Travel and expense reimbursement policy (Utah): Free template

Travel and expense reimbursement policy (Utah)

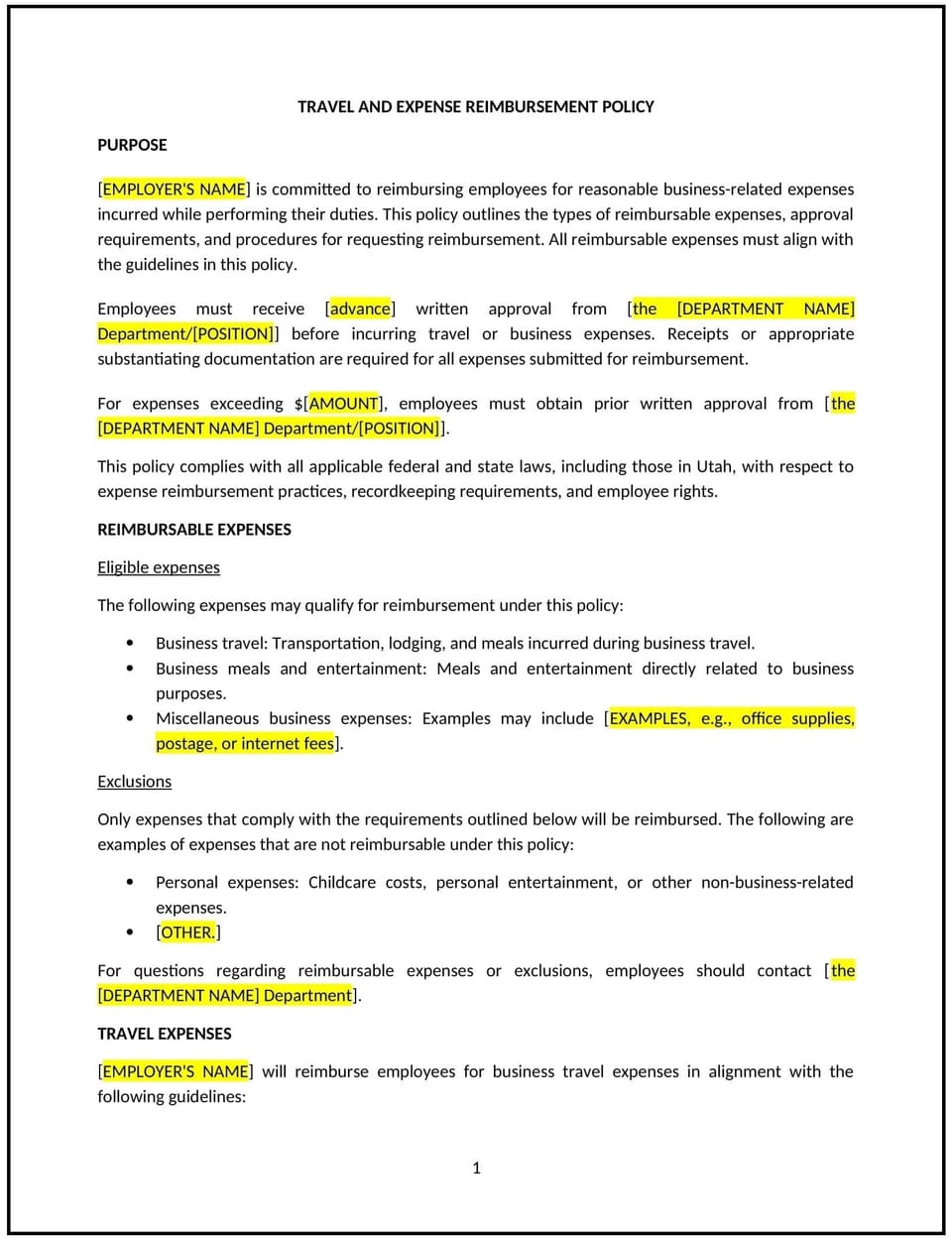

This travel and expense reimbursement policy is designed to help Utah businesses establish guidelines for reimbursing employees for business-related travel and expenses. It outlines procedures for submitting expense reports, eligible expenses, and reimbursement timelines.

By adopting this policy, businesses can ensure fair and consistent reimbursement practices, reduce financial risks, and align with general best practices for expense management.

How to use this travel and expense reimbursement policy (Utah)

- Define eligible expenses: Specify which expenses are reimbursable, such as airfare, accommodations, meals, or transportation.

- Establish submission procedures: Provide steps for employees to submit expense reports, including required documentation and approvals.

- Set reimbursement timelines: Define how long employees should wait for reimbursement after submitting expense reports.

- Address spending limits: Specify limits for certain expenses, such as daily meal allowances or hotel rates.

- Train employees: Educate employees on the policy, eligible expenses, and submission procedures.

- Monitor compliance: Regularly review expense reports to ensure adherence to the policy.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.

Benefits of using this travel and expense reimbursement policy (Utah)

This policy offers several advantages for Utah businesses:

- Ensures fairness: Provides clear guidelines for reimbursing employees, reducing disputes or inconsistencies.

- Reduces financial risks: Minimizes the potential for fraud or misuse of company funds.

- Aligns with best practices: Offers a structured approach to managing travel and expense reimbursements.

- Enhances transparency: Demonstrates a commitment to fair and accountable financial practices.

- Builds trust: Shows employees that the business values their contributions and supports their business-related expenses.

Tips for using this travel and expense reimbursement policy (Utah)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate employees on the policy, eligible expenses, and submission procedures.

- Monitor compliance: Regularly review expense reports to ensure adherence to the policy.

- Address issues promptly: Take corrective action if expense reports are submitted improperly or violate the policy.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.

Q: How does this policy benefit businesses?

A: By managing travel and expense reimbursements effectively, businesses can ensure fairness, reduce financial risks, and enhance transparency.

Q: What types of expenses are typically reimbursable?

A: Reimbursable expenses may include airfare, accommodations, meals, transportation, and other business-related costs.

Q: How can businesses ensure compliance with the policy?

A: Businesses should provide clear guidelines, require documentation for all expenses, and review expense reports regularly.

Q: What should businesses do if an employee submits an ineligible expense?

A: Businesses should reject the expense, provide an explanation, and remind the employee of the policy.

Q: How often should businesses review this policy?

A: Businesses should review the policy annually or as needed to ensure it aligns with evolving business needs and financial practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.