Travel and expense reimbursement policy (Wisconsin): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

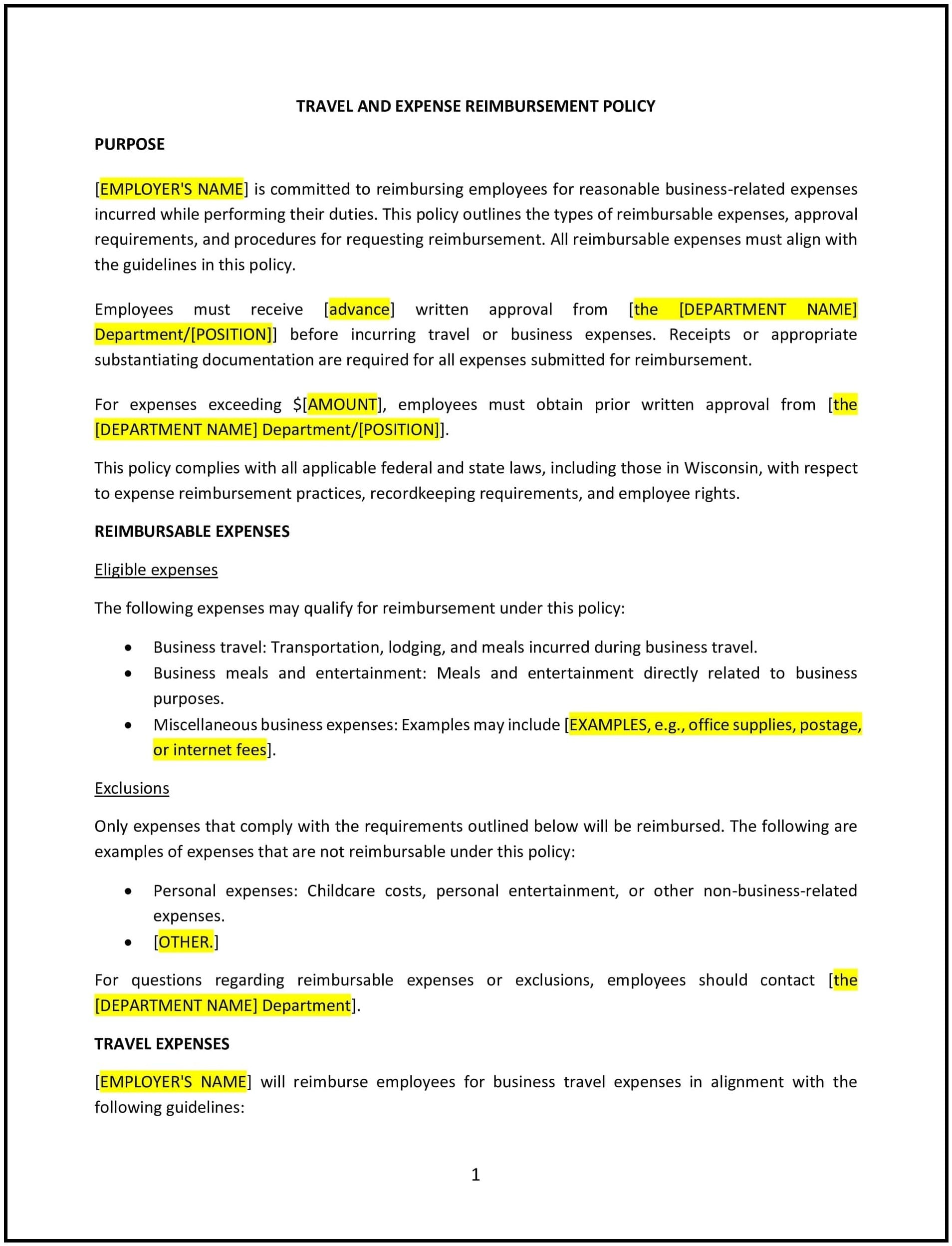

Travel and expense reimbursement policy (Wisconsin)

In Wisconsin, a travel and expense reimbursement policy ensures that employees are reimbursed for work-related travel expenses in a fair, timely, and transparent manner. This policy outlines eligible expenses, the reimbursement process, and the documentation required, helping businesses maintain compliance with state and federal regulations while promoting financial accountability.

This policy establishes clear guidelines for managing travel and expense claims, ensuring employees understand their responsibilities and the company’s reimbursement procedures.

How to use this travel and expense reimbursement policy (Wisconsin)

- Define eligible expenses: Clearly specify what types of expenses are reimbursable, such as transportation, lodging, meals, and other work-related costs.

- Outline the reimbursement process: Provide detailed instructions on how employees can submit expense claims, including required forms, deadlines, and supporting documentation.

- Set approval procedures: Identify the individuals or departments responsible for reviewing and approving expense claims to ensure accountability.

- Communicate payment timelines: Inform employees of the expected timeframe for processing and reimbursing approved expenses.

- Support compliance: Align the policy with Wisconsin state laws and federal tax regulations, such as the IRS guidelines for expense deductions.

Benefits of using a travel and expense reimbursement policy (Wisconsin)

- Promotes fairness: Ensures employees are reimbursed consistently for valid business expenses.

- Supports compliance: Helps businesses adhere to Wisconsin labor laws and federal tax regulations, minimizing the risk of penalties or audits.

- Enhances transparency: Provides a clear framework for managing travel and expense claims, reducing misunderstandings or disputes.

- Encourages accountability: Establishes guidelines that help employees manage work-related expenses responsibly.

- Improves employee satisfaction: Demonstrates a commitment to supporting employees’ work-related needs and maintaining a positive workplace culture.

Tips for using a travel and expense reimbursement policy (Wisconsin)

- Communicate the policy clearly: Share the policy with all employees during onboarding and ensure it is easily accessible for reference.

- Use standardized forms: Provide employees with templates or digital tools to streamline the expense reporting process.

- Set spending limits: Establish reasonable limits for reimbursable expenses, such as daily meal allowances or maximum lodging costs.

- Audit expense claims: Regularly review expense reports to ensure compliance with company policy and prevent fraud or errors.

- Review and update the policy: Periodically assess the policy to reflect changes in business practices, Wisconsin labor laws, or IRS regulations.