Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

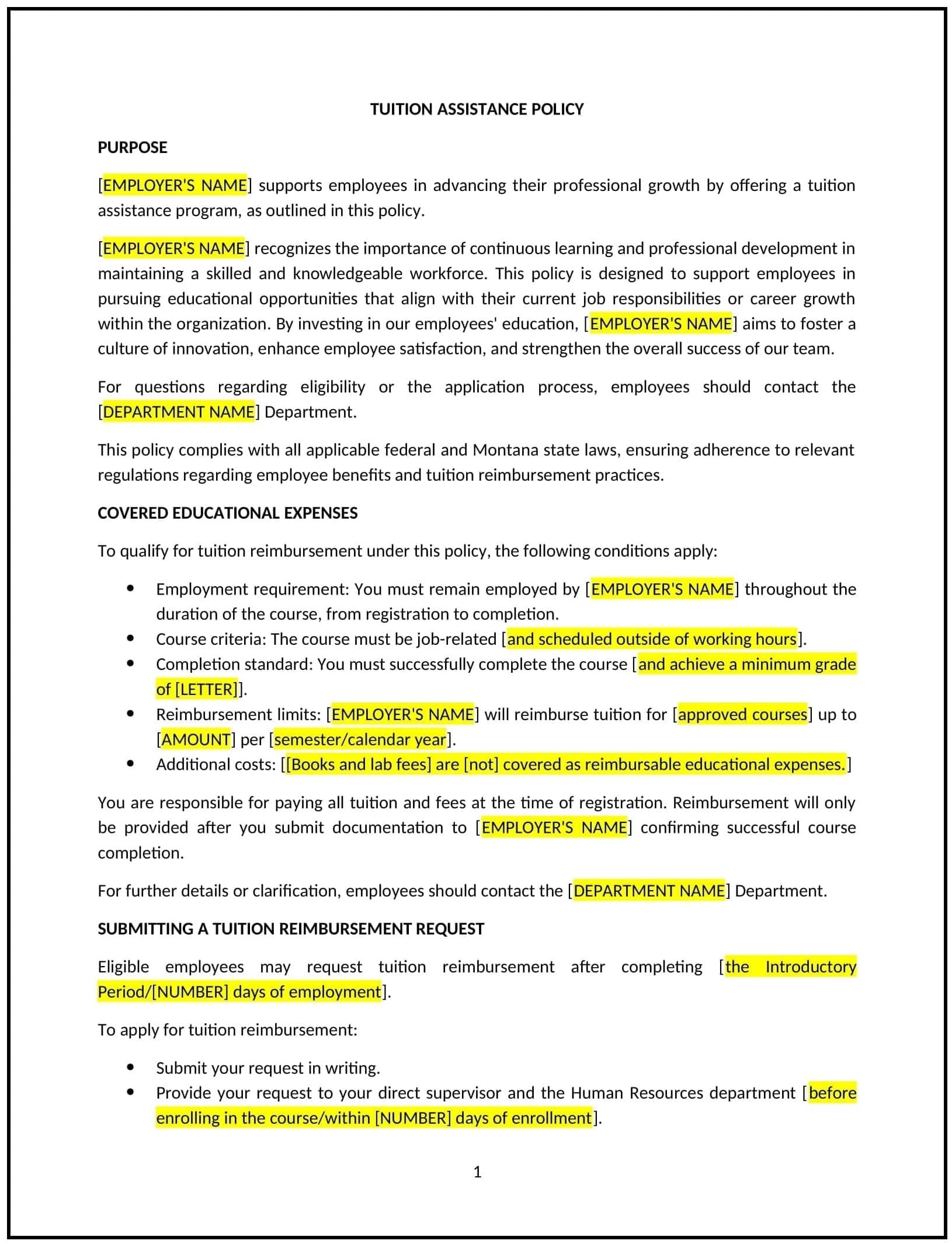

Tuition assistance policy (Montana)

A tuition assistance policy helps Montana businesses support the professional development and education of their employees by offering financial assistance for approved education programs, such as degree programs, certifications, or job-related courses. This policy outlines the eligibility criteria, the process for applying for tuition assistance, and the company’s expectations regarding the educational outcomes and post-education obligations.

By implementing this policy, businesses can attract and retain top talent, improve employee performance, and foster a culture of continuous learning and career growth.

How to use this tuition assistance policy (Montana)

- Define eligible educational programs: The policy should specify what types of educational programs are eligible for tuition assistance, such as degree programs, certifications, workshops, or other professional development courses that are directly related to the employee's role or the company’s needs.

- Set eligibility criteria: The policy should define the criteria employees must meet to qualify for tuition assistance, such as a minimum length of employment, job performance requirements, or whether the employee must be a full-time employee.

- Outline the application process: The policy should outline the steps employees need to follow to apply for tuition assistance, including any required documentation, timelines for submission, and approval procedures.

- Define reimbursement limits: The policy should establish the maximum amount the company will reimburse for tuition, books, fees, and other related costs, as well as any restrictions on reimbursement, such as a cap on annual funding or a limit per course or program.

- Address repayment obligations: The policy should include provisions for situations where an employee leaves the company after receiving tuition assistance, including any repayment obligations or conditions, such as a specified duration of service following the completion of the program.

- Set academic performance expectations: The policy should define the required academic performance for continued assistance, such as a minimum grade point average (GPA) or successful completion of the course or degree program.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains aligned with the business's goals, legal requirements, and employee needs.

Benefits of using this tuition assistance policy (Montana)

This policy provides several key benefits for Montana businesses:

- Attracts and retains talent: Offering tuition assistance helps businesses attract and retain skilled employees by demonstrating a commitment to their professional growth and education.

- Enhances employee performance: By supporting education and skill development, businesses can improve the overall performance and productivity of their workforce.

- Supports career development: Tuition assistance encourages employees to pursue educational opportunities that advance their careers, helping to prepare them for future roles within the company.

- Improves job satisfaction: Employees who receive support for their education are likely to feel valued and appreciated, leading to higher job satisfaction and increased employee morale.

- Promotes long-term growth: Investing in employees' education can contribute to the long-term success of the business by ensuring that the workforce is skilled, knowledgeable, and capable of adapting to industry changes.

- Reduces turnover: Offering educational benefits helps increase employee loyalty and reduces turnover by providing employees with the tools to advance within the company.

Tips for using this tuition assistance policy (Montana)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy and understand the eligibility criteria, application process, and reimbursement limits. Make the policy easily accessible to employees.

- Align educational programs with business needs: Prioritize programs that are relevant to the employee’s role or the company's objectives to maximize the return on investment in employee education.

- Offer a straightforward application process: Streamline the application and approval process to make it as easy as possible for employees to apply for tuition assistance and receive timely responses.

- Track and monitor educational progress: Keep track of employees' progress in their educational programs to ensure that they are meeting academic performance expectations and completing their courses or degrees.

- Review the policy periodically: Regularly review the tuition assistance policy to ensure it remains aligned with company goals, employee needs, and industry trends, and make adjustments as necessary.

- Encourage employees to share knowledge: After completing their programs, encourage employees to share their new skills and knowledge with their colleagues to help benefit the entire team.