Tuition assistance policy (Massachusetts): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

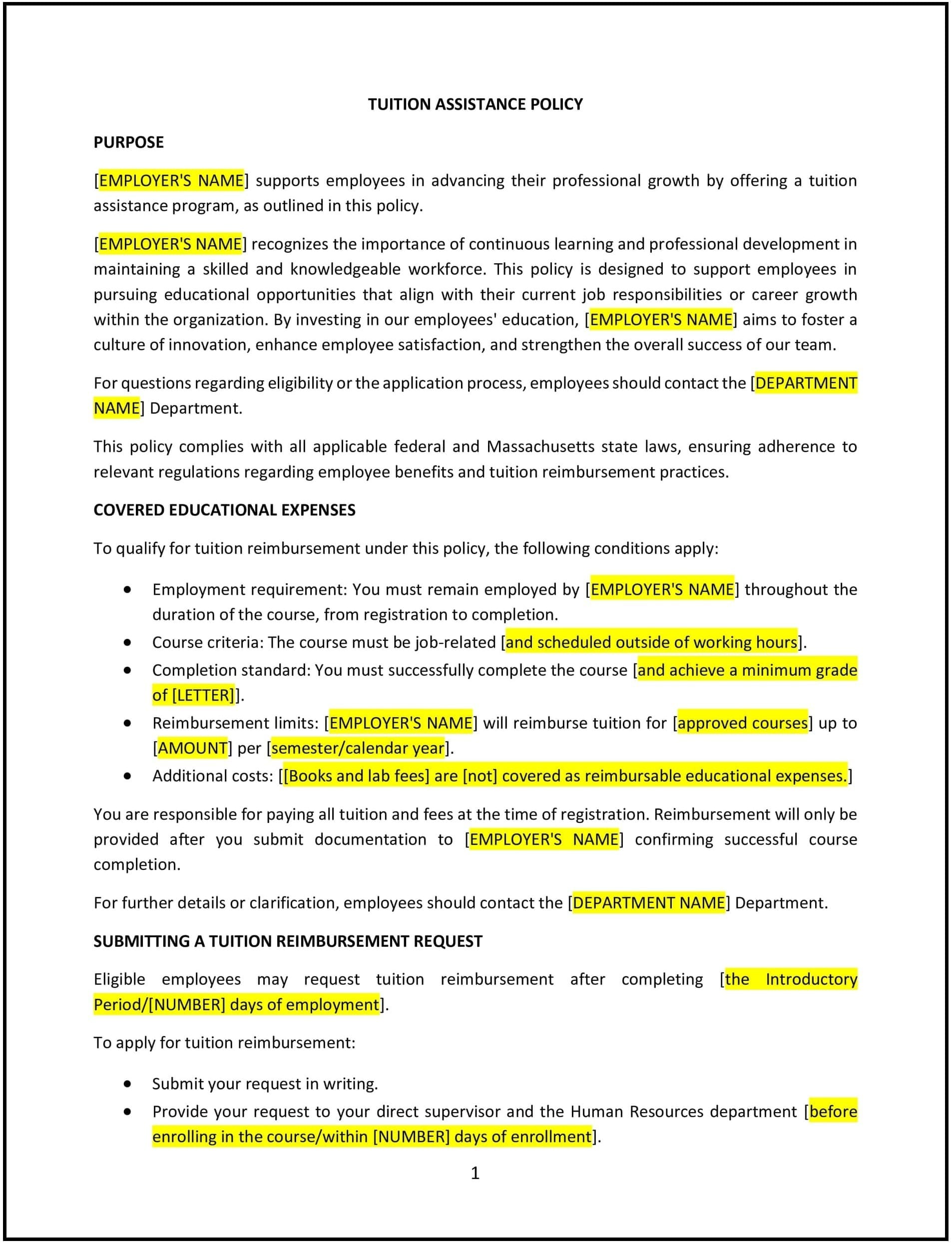

This tuition assistance policy is designed to help Massachusetts businesses support employees in their educational and professional development by providing financial assistance for tuition expenses related to job-relevant courses, degree programs, or certifications. The policy outlines the eligibility requirements, process for requesting tuition assistance, and guidelines for how tuition benefits will be applied. It promotes an environment of continuous learning and helps employees develop the skills needed to contribute to the company’s success.

By adopting this policy, businesses can foster employee growth, increase job satisfaction, and improve retention while promoting a culture of learning and professional development.

How to use this tuition assistance policy (Massachusetts)

- Define eligibility criteria: Specify which employees are eligible for tuition assistance. This may include full-time employees with a certain length of service, employees who are enrolled in job-related courses or degree programs, or employees seeking professional certifications that directly benefit their role.

- Outline the process for requesting tuition assistance: Provide a clear process for requesting tuition assistance, including how to apply, when to apply (e.g., before registering for a course), and what documentation is required. Employees should be asked to submit course details, tuition costs, and a brief explanation of how the course will benefit their role.

- Set financial limits and caps: Establish clear guidelines for how much tuition assistance will be provided. This may include an annual cap on the amount of assistance per employee, or specific limits for certain types of courses or programs (e.g., degree programs vs. certifications).

- Define reimbursement conditions: Specify the conditions under which tuition assistance will be reimbursed. For example, businesses may reimburse employees after they successfully complete the course with a minimum grade, or upon providing proof of payment for the course.

- Address repayment terms: Include a clause outlining any repayment requirements if an employee leaves the company within a certain period after receiving tuition assistance. For example, the company may require repayment if the employee leaves within one year of receiving the assistance.

- Promote relevance to job responsibilities: The policy should encourage employees to pursue education that is relevant to their current role or career progression within the company. If the education is unrelated to the employee's role, the policy may limit eligibility for tuition assistance.

- Ensure compliance with Massachusetts and federal laws: Ensure that the policy complies with Massachusetts state laws, such as any tax implications related to tuition reimbursement, and federal regulations that may apply to educational benefits.

- Review and update regularly: Periodically review and update the policy to ensure it remains aligned with the company’s goals, the needs of employees, and any changes in Massachusetts state laws or federal regulations.

Benefits of using this tuition assistance policy (Massachusetts)

This policy offers several benefits for Massachusetts businesses:

- Promotes employee development: By supporting employees' education and career growth, businesses can help employees develop the skills they need to perform their jobs better and advance within the company.

- Increases employee retention: Offering tuition assistance helps demonstrate the company’s commitment to employee development, which can improve job satisfaction and reduce turnover.

- Improves company performance: Well-trained employees are more likely to be productive, engaged, and able to contribute to the company’s overall success.

- Strengthens employer brand: Companies that invest in employees’ education and development are more attractive to potential hires and can position themselves as employers of choice in competitive labor markets.

- Aligns educational goals with business needs: The policy encourages employees to pursue educational opportunities that are directly related to their role or career within the company, which can lead to a more skilled and capable workforce.

- Enhances diversity and inclusion: Tuition assistance can help employees from various backgrounds and financial situations access educational opportunities that may have been previously out of reach, promoting diversity within the workforce.

Tips for using this tuition assistance policy (Massachusetts)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy and understand the eligibility criteria, application process, and any limits or restrictions. Provide the policy in the employee handbook and review it during onboarding or in team meetings.

- Encourage career development: Promote the policy to employees as part of the company’s commitment to their long-term growth. Encourage employees to take advantage of tuition assistance to improve their skills and qualifications.

- Establish a streamlined process for applications: Make the process of applying for tuition assistance as straightforward as possible. This could involve providing an online application form or creating a dedicated point of contact for tuition assistance inquiries.

- Set clear expectations for academic performance: Clearly define the academic requirements for reimbursement, such as a minimum grade or completion rate. This ensures that employees understand the company’s expectations regarding the results of their educational efforts.

- Track employee participation and expenses: Keep records of the employees who apply for and use tuition assistance, as well as the amounts reimbursed. This helps track the impact of the program and ensures that the budget for tuition assistance is managed effectively.

- Review and update regularly: Periodically review the policy to ensure it aligns with Massachusetts state laws, federal regulations, and the company’s needs. Updates may be necessary to reflect changes in education costs, employee demand, or tax rules.