Tuition assistance policy (Nebraska): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Nebraska)

A tuition assistance policy helps Nebraska businesses support their employees' educational development by providing financial assistance for job-related or professional growth courses. This policy outlines the eligibility criteria, process for requesting assistance, and the types of educational programs covered. It is designed to promote continuous learning, enhance employee skills, and increase job satisfaction while helping the company meet its long-term goals through a more skilled workforce.

By adopting this policy, businesses in Nebraska can demonstrate a commitment to employee development, reduce turnover, and help employees further their careers while contributing to the company’s success.

How to use this tuition assistance policy (Nebraska)

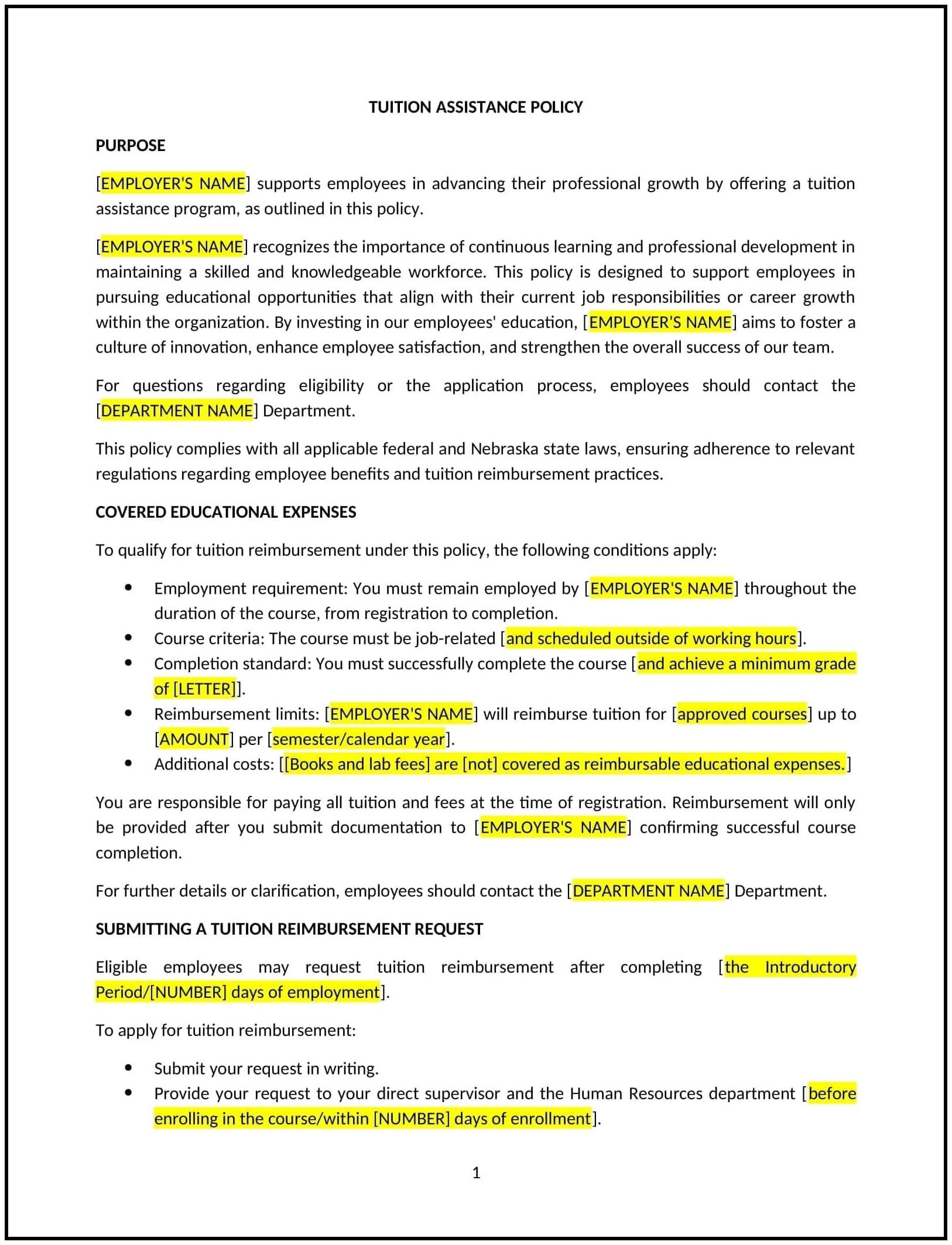

- Define eligibility criteria: Specify which employees are eligible for tuition assistance, such as full-time employees who have been with the company for a certain period, or those whose job duties directly benefit from the course or program. Be clear about any other criteria, such as minimum performance levels or academic standing.

- Clarify the types of programs covered: Define which educational programs are eligible for assistance. These can include degree programs, certifications, workshops, or other job-related courses. Ensure that the courses align with the company’s goals and benefit the employee’s current role or career growth.

- Set limits on assistance: Specify how much tuition assistance the company will provide, including maximum reimbursement amounts per course, per year, or lifetime limits. Outline any restrictions on what the company will cover, such as tuition only or also including books, fees, or transportation costs.

- Establish the reimbursement process: Outline the process for requesting tuition assistance, including the steps for submitting a request before enrolling in a program and the documentation required (e.g., course syllabus, tuition receipts). Specify whether the reimbursement will be made in advance or after completion of the course.

- Set performance and grade requirements: Define the grade or performance standards employees must meet to qualify for reimbursement, such as achieving a minimum grade (e.g., "C" or better). Clarify the process for handling situations where an employee does not meet the required standard.

- Address repayment conditions: Specify any conditions under which employees may be required to repay the tuition assistance if they leave the company within a specified time period after receiving assistance. For example, employees may need to repay the tuition if they resign or are terminated within a year of receiving assistance.

- Provide guidelines for course approval: Outline the process for course approval, including how employees should submit requests for courses or programs they wish to pursue. Ensure that the courses are relevant to the employee’s role or career path within the company.

- Review and update: Periodically review and update the policy to ensure it remains aligned with company goals, employee needs, and Nebraska state regulations. This can include adjusting tuition reimbursement limits or adding new types of eligible programs.

Benefits of using this tuition assistance policy (Nebraska)

This policy provides several benefits for Nebraska businesses:

- Promotes employee development: By offering tuition assistance, businesses encourage continuous learning and professional development, helping employees acquire the skills needed to succeed in their roles and advance in their careers.

- Increases employee retention: Offering tuition assistance can improve employee satisfaction and retention by providing opportunities for personal growth and showing the company’s commitment to their long-term career development.

- Enhances company performance: A more educated workforce contributes to improved performance, innovation, and problem-solving, benefiting the company by driving growth and enhancing operational efficiency.

- Attracts top talent: A tuition assistance program can help businesses attract highly skilled candidates who value educational opportunities and are looking for companies that invest in their employees’ development.

- Improves employee morale: Providing tuition assistance helps employees feel valued and supported in their career growth, which can lead to higher morale and productivity.

Tips for using this tuition assistance policy (Nebraska)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy, including eligibility requirements, the types of courses covered, and the reimbursement process. Include the policy in employee handbooks and during onboarding.

- Encourage early submission: Encourage employees to submit requests for tuition assistance before enrolling in courses to ensure that the company’s financial support is in place and to allow time for course approval.

- Monitor program effectiveness: Regularly assess the impact of the tuition assistance program on employee performance and company outcomes. Gather feedback from employees to determine if the program meets their needs and expectations.

- Keep records organized: Maintain accurate records of tuition assistance requests, approvals, grades, and reimbursements. This ensures smooth processing and helps manage the program effectively.

- Review the policy regularly: Review the policy at least once a year to ensure it remains competitive, addresses company needs, and aligns with changes in Nebraska state regulations or business goals.