Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Nevada)

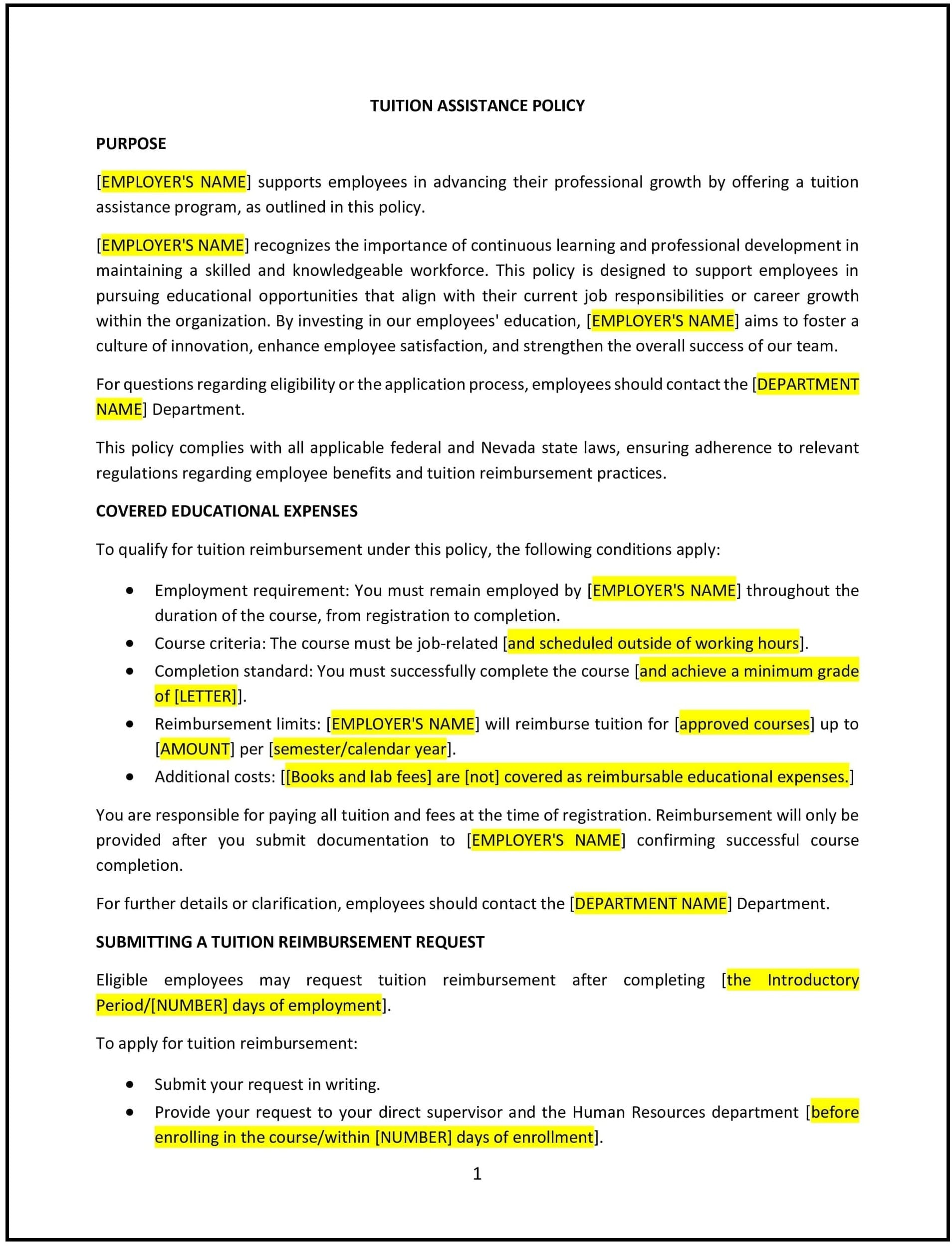

This tuition assistance policy is designed to help Nevada businesses support employees seeking educational opportunities to enhance their skills and advance their careers. It provides guidelines for eligibility, approved programs, and reimbursement procedures to ensure fairness and alignment with company objectives.

By adopting this policy, businesses can promote employee development, improve retention, and strengthen the organization’s talent pool.

How to use this tuition assistance policy (Nevada)

- Define eligible programs: Specify the types of educational programs covered, such as degree programs, certifications, or job-related courses, and outline any accreditation requirements.

- Establish eligibility criteria: Detail the qualifications employees must meet, such as length of employment, full-time status, or manager approval.

- Set reimbursement limits: Include maximum reimbursement amounts per year or semester and outline any conditions for partial or full reimbursement.

- Require pre-approval: Mandate that employees obtain approval before enrolling in courses to ensure alignment with business goals and budget constraints.

- Address repayment obligations: Specify if employees must repay assistance if they leave the company within a certain timeframe after completing their education.

- Include documentation requirements: Require employees to submit proof of enrollment, grades, and receipts for eligible expenses to qualify for reimbursement.

- Clarify covered expenses: List reimbursable costs, such as tuition, textbooks, and mandatory fees, and exclude personal expenses like travel or lodging.

- Monitor program alignment: Emphasize that educational pursuits must directly benefit the employee’s current role or potential career path within the company.

Benefits of using this tuition assistance policy (Nevada)

This policy provides several benefits for Nevada businesses:

- Encourages employee development: Supports professional growth by providing access to educational opportunities.

- Improves retention: Demonstrates a commitment to employees’ career advancement, fostering loyalty and reducing turnover.

- Enhances skills: Helps employees acquire knowledge and skills that contribute to the organization’s success.

- Promotes fairness: Establishes clear and consistent guidelines for tuition assistance eligibility and reimbursement.

- Aligns with business goals: Ensures educational efforts support the company’s objectives and operational needs.

Tips for using this tuition assistance policy (Nevada)

- Communicate the policy: Share the policy with employees during onboarding and make it accessible through internal resources.

- Provide regular reminders: Encourage employees to explore educational opportunities by promoting the policy in internal communications.

- Train managers: Equip managers to guide employees through the tuition assistance request and approval process.

- Monitor usage: Track tuition assistance requests and reimbursements to ensure compliance with policy guidelines and budget allocations.

- Update as needed: Review and revise the policy periodically to reflect changes in company goals, industry trends, or Nevada laws.