Travel and expense reimbursement policy (Texas): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Travel and expense reimbursement policy (Texas)

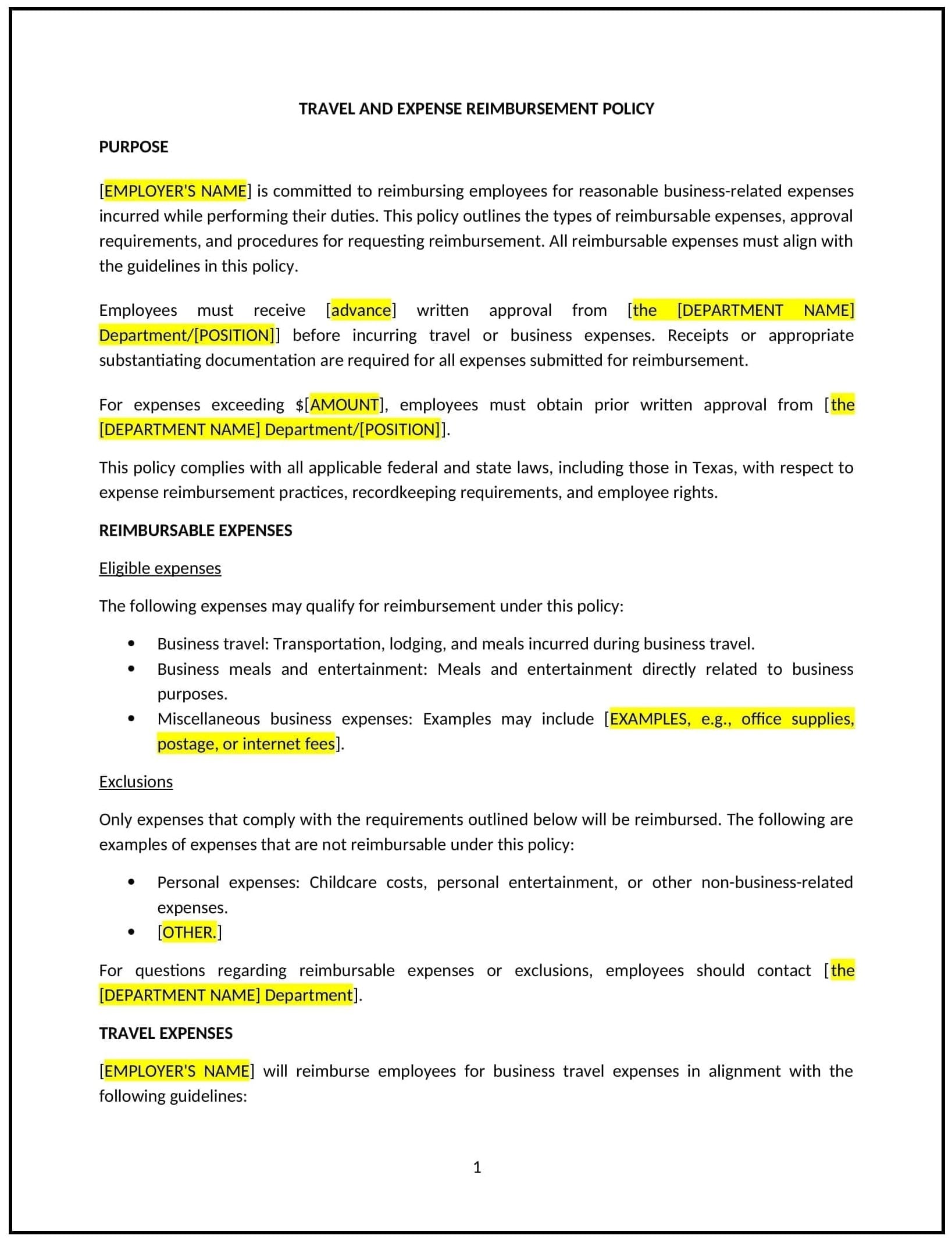

This travel and expense reimbursement policy is designed to help Texas businesses establish clear guidelines for reimbursing employees for travel-related expenses incurred during business trips. The policy outlines the types of expenses eligible for reimbursement, the process for submitting reimbursement requests, and the documentation required, ensuring that the company maintains control over expenses while supporting employee travel needs.

By adopting this policy, businesses can promote accountability, ensure consistent and fair reimbursement practices, and streamline the expense reimbursement process.

How to use this travel and expense reimbursement policy (Texas)

- Define eligible expenses: Clearly outline what types of travel-related expenses are eligible for reimbursement, such as transportation (airfare, mileage, rental cars), lodging, meals, parking, and other necessary business-related costs incurred during travel. Specify any exclusions, such as personal expenses or luxury upgrades.

- Set approval procedures: Outline the process for obtaining approval for travel expenses before the trip, including who must approve travel requests, any budgetary constraints, and how employees should submit travel plans for review.

- Specify reimbursement limits: Define the maximum amounts that will be reimbursed for various types of expenses, such as per diem meal allowances, hotel rates, and transportation costs. The policy should include guidelines for standard rates and reasonable expenses.

- Require documentation: Specify the documentation that employees must provide when submitting reimbursement requests, including receipts, proof of payment, and a detailed breakdown of the expenses. The policy should also address the acceptable format for submitting documentation, such as digital or paper copies.

- Address travel-related advances: If applicable, explain the process for providing travel advances to employees before business trips and the requirements for reconciling the advance with the actual expenses upon return.

- Set timelines for reimbursement: Define the timeline for submitting reimbursement requests, such as within 30 days of the trip's conclusion, and the process for processing reimbursements once the request is received.

- Clarify non-reimbursable expenses: List expenses that will not be reimbursed, such as personal travel costs, alcoholic beverages, entertainment, or other non-business-related expenses, to prevent misunderstandings.

- Provide guidelines for international travel: If applicable, outline the procedure for reimbursing international travel expenses, including currency conversion rates, approval for international trips, and any additional documentation required for foreign expenses.

Benefits of using this travel and expense reimbursement policy (Texas)

This policy offers several benefits for Texas businesses:

- Promotes financial control: By setting clear guidelines for reimbursable expenses and providing approval limits, businesses can maintain control over travel-related costs and ensure that spending stays within budgetary limits.

- Increases consistency: The policy ensures that all employees are reimbursed fairly and consistently for travel expenses, reducing the risk of misunderstandings or discrepancies in the reimbursement process.

- Improves administrative efficiency: By establishing a streamlined process for submitting and processing reimbursements, the business can reduce administrative workload and ensure faster turnaround times for employees.

- Enhances compliance: A well-defined travel and expense reimbursement policy strengthens the company’s compliance with Texas state laws, federal regulations, and tax requirements, such as proper recordkeeping and documentation for tax deductions.

- Supports employee satisfaction: By covering necessary travel expenses and providing clear guidelines, businesses show support for employees who are required to travel for work, improving employee satisfaction and engagement.

- Reduces the risk of fraud or misuse: Setting clear documentation requirements and reimbursement limits helps prevent fraudulent or unnecessary expense claims, ensuring that only legitimate business-related costs are reimbursed.

Tips for using this travel and expense reimbursement policy (Texas)

- Communicate the policy clearly: Ensure that all employees who are required to travel for business purposes are aware of the travel and expense reimbursement policy, including the reimbursement process, documentation requirements, and approval procedures.

- Be proactive with approvals: Encourage employees to obtain approval for travel expenses before booking trips to avoid misunderstandings or non-reimbursable expenses.

- Monitor compliance: Regularly review expense reports and receipts to ensure compliance with the policy and address any discrepancies or non-compliant claims promptly.

- Streamline reimbursement procedures: Use digital tools or expense management software to simplify the submission, approval, and reimbursement processes, making it easier for employees and managers to track expenses and approvals.

- Review and update regularly: Periodically review the policy to ensure that it remains aligned with Texas state laws, federal regulations, and the company’s evolving travel needs and financial practices.