Tuition assistance policy (New Jersey): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (New Jersey)

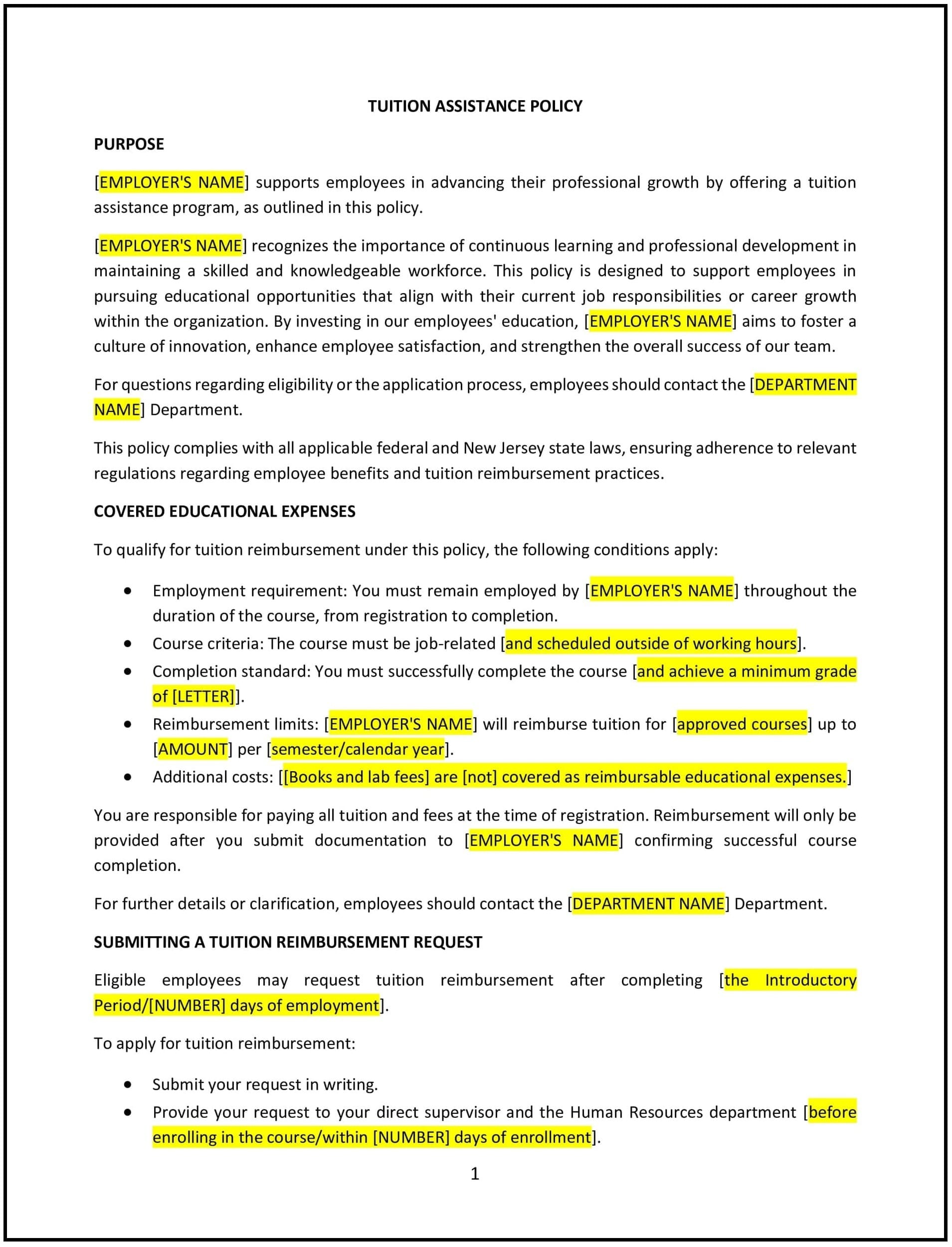

A tuition assistance policy helps New Jersey businesses support the professional development of their employees by offering financial assistance for education or training programs. This policy outlines the eligibility criteria, application process, and reimbursement guidelines for employees seeking financial help for educational expenses.

By adopting this policy, businesses in New Jersey can invest in their employees' career growth, enhance job satisfaction, and improve overall company performance through continued learning and skill development.

How to use this tuition assistance policy (New Jersey)

- Define eligible education programs: Specify which types of programs, such as degree courses, certifications, or job-related training, are eligible for tuition assistance.

- Establish eligibility criteria: Set clear requirements for employees to qualify for tuition assistance, such as length of service, performance, or job-related relevance of the program.

- Outline the application process: Provide a step-by-step process for employees to apply for tuition assistance, including necessary documentation (e.g., course details, fees, and enrollment verification).

- Define reimbursement terms: Set clear guidelines on how tuition assistance will be provided, including whether it is upfront or reimbursed after completion of the program, and what percentage of the tuition will be covered.

- Address academic performance: Specify any academic performance requirements for receiving tuition assistance, such as maintaining a certain grade point average (GPA) or successfully completing courses.

- Set limits on funding: Determine the maximum amount of tuition assistance available per employee per year and any caps on the total number of programs that can be funded.

- Provide guidelines for program completion: Clarify whether employees must remain with the company for a specified period after receiving tuition assistance or if there are any penalties for leaving early.

- Review and update: Regularly assess the policy to ensure it reflects business needs, New Jersey regulations, and evolving company practices.

Benefits of using this tuition assistance policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Promotes employee development: Provides employees with opportunities to advance their education, improving their skills and qualifications.

- Increases retention: Shows employees that the company is invested in their growth, which can lead to greater job satisfaction and long-term loyalty.

- Attracts top talent: Offers a competitive advantage when recruiting skilled professionals who value opportunities for professional development.

- Enhances company performance: Encourages employees to develop new skills that can improve job performance and contribute to business growth.

- Demonstrates commitment to education: Positions the company as an employer that supports lifelong learning and development, boosting its reputation as an employer of choice.

Tips for using this tuition assistance policy (New Jersey)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance program, including eligibility, benefits, and the application process.

- Monitor program usage: Track how employees are using the tuition assistance program, ensuring that it is being used in accordance with company guidelines and policies.

- Be flexible with program choices: Allow employees to pursue programs that align with their roles or professional goals, even if they are not directly related to their current position.

- Evaluate the effectiveness: Assess how the tuition assistance program contributes to employee development and retention, and adjust the policy as necessary to meet business needs.

- Review the policy regularly: Update the policy to reflect any changes in New Jersey education regulations, business practices, or employee needs.