Tuition assistance policy (New Mexico): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (New Mexico)

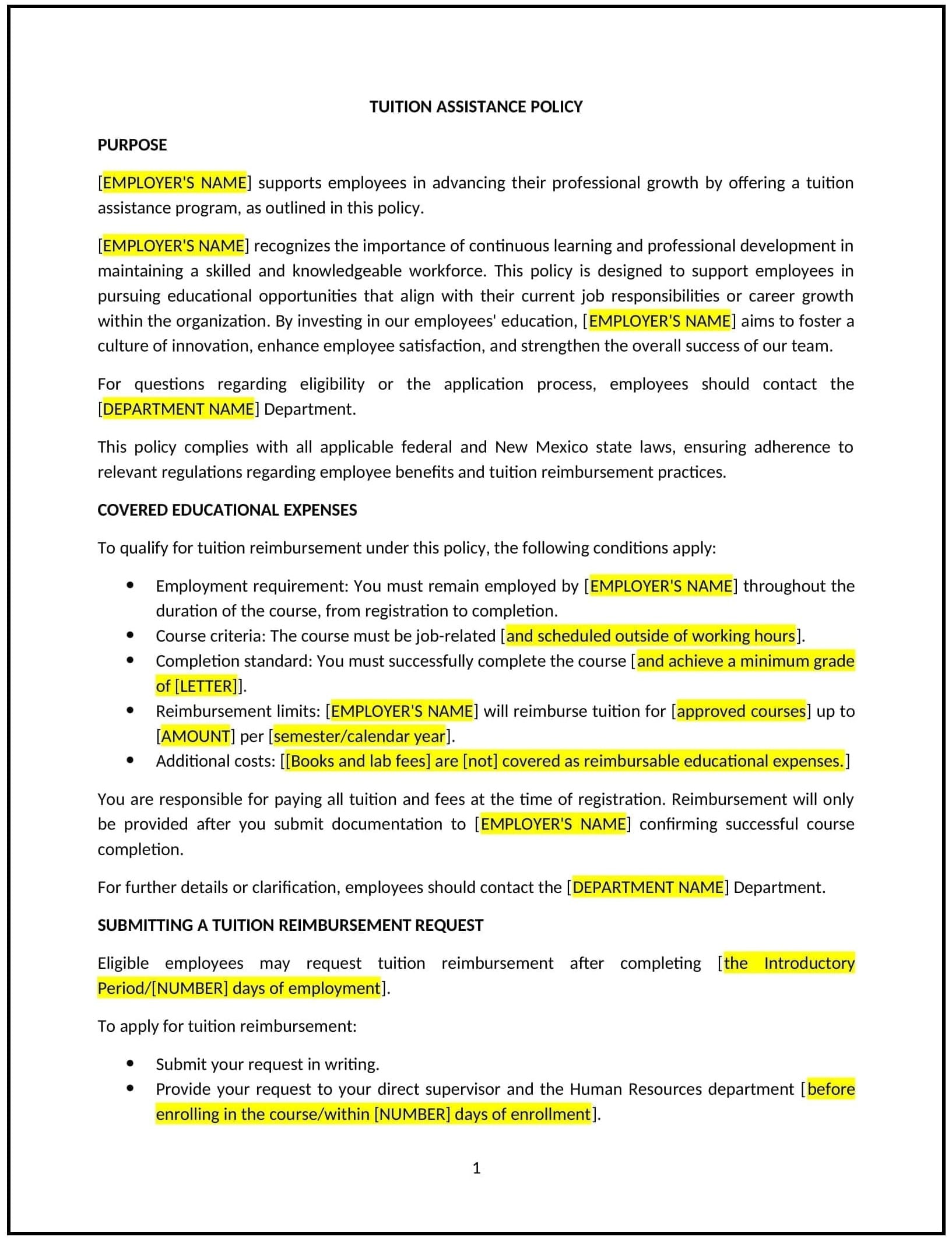

A tuition assistance policy helps New Mexico businesses support employees in pursuing higher education and professional development by offering financial assistance for approved courses and programs. This policy outlines the eligibility requirements, types of education expenses covered, and the process for requesting and receiving tuition assistance. It is designed to promote employee growth, enhance skills, and support business success through an educated and capable workforce.

By implementing this policy, businesses in New Mexico can attract and retain talent, foster professional development, and contribute to the overall growth and success of both employees and the business.

How to use this tuition assistance policy (New Mexico)

- Define eligibility criteria: Specify the requirements employees must meet to qualify for tuition assistance, such as length of employment, job performance, and relevance to current or future roles.

- Outline covered expenses: Clearly list the types of expenses that will be covered under the policy, such as tuition, books, and required fees for approved courses or programs.

- Set application process: Provide employees with a step-by-step process for applying for tuition assistance, including required forms, documentation, and timelines for submitting requests.

- Establish reimbursement procedures: Define how and when employees will be reimbursed for approved tuition expenses, including any limits or maximum reimbursement amounts.

- Specify course/program approval: Indicate that courses or programs must be pre-approved by the business to ensure they align with company needs and goals.

- Communicate the policy: Ensure all employees are informed about the tuition assistance policy through onboarding and regular updates.

- Review and update: Regularly review the policy to ensure it remains aligned with business needs, changes in New Mexico education laws, or shifts in employee development strategies.

Benefits of using this tuition assistance policy (New Mexico)

This policy offers several advantages for New Mexico businesses:

- Enhances employee skills: Supporting education helps employees develop new skills and competencies that directly benefit the business.

- Improves employee retention: Offering tuition assistance demonstrates a commitment to employee growth and can increase job satisfaction and loyalty.

- Attracts top talent: A strong tuition assistance program can make a business more attractive to prospective employees, particularly those seeking professional development opportunities.

- Supports business goals: Investing in employees’ education helps align their skills with the company’s evolving needs, supporting long-term business growth.

- Encourages a learning culture: Promoting education fosters a culture of continuous learning, which can drive innovation and performance improvements across the business.

Tips for using this tuition assistance policy (New Mexico)

- Communicate the benefits clearly: Ensure employees understand the value of the program, how to apply, and the requirements for receiving assistance.

- Set realistic expectations: Establish clear guidelines on what expenses will be covered and any reimbursement limits to avoid confusion.

- Track employee participation: Keep records of employees who participate in the program to evaluate the impact on skills development and business needs.

- Align education with business objectives: Encourage employees to pursue courses or programs that directly enhance their job performance and contribute to company goals.

- Regularly evaluate the program: Periodically review the policy to ensure it meets employee needs, aligns with business priorities, and remains competitive with local or industry standards.