Tuition assistance policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Michigan)

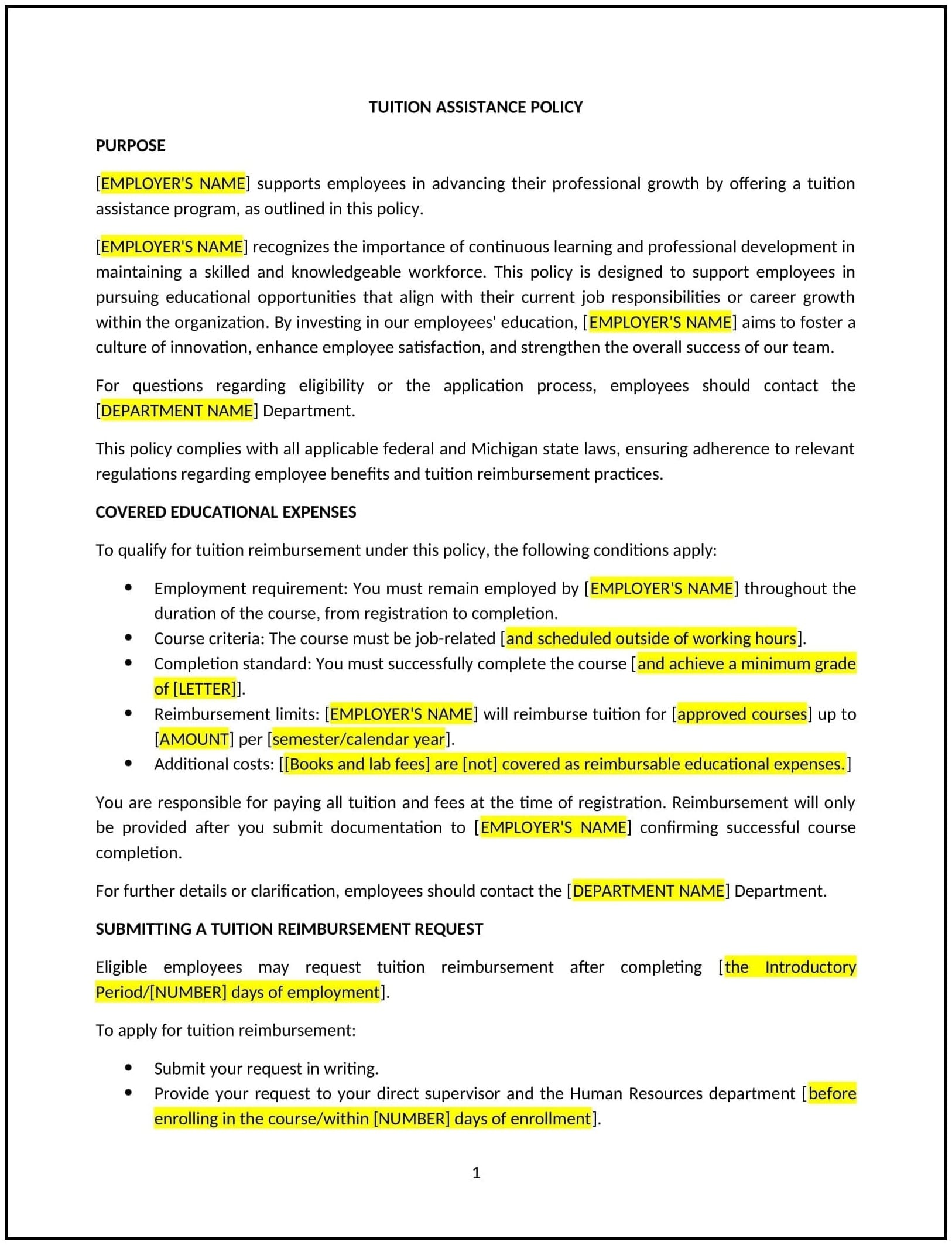

A tuition assistance policy provides Michigan businesses with guidelines for offering financial support to employees who wish to pursue higher education or job-related training. This policy outlines the eligibility criteria, reimbursement rates, application process, and the types of educational programs that qualify for assistance. It helps businesses support employees’ professional development while ensuring that the educational pursuits align with the company’s goals and needs.

By implementing this policy, businesses can attract and retain talent, improve employee skills, and foster a culture of continuous learning and development, benefiting both employees and the organization as a whole.

How to use this tuition assistance policy (Michigan)

- Define eligible educational programs: Clearly outline which types of education or training programs qualify for tuition assistance, such as degree programs, certifications, or industry-related courses. Specify whether the programs must be directly related to the employee’s current job or if broader professional development is allowed.

- Set eligibility criteria: Specify which employees are eligible for tuition assistance, such as full-time employees, employees with a minimum length of service, or employees in specific job roles.

- Outline the application process: Define the process for requesting tuition assistance, including how employees should submit their applications, the required documentation (such as course enrollment or tuition fees), and the timeline for submitting requests.

- Determine reimbursement rates: Clearly state how much tuition will be reimbursed, such as covering a percentage of tuition costs, or a maximum dollar amount per year. The policy should specify any caps or limits on reimbursement amounts and whether additional costs, like books or fees, are eligible.

- Set academic performance standards: Include guidelines for academic performance to qualify for reimbursement, such as requiring employees to maintain a minimum grade point average (GPA) or successful course completion.

- Address repayment obligations: Specify if employees need to repay tuition assistance if they leave the company within a certain timeframe after receiving assistance. The policy should outline any repayment conditions, such as the length of time employees must stay with the business to avoid repayment.

- Comply with Michigan state and federal laws: Ensure that the policy complies with Michigan state laws, federal tax laws, and any industry-specific regulations regarding education assistance and benefits.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with legal requirements, industry standards, and the evolving needs of the business.

Benefits of using this tuition assistance policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Enhances employee skills: By supporting employees' educational goals, businesses can improve their workforce's skills, helping employees to perform better in their roles and increase their contributions to the business.

- Attracts and retains top talent: Offering tuition assistance can make the business more attractive to potential employees, especially those looking for opportunities to grow their careers. It also helps retain current employees by showing that the business values their professional development.

- Increases employee engagement: Providing opportunities for education and skill development can increase employee satisfaction, morale, and engagement, leading to higher job retention rates and overall productivity.

- Supports business growth: A highly skilled workforce can contribute to the growth and competitiveness of the business. Employees who receive training can help the business stay ahead of industry trends, improve customer service, and innovate in their roles.

- Reduces turnover: Offering tuition assistance can lower employee turnover rates by providing employees with opportunities for growth, demonstrating the business’s commitment to their long-term career success.

- Promotes a culture of learning: By offering tuition assistance, businesses demonstrate their commitment to a culture of continuous learning, fostering an environment where employees are encouraged to improve and develop professionally.

Tips for using this tuition assistance policy (Michigan)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy by including it in the employee handbook, during onboarding, and in regular communications about employee benefits.

- Set clear expectations for eligibility: Clearly define which employees are eligible for tuition assistance and what types of educational programs qualify. Be transparent about the reimbursement rates and any performance requirements.

- Streamline the application process: Make the application process simple and efficient by providing a clear process for submitting requests and supporting documents. Consider using online forms or software to manage applications and track reimbursements.

- Encourage ongoing education: Encourage employees to take advantage of the tuition assistance program by promoting available programs, highlighting the benefits of professional development, and sharing success stories from employees who have used the program.

- Track program effectiveness: Regularly assess the effectiveness of the tuition assistance program by monitoring employee participation, performance, and retention rates. Use feedback to make improvements and adjustments to the policy as necessary.

- Review the policy regularly: Periodically review the policy to ensure it is aligned with business goals, compliant with Michigan state laws, and effective in meeting the needs of the business and its employees.