Travel and expense reimbursement policy (Vermont): Free template

Travel and expense reimbursement policy (Vermont)

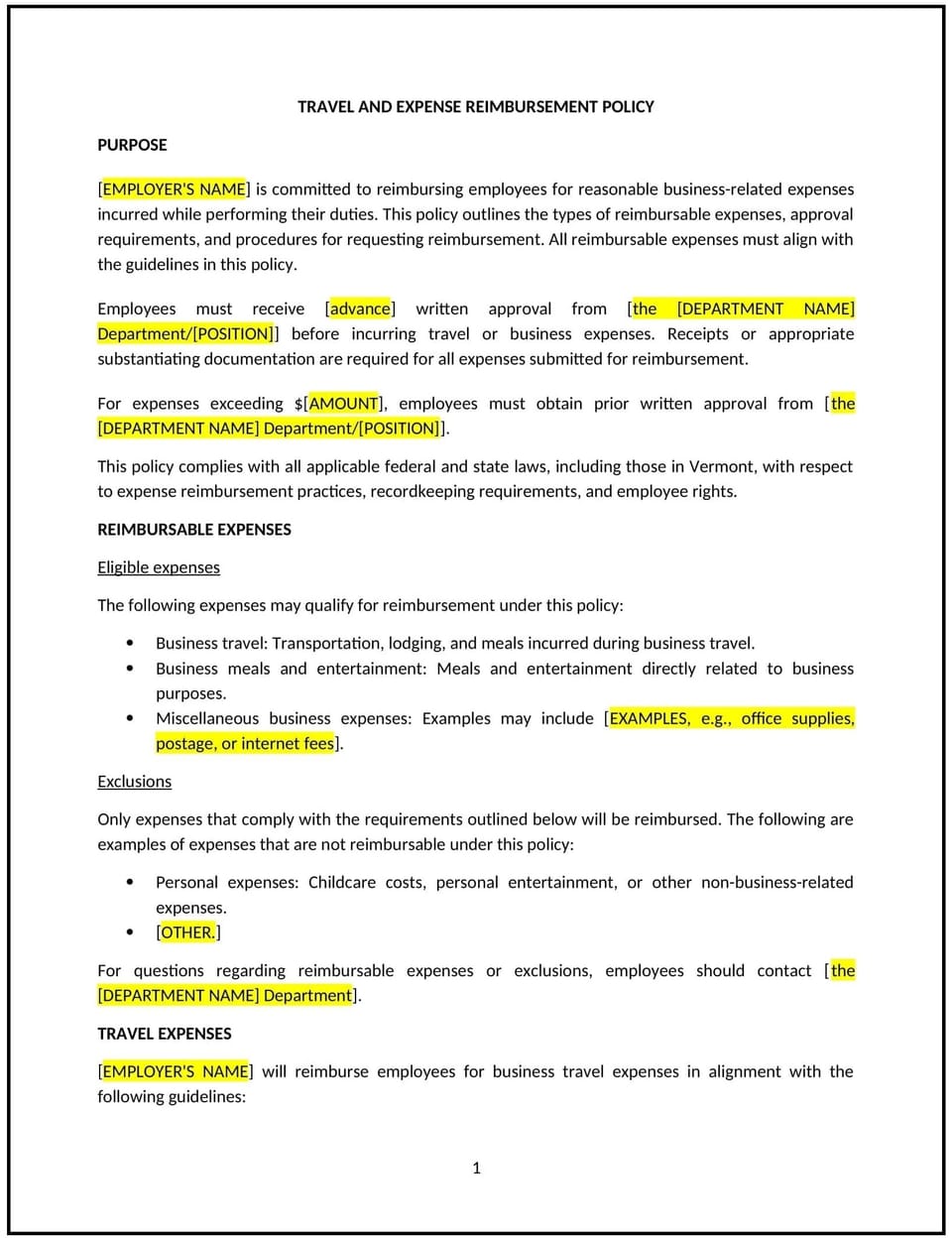

This travel and expense reimbursement policy is designed to help Vermont businesses manage and reimburse business-related travel and expenses. It outlines guidelines for expense eligibility, submission procedures, and reimbursement timelines to ensure transparency, compliance, and accountability.

By adopting this policy, businesses can support employees’ travel needs while maintaining cost control and adherence to Vermont regulations.

How to use this travel and expense reimbursement policy (Vermont)

- Define eligible expenses: Specify reimbursable costs, such as transportation, lodging, meals, and business-related incidentals.

- Set spending limits: Establish limits for specific expense categories, such as daily meal allowances or maximum hotel rates, to manage costs effectively.

- Include pre-approval requirements: Require employees to obtain approval for travel or significant expenses before incurring costs.

- Provide submission procedures: Detail how employees should submit expense reports, including required documentation like receipts and forms.

- Outline reimbursement timelines: Specify when employees can expect reimbursement after submitting an approved expense report.

- Address compliance: Emphasize adherence to Vermont tax regulations and company standards for expense reporting.

- Monitor compliance: Conduct periodic reviews of expense reports to ensure alignment with this policy and Vermont laws.

Benefits of using this travel and expense reimbursement policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Enhances transparency: Establishes clear guidelines for managing and reimbursing travel expenses.

- Promotes compliance: Aligns with Vermont tax laws and reporting requirements.

- Supports accountability: Ensures employees and managers understand their roles in controlling business travel costs.

- Reduces disputes: Minimizes misunderstandings by clarifying reimbursement expectations.

- Improves cost management: Helps businesses track and control travel-related expenses effectively.

Tips for using this travel and expense reimbursement policy (Vermont)

- Communicate the policy: Share the policy with employees during onboarding and include it in the employee handbook or internal resources.

- Provide training: Educate employees on submission procedures, eligible expenses, and spending limits.

- Use technology: Implement expense management software to streamline reporting, approvals, and reimbursements.

- Maintain records: Keep detailed documentation of all travel and expense reports for tax compliance and audits.

- Update regularly: Revise the policy to reflect changes in Vermont laws, company practices, or industry standards.

Q: What expenses are eligible for reimbursement under this policy?

A: Eligible expenses include transportation, lodging, meals, and other business-related costs, such as conference fees or mileage reimbursement for personal vehicle use.

Q: Are there limits on reimbursable expenses?

A: Yes, limits are established for specific categories, such as daily meal allowances or maximum lodging rates, to ensure cost control.

Q: How should employees submit expense reports?

A: Employees should complete a standardized expense report form, attach required receipts, and submit it to their manager or HR for approval.

Q: What documentation is required for reimbursement?

A: Receipts, invoices, or other proof of payment must accompany all expense reports to verify reimbursable costs.

Q: How soon can employees expect reimbursement?

A: Reimbursements are typically processed within a set timeframe, such as 14 days, after submission and approval of expense reports.

Q: Can employees use personal vehicles for business travel?

A: Yes, employees can use personal vehicles and may be reimbursed for mileage at the current IRS-approved rate, as outlined in the policy.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever significant changes occur in Vermont laws, company practices, or industry standards.

Q: Does this policy apply to contractors or freelancers?

A: Contractors and freelancers may be covered under separate agreements, and this policy applies primarily to employees unless otherwise specified.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.