Tuition assistance policy (Maryland): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Maryland)

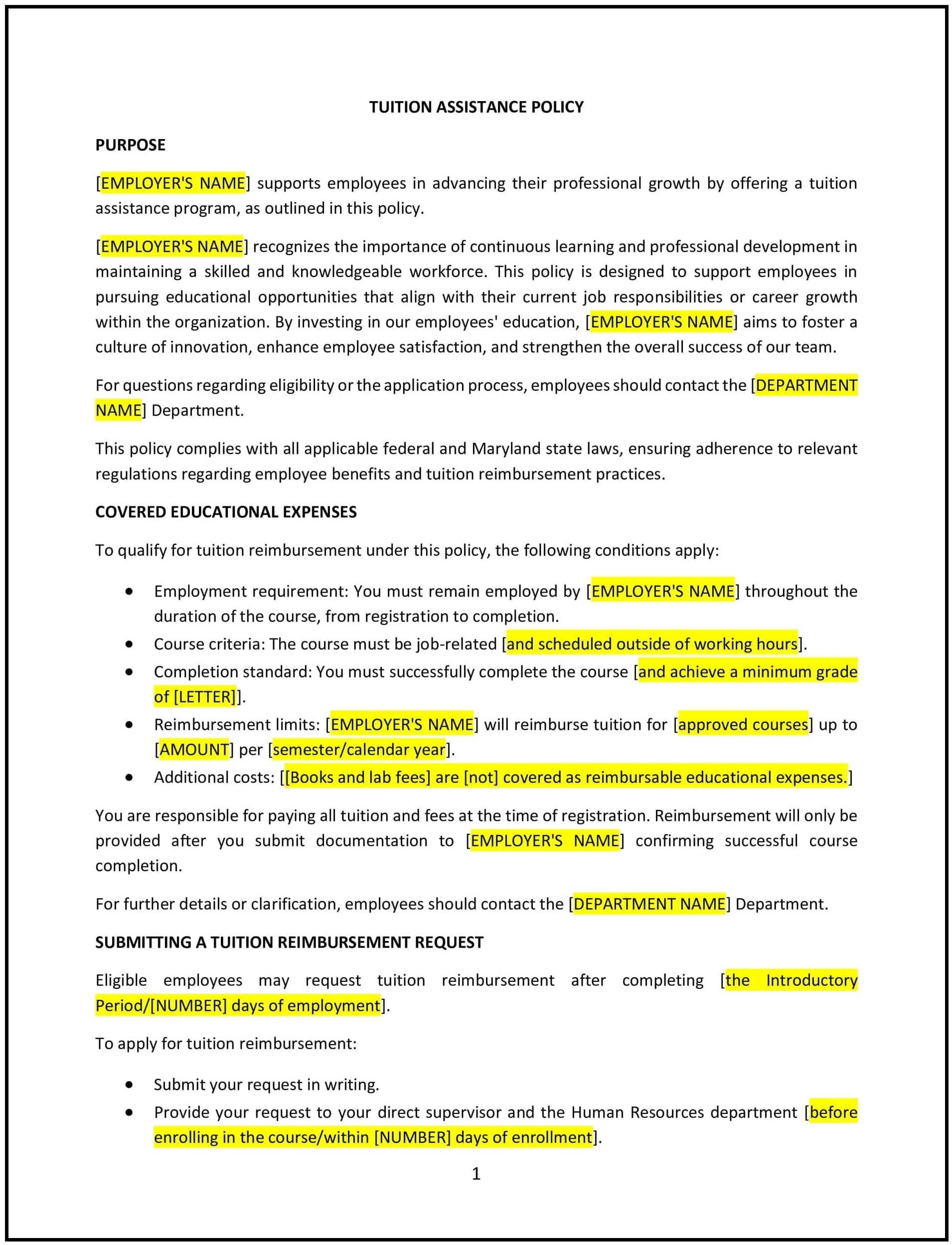

This tuition assistance policy is designed to help Maryland businesses support the professional development of their employees by offering financial assistance for job-related education, certifications, and degree programs. It outlines eligibility, application procedures, and reimbursement processes for employees seeking tuition assistance.

By adopting this policy, Maryland businesses can invest in their employees’ growth, improve skill sets, and enhance overall organizational performance.

How to use this tuition assistance policy (Maryland)

- Define eligibility: Specify which employees are eligible for tuition assistance, including criteria such as employment duration, performance, and job relevance.

- Establish approved programs: Detail the types of educational programs that qualify for assistance, such as degrees, certifications, and job-related training programs.

- Set reimbursement limits: Outline the maximum amount the company will contribute toward tuition and related expenses, including fees, books, and materials.

- Define reimbursement process: Specify the steps for applying for tuition assistance, including pre-approval requirements, documentation submission, and reimbursement procedures.

- Include performance requirements: Set expectations for academic performance (e.g., minimum GPA) for reimbursement eligibility and specify the timeframe within which employees must complete their education.

- Reflect Maryland-specific considerations: Include any state-specific laws or regulations that may apply to tuition assistance programs, such as tax implications or educational benefits for Maryland employees.

Benefits of using this tuition assistance policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Enhances employee skills: Provides employees with opportunities to acquire new skills and knowledge that can directly benefit their roles and contribute to company success.

- Increases retention: Demonstrates the company’s commitment to employee growth, improving job satisfaction and reducing turnover.

- Supports business goals: Aligns employee education with the company’s strategic objectives, fostering a more skilled and capable workforce.

- Promotes a culture of learning: Encourages employees to engage in continuous learning and professional development.

- Aligns with Maryland practices: Reflects the growing demand for employee education and professional development within the workforce.

Tips for using this tuition assistance policy (Maryland)

- Communicate clearly: Ensure that all employees understand the eligibility requirements, available benefits, and the application process for tuition assistance.

- Streamline the application process: Make it easy for employees to submit applications and track their progress, ensuring clear communication about deadlines and documentation requirements.

- Monitor compliance: Regularly review applications and academic performance to ensure that employees are meeting the necessary criteria for reimbursement.

- Track educational benefits: Keep records of tuition assistance provided to employees for budget tracking and tax purposes.

- Review regularly: Update the policy as needed to reflect changes in Maryland regulations, employee needs, or company priorities.