Tuition assistance policy (Connecticut): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Connecticut)

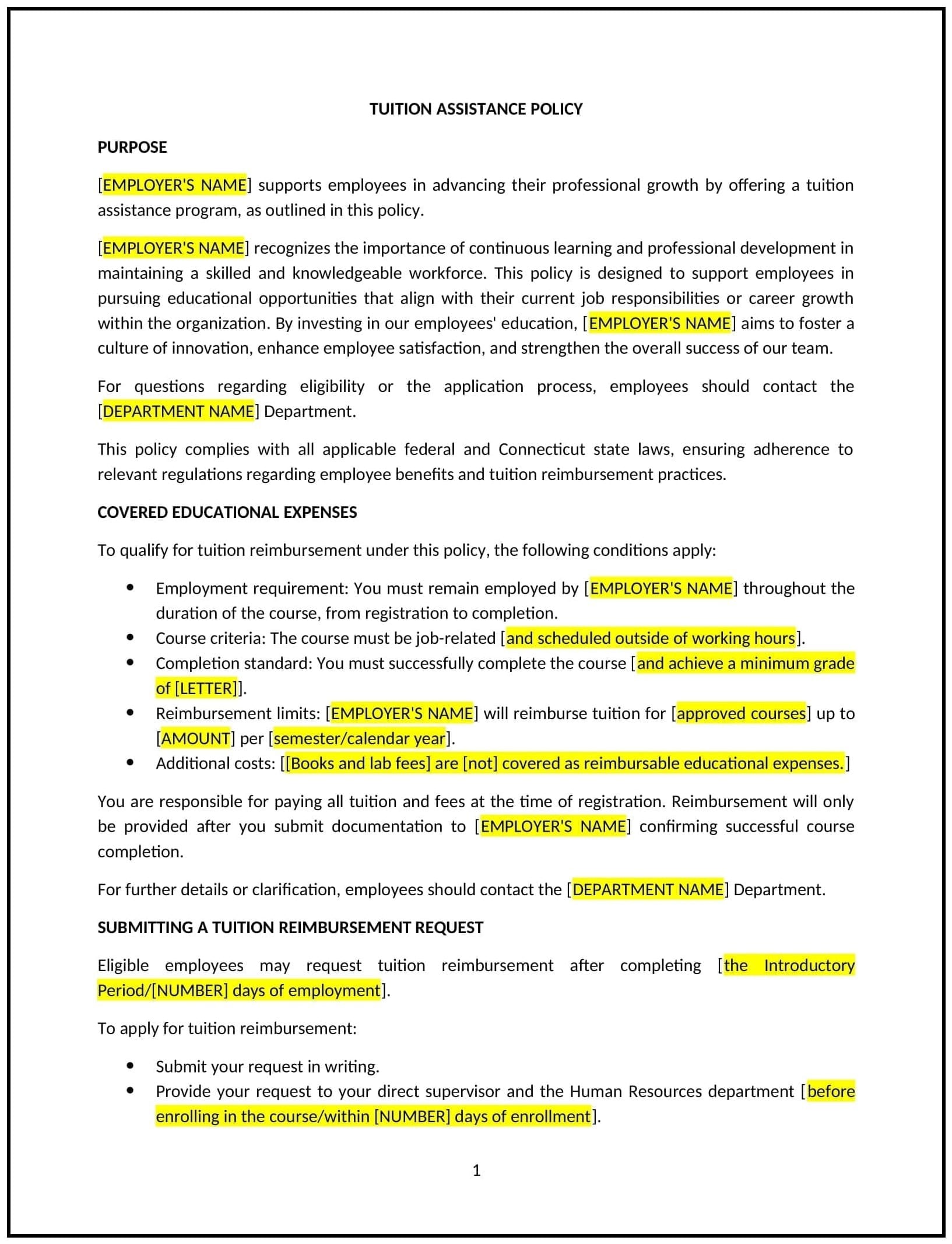

A tuition assistance policy helps Connecticut businesses support employees' educational growth by offering financial assistance for job-related coursework, certifications, or degree programs. This policy outlines the company’s approach to providing tuition reimbursement, including eligibility, covered expenses, application procedures, and the requirements for receiving financial support for educational pursuits.

By implementing this policy, businesses can encourage employees to enhance their skills, improve job performance, and foster long-term loyalty by supporting their professional development.

How to use this tuition assistance policy (Connecticut)

- Define eligibility: Specify the criteria for employees to qualify for tuition assistance, such as length of employment, job relevance of the course or program, and performance requirements.

- Outline covered expenses: List the expenses that will be covered by the tuition assistance program, such as tuition, textbooks, fees, or materials, and set any limits on reimbursement amounts.

- Set application procedures: Establish a clear process for employees to apply for tuition assistance, including how far in advance applications should be submitted, the required documentation (e.g., course enrollment proof), and the approval process.

- Define reimbursement terms: Specify whether the reimbursement is paid upfront or after the course is completed, and include any conditions for receiving the reimbursement, such as achieving a certain grade or completing the course.

- Address job relevance: Ensure that the courses or programs being funded align with the employee’s current job or career path within the company.

- Set timeframes for repayment: If applicable, include a provision requiring employees to repay tuition assistance if they leave the company within a certain period after receiving the assistance.

- Promote ongoing learning: Encourage employees to take advantage of educational opportunities and continually improve their skills by clarifying the availability and benefits of tuition assistance.

Benefits of using this tuition assistance policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Enhances employee skills: By providing tuition assistance, businesses help employees develop new skills, which improves job performance and contributes to overall company success.

- Increases employee satisfaction and retention: Offering educational support shows that the company is committed to employees’ professional growth, boosting morale and encouraging long-term loyalty.

- Supports business growth: As employees gain new knowledge and skills, they can apply these lessons to their roles, which helps the company stay competitive and foster innovation.

- Fosters a culture of learning: The policy encourages continuous development, creating a workplace where employees are motivated to grow professionally.

- Reduces turnover: By offering tuition assistance, businesses show a commitment to investing in their employees, which can help reduce turnover and retain top talent.

Tips for using this tuition assistance policy (Connecticut)

- Communicate the policy clearly: Ensure all employees are aware of the tuition assistance program, including how to apply, the types of courses that are eligible, and the approval process.

- Encourage relevant courses: Focus on supporting educational programs that are relevant to employees’ current roles or potential career growth within the company.

- Monitor reimbursement and performance: Keep track of tuition assistance requests and ensure employees meet the requirements for reimbursement, such as passing courses or achieving certain grades.

- Offer additional support: Consider providing resources, such as study time during work hours or access to online learning platforms, to encourage employees to succeed in their educational pursuits.

- Review periodically: Regularly review the policy to ensure it remains effective, complies with changes in Connecticut laws or business needs, and aligns with the company’s educational goals.