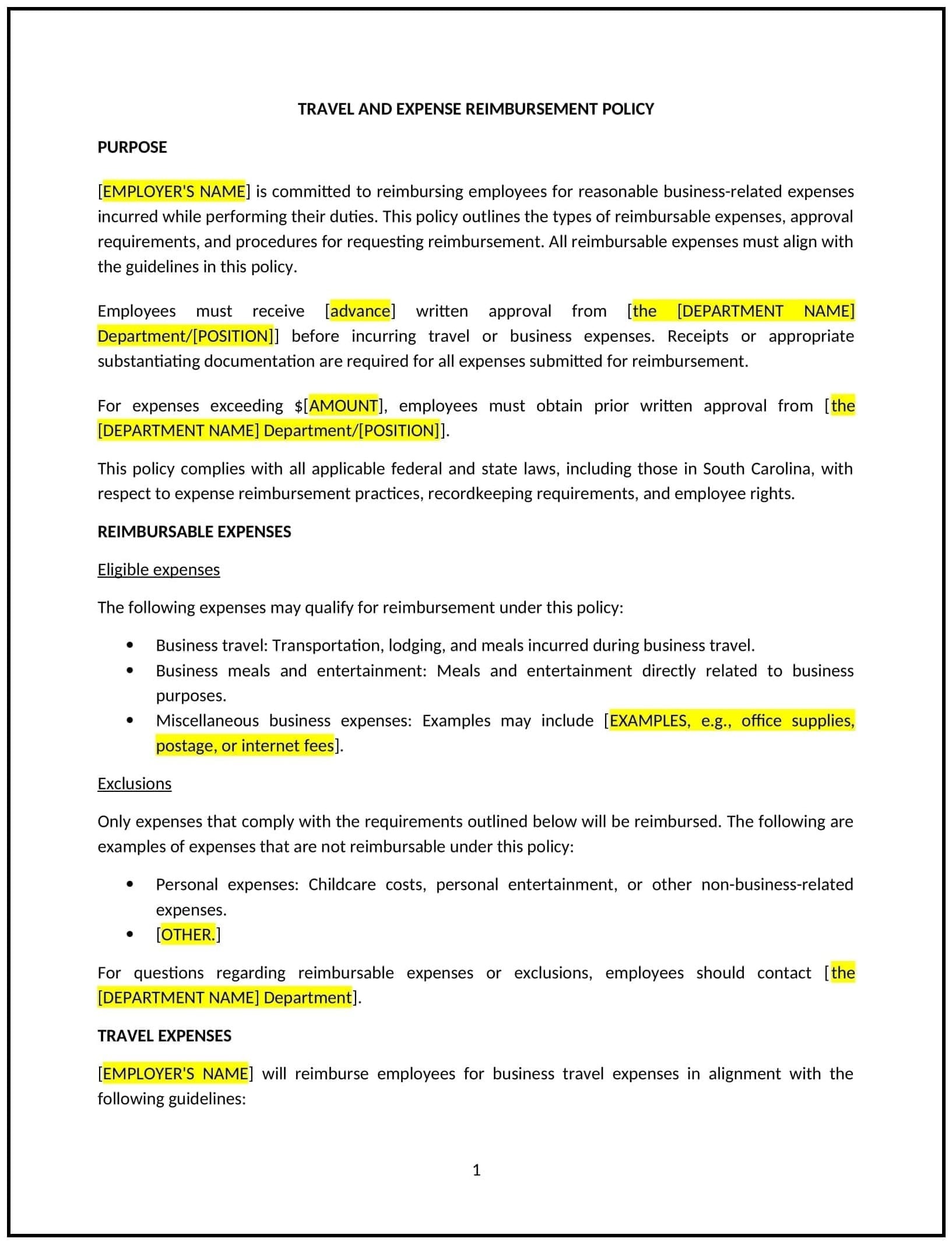

Travel and expense reimbursement policy (South Carolina)

This travel and expense reimbursement policy is designed to help South Carolina businesses establish guidelines for managing employee travel and business-related expenses. It outlines procedures for submitting expense reports, approving reimbursements, and maintaining financial accountability.

By adopting this policy, businesses can streamline expense management, reduce administrative burdens, and align with general best practices for financial transparency.

How to use this travel and expense reimbursement policy (South Carolina)

- Define eligible expenses: Explain what constitutes reimbursable expenses, such as airfare, accommodations, meals, and transportation.

- Establish approval processes: Provide steps for employees to submit expense reports and obtain approval for reimbursements.

- Set spending limits: Specify maximum amounts for different expense categories, such as daily meal allowances or hotel rates.

- Address documentation requirements: Outline the receipts or documentation needed to support reimbursement requests.

- Train employees: Educate staff on their responsibilities for adhering to the policy and submitting accurate expense reports.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and financial standards.

Benefits of using this travel and expense reimbursement policy (South Carolina)

This policy offers several advantages for South Carolina businesses:

- Streamlines expense management: Simplifies the process of handling travel and business-related expenses.

- Enhances accountability: Ensures expenses are documented and approved appropriately.

- Aligns with best practices: Provides a structured approach to managing travel and expense reimbursements.

- Reduces administrative burdens: Minimizes paperwork and processing time for expense reports.

- Builds trust: Demonstrates a commitment to financial transparency and accountability.

Tips for using this travel and expense reimbursement policy (South Carolina)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate staff on their responsibilities for adhering to the policy and submitting accurate expense reports.

- Monitor adherence: Regularly review expense reports to ensure compliance with the policy.

- Address issues promptly: Take corrective action if expenses are misreported or if documentation is incomplete.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs and financial standards.