Travel and expense reimbursement policy (Washington): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

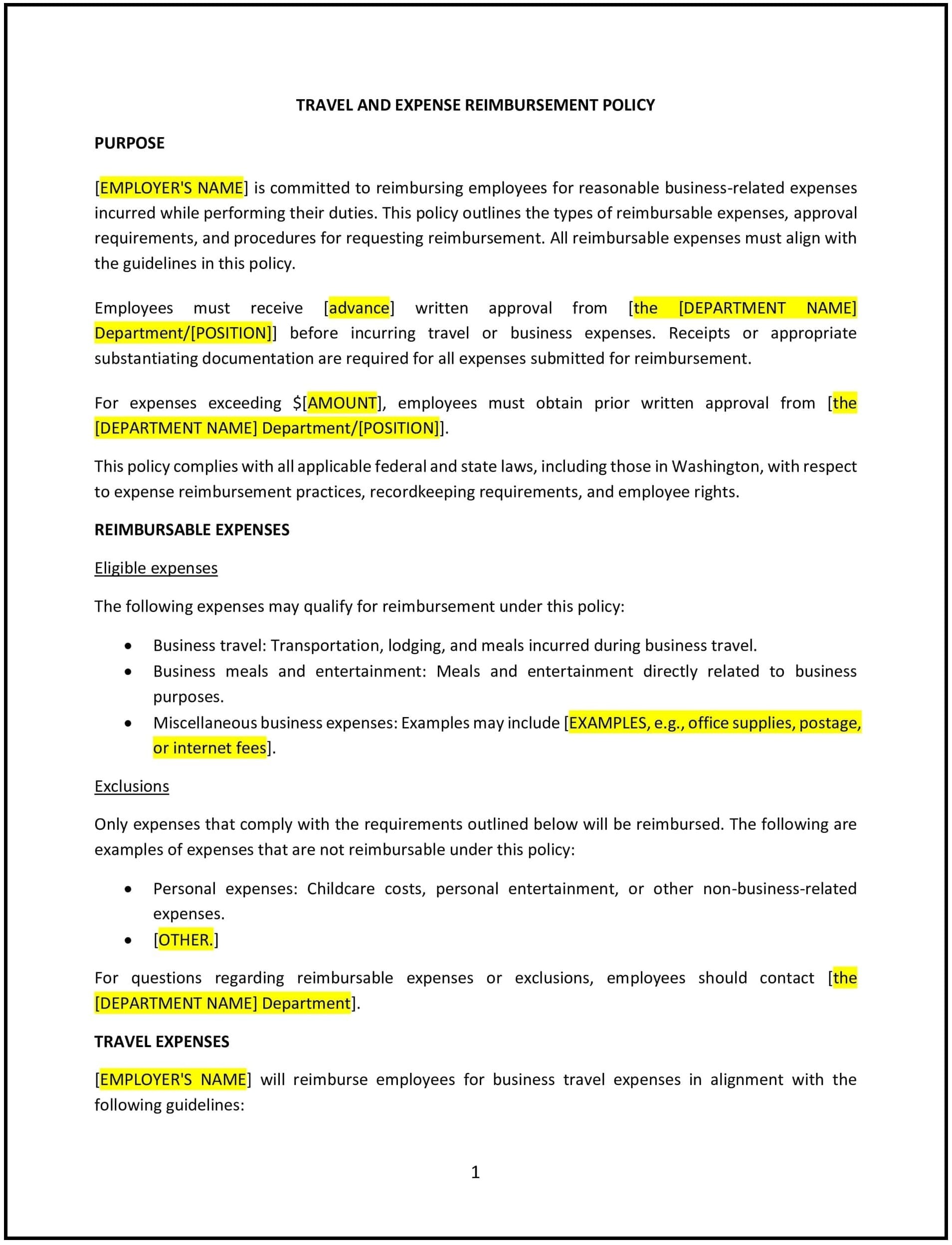

This travel and expense reimbursement policy is designed to help Washington businesses manage employee travel and expenses related to business activities. The policy outlines the procedures for submitting expenses, the types of expenses that are reimbursable, and the documentation required to ensure compliance with Washington state laws and federal regulations. It also establishes clear guidelines for managing company finances while promoting transparency and accountability.

By adopting this policy, businesses can maintain control over travel and expense costs, ensure that employees are fairly reimbursed for business-related expenses, and promote legal compliance with Washington state and federal tax laws.

How to use this travel and expense reimbursement policy (Washington)

- Define reimbursable expenses: The policy should clearly define what expenses are eligible for reimbursement, including travel (flights, accommodations, car rentals), meals, and incidental expenses (e.g., parking, tolls). It should outline any limits or guidelines for each category of expense, ensuring that employees understand what is considered reasonable and acceptable.

- Establish approval procedures: The policy should specify the process for obtaining pre-approval for travel and expenses. This includes who needs to approve travel requests, any necessary documentation, and the required steps before an employee can incur expenses or book travel arrangements.

- Set limits and guidelines for expenses: The policy should outline any limits on travel and meal expenses (e.g., daily meal allowances, hotel price limits), as well as acceptable alternatives for transportation (e.g., personal car use versus rental cars). It should ensure that expenses are reasonable and within the company’s budget.

- Require documentation for reimbursement: The policy should specify the types of documentation required for reimbursement, such as receipts, invoices, and proof of payment. Employees should be instructed on how to submit expense reports, the format for submission, and the timeline for reimbursement.

- Specify reimbursement timelines: The policy should establish a timeline for submitting expense reports, such as within 30 days of the business trip or purchase. It should also clarify how quickly employees can expect reimbursement after submitting their expenses.

- Address non-reimbursable expenses: The policy should clearly state which expenses are not reimbursable, such as personal expenses, fines, or costs related to activities outside of business purposes. This ensures that employees do not mistakenly submit non-business-related expenses.

- Ensure compliance with Washington and federal tax laws: The policy should ensure compliance with relevant Washington state and federal tax laws, including tax treatment of certain expenses, mileage reimbursements, and the reporting of travel-related expenses for tax purposes.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this travel and expense reimbursement policy (Washington)

This policy offers several benefits for Washington businesses:

- Promotes financial transparency: By establishing clear guidelines for travel and expense reimbursements, the policy promotes transparency and helps ensure that expenses are properly documented and approved.

- Controls costs: The policy helps businesses manage travel and expense costs by setting limits on spending and requiring pre-approval for travel arrangements. This can help the company stay within budget and avoid unnecessary expenses.

- Ensures fair reimbursement: Employees are reimbursed fairly for legitimate business expenses incurred while traveling or conducting business on behalf of the company. This can improve employee satisfaction and reduce financial stress.

- Enhances employee accountability: The policy encourages employees to be responsible for their spending and to submit accurate documentation for reimbursement. This promotes accountability and helps prevent abuse of the system.

- Supports compliance with tax regulations: The policy helps businesses comply with tax laws and regulations regarding travel and expense reimbursements, reducing the risk of tax-related issues or penalties.

- Increases employee trust: A clear and fair expense reimbursement policy fosters trust between employees and the company, improving morale and reinforcing the company's commitment to supporting its workforce.

Tips for using this travel and expense reimbursement policy (Washington)

- Communicate the policy clearly: Ensure that all employees are aware of the travel and expense reimbursement policy and understand how to submit their expenses for reimbursement. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Provide training on the policy: Train employees on how to comply with the policy, including how to submit expense reports, what expenses are reimbursable, and the importance of providing accurate documentation. This can reduce errors and streamline the reimbursement process.

- Monitor compliance: Ensure that employees are following the policy by regularly reviewing expense reports for compliance with company guidelines. Address any discrepancies or non-compliance promptly and fairly.

- Implement an efficient submission process: Make it easy for employees to submit their expense reports by offering an online submission system or clear guidelines on how to submit receipts and documentation. This can improve the efficiency of the reimbursement process.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.