Tuition assistance policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (New York)

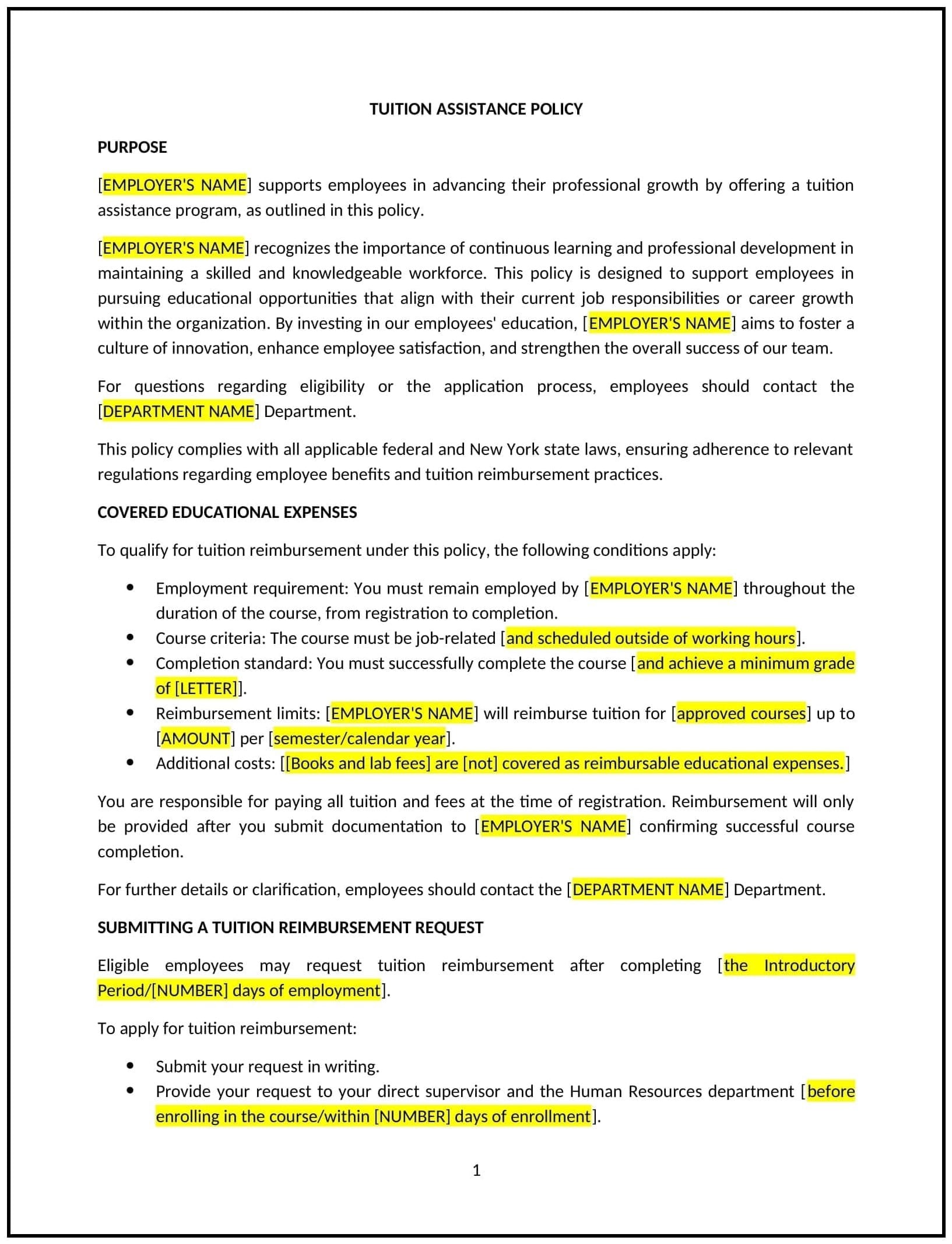

This tuition assistance policy is designed to help New York businesses provide financial support for employees seeking to further their education through job-related courses, certifications, or degree programs. Whether businesses are offering partial or full reimbursement for tuition, this template provides a structured approach to managing tuition assistance requests and promoting employee development.

By adopting this template, businesses can invest in their employees’ growth, improve job satisfaction, and enhance the company’s talent pool.

How to use this tuition assistance policy (New York)

- Define eligibility: Clearly outline the criteria for employees to qualify for tuition assistance, such as length of employment, job performance, or specific educational programs relevant to their roles.

- Specify the reimbursement process: Detail how employees can apply for tuition assistance, including the necessary documentation (e.g., proof of enrollment, tuition invoices) and the steps for submitting requests.

- Establish funding limits: Set clear guidelines for the amount of tuition assistance available per employee, including caps on annual reimbursement amounts, covered expenses (tuition, books, fees), and the reimbursement percentage.

- Address academic performance: Include expectations for academic performance, such as a minimum grade or GPA required to receive reimbursement, and outline how employees should report their progress.

- Set repayment terms: Define the terms for repayment if employees leave the company within a specified period after receiving tuition assistance, such as a prorated amount or full repayment based on the length of employment post-assistance.

Benefits of using this tuition assistance policy (New York)

This policy offers several benefits for New York businesses:

- Enhances employee skills: By supporting educational opportunities, businesses can help employees improve their skills and knowledge, leading to improved job performance.

- Increases employee retention: Offering tuition assistance is a valuable benefit that can increase employee loyalty and reduce turnover by showing investment in their career development.

- Promotes workforce development: A well-educated workforce can contribute to a business’s growth, innovation, and competitiveness in the market.

- Improves job satisfaction: Employees who feel supported in their educational pursuits are likely to be more engaged, motivated, and satisfied with their jobs.

- Supports business success: A more skilled workforce leads to better overall business outcomes, including improved productivity and the ability to meet evolving industry demands.

Tips for using this tuition assistance policy (New York)

- Communicate clearly: Ensure that all employees are aware of the tuition assistance program and understand the eligibility criteria, reimbursement process, and application timelines.

- Offer flexibility: Allow employees to choose from a range of relevant educational programs, such as certifications, degrees, or professional development courses, that align with their career goals and the business’s needs.

- Track progress: Monitor the use of tuition assistance and ensure that reimbursement is based on submitted documentation and academic performance.

- Foster a culture of learning: Encourage employees to take advantage of tuition assistance and provide resources for continuing education and professional development.

- Review regularly: Update the policy as necessary to reflect changes in educational costs, business needs, or New York state regulations.