Travel and expense reimbursement policy (Virginia): Free template

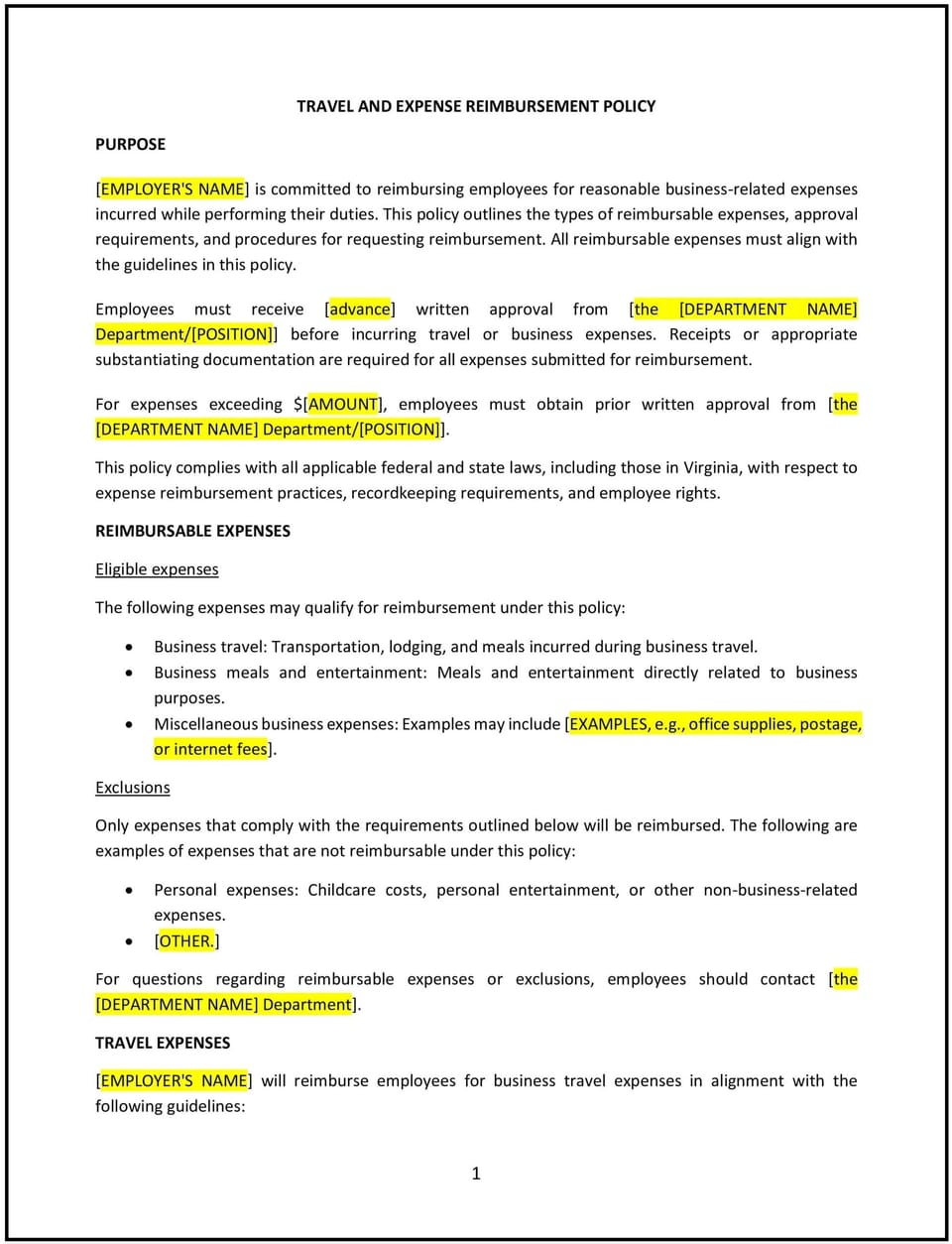

This travel and expense reimbursement policy is designed to help Virginia businesses manage employee travel and expenses in a consistent, transparent, and compliant manner. The policy outlines the procedures and guidelines for reimbursing employees for travel-related expenses incurred during business trips, including transportation, lodging, meals, and other incidentals. It ensures that both employees and the company are clear on what is reimbursable and how expenses should be documented and submitted.

By adopting this policy, businesses can maintain financial control, ensure fair treatment of employees, and comply with state and federal regulations related to travel and expense reimbursement.

How to use this travel and expense reimbursement policy (Virginia)

- Define eligible expenses: The policy should specify which types of expenses are eligible for reimbursement, including transportation (flights, rental cars, mileage), lodging (hotel accommodations), meals, and other incidental expenses (e.g., parking, tolls). It should also clarify any specific guidelines, such as maximum spending limits or preferred vendors.

- Set approval processes: The policy should define the process for getting travel and expense requests approved before the trip takes place. Employees should be required to submit a travel plan or budget that outlines the expected expenses and obtains prior approval from their supervisor or manager.

- Outline the reimbursement process: The policy should describe how employees should submit their expenses for reimbursement, including the required documentation (receipts, expense forms) and the timeline for submission. It should specify the timeframe within which employees must submit their expenses after returning from a business trip.

- Provide guidelines for reimbursable and non-reimbursable expenses: Clearly outline which expenses are reimbursable and which are not, such as personal travel expenses, entertainment, or alcohol. Employees should understand what they are and are not allowed to claim as business expenses.

- Address per diem and meal allowances: The policy should address whether employees will receive a per diem for meals and incidentals or if they will be reimbursed based on actual expenses. If per diem rates are used, the policy should specify the amount and any applicable conditions.

- Ensure compliance with Virginia state and federal tax laws: The policy should ensure compliance with Virginia state tax laws and federal regulations related to travel and expense reimbursements. This includes proper documentation for tax purposes and any tax implications for non-compliant expense claims.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this travel and expense reimbursement policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Promotes financial accountability: By clearly defining what is eligible for reimbursement, the policy helps businesses maintain financial control and prevent misuse of company funds.

- Ensures fair treatment of employees: The policy ensures that employees are fairly reimbursed for expenses incurred while conducting business on behalf of the company, helping to maintain employee trust and satisfaction.

- Reduces administrative overhead: The policy streamlines the expense reporting and reimbursement process, reducing confusion and ensuring that employees understand how to submit their expenses efficiently.

- Supports legal compliance: By adhering to Virginia state laws and federal regulations, businesses reduce the risk of legal issues related to non-compliant reimbursement practices or tax implications.

- Improves budget management: By setting clear guidelines for travel-related expenses, the policy helps businesses better forecast and manage travel budgets, avoiding unexpected or excessive costs.

- Enhances employee satisfaction: Clear and timely reimbursement for business-related expenses improves employee morale and encourages compliance with company policies and procedures.

Tips for using this travel and expense reimbursement policy (Virginia)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy, including the types of reimbursable expenses, approval processes, and required documentation. Include the policy in the employee handbook and review it during onboarding and training.

- Set clear expectations for travel planning: Employees should plan their travel in advance and submit requests for approval in accordance with the policy. Clearly communicate deadlines for submitting expense reports to ensure timely reimbursement.

- Monitor compliance: Regularly review submitted expenses to ensure they comply with the policy guidelines. Implement a system for auditing expense claims to identify any discrepancies or areas for improvement.

- Encourage cost-effective practices: While adhering to company policies, encourage employees to seek cost-effective options for travel and accommodations. This helps reduce business travel expenses and optimize the overall budget.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

Q: What expenses are eligible for reimbursement?

A: The policy specifies that eligible expenses include transportation (flights, rental cars, mileage), lodging (hotel accommodations), meals, and other incidentals (e.g., parking, tolls). Personal expenses, entertainment, or alcohol are typically not reimbursable unless explicitly stated in the policy.

Q: How do employees submit their expenses for reimbursement?

A: Employees should submit their expenses through the company’s designated expense reporting system, attaching all relevant receipts and documentation. The expenses should be submitted within [specified number of days] after the business trip.

Q: Is there a cap on meal allowances or per diems?

A: Yes, the policy outlines the allowable per diem rates for meals and incidentals based on the destination of the business trip. Employees should adhere to these limits to avoid exceeding the company’s reimbursement guidelines.

Q: How should employees handle international travel expenses?

A: The policy may include specific guidelines for international travel expenses, including currency conversion, per diem rates for different countries, and any additional documentation or tax requirements. Employees should review these guidelines before traveling internationally.

Q: What should employees do if their expenses are rejected?

A: If an expense is rejected, the employee should review the policy to understand the reason for the rejection and resubmit the claim with the necessary corrections or additional documentation. Employees can also reach out to the HR or finance department for clarification.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.