Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

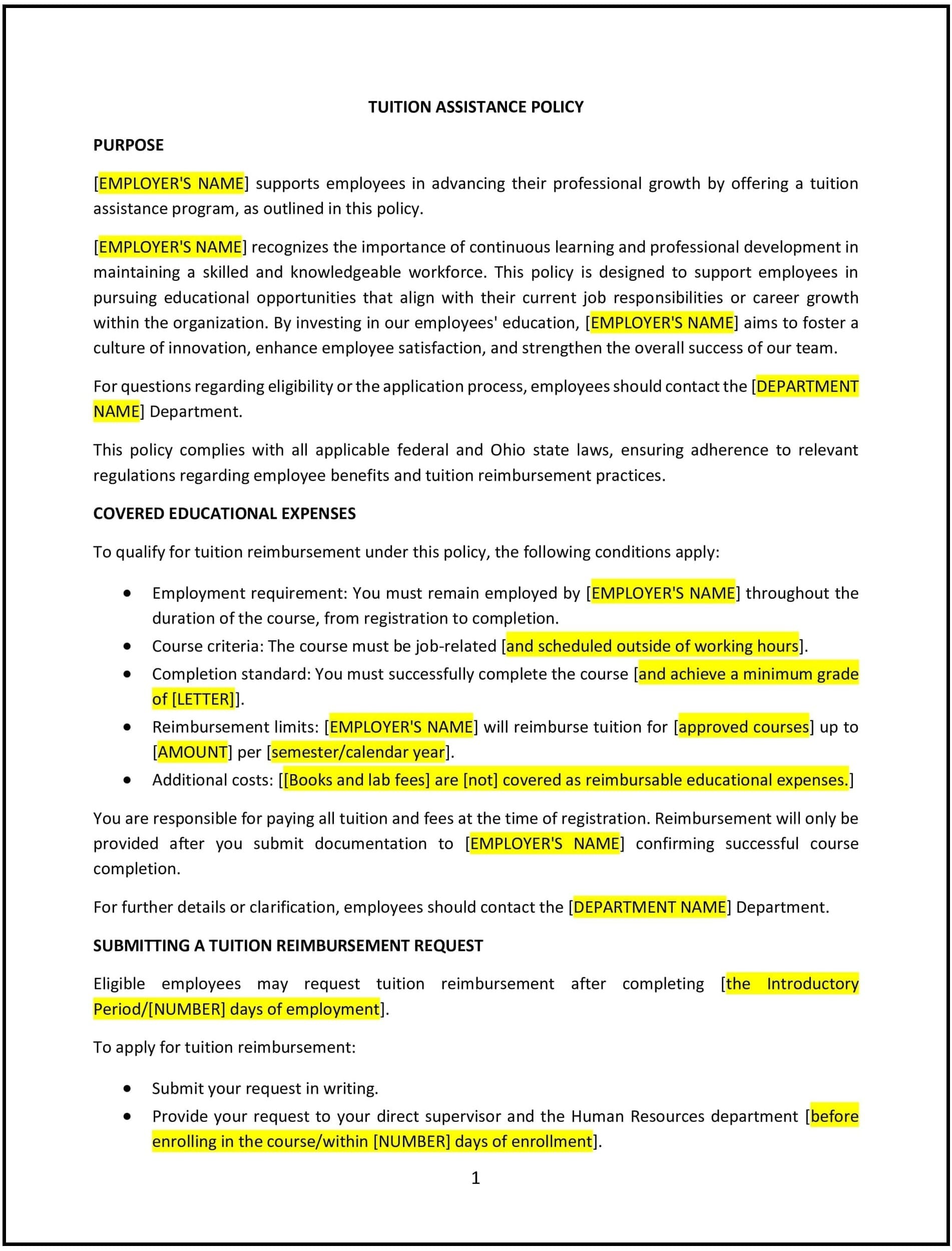

Tuition assistance policy (Ohio)

A tuition assistance policy provides Ohio businesses with a clear framework for offering financial support to employees pursuing higher education, certifications, or professional development programs. This policy outlines the eligibility criteria, covered expenses, application process, and reimbursement procedures for employees seeking tuition assistance. It helps businesses foster employee growth, improve job performance, and enhance retention by supporting educational advancement.

By implementing this policy, Ohio businesses can invest in their workforce, promote continuous learning, and improve employee skills, leading to a more competent and engaged team.

How to use this tuition assistance policy (Ohio)

- Define eligibility criteria: The policy should specify which employees are eligible for tuition assistance, such as full-time or part-time employees, employees with a certain tenure, or employees in specific job roles. It should also address whether dependents are eligible for assistance.

- Clarify covered expenses: The policy should outline what expenses are covered by the tuition assistance program, including tuition fees, books, materials, and lab fees. It should also specify any exclusions, such as non-degree programs or personal expenses.

- Set maximum reimbursement limits: The policy should set clear limits on the amount of tuition assistance available to each employee, whether per year or per course, and specify any caps on the total reimbursement amount.

- Outline the approval process: The policy should detail the procedure for applying for tuition assistance, including any required documentation (e.g., proof of enrollment, course syllabus), approval timelines, and the process for receiving funding.

- Specify performance and academic requirements: The policy should include academic performance standards, such as a minimum grade requirement, to qualify for reimbursement. It may specify that employees must maintain a certain GPA or grade in courses to be eligible for continued support.

- Address repayment requirements: The policy should outline conditions under which the business may require employees to repay tuition assistance, such as if the employee leaves the company within a specified time period after receiving funding.

- Clarify the reimbursement process: The policy should explain how employees can receive reimbursement, whether it is paid upfront or upon completion of the course. It should also specify whether employees need to submit proof of payment or grades before reimbursement is issued.

- Review and update regularly: The policy should be reviewed periodically to ensure it aligns with Ohio state laws, federal regulations, and the evolving needs of the business.

Benefits of using this tuition assistance policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Enhances employee development: By providing financial support for education, businesses help employees develop skills that improve their performance, contribute to the company’s success, and advance their careers.

- Improves retention: Offering tuition assistance is a valuable employee benefit that increases loyalty and retention by demonstrating the company’s commitment to the employee's personal and professional growth.

- Strengthens workforce capabilities: Employees who pursue further education or professional development through tuition assistance bring new knowledge, expertise, and innovation to the business, improving overall capabilities and competitiveness.

- Promotes a culture of continuous learning: A well-supported tuition assistance policy fosters a culture of learning and development within the organization, helping employees stay current with industry trends and best practices.

- Supports employee satisfaction: Offering tuition assistance shows employees that the business values their growth and is willing to invest in their education, which can increase job satisfaction and engagement.

- Reduces recruitment costs: A focus on developing current employees through educational assistance can reduce the need for external hires and recruitment efforts by creating a more skilled internal talent pool.

- Aligns with business goals: The policy ensures that employees' education aligns with the business's objectives by supporting relevant degrees, certifications, or training that contribute to improved performance and business outcomes.

Tips for using this tuition assistance policy (Ohio)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy by including it in the employee handbook, discussing it during onboarding, and providing periodic reminders about how to apply for the program.

- Set clear application deadlines: Establish clear deadlines for employees to apply for tuition assistance, and ensure that the application process is straightforward and accessible to all eligible employees.

- Align tuition assistance with business goals: Ensure that the tuition assistance program supports the company’s goals by prioritizing educational programs and courses that enhance the skills needed for the business’s growth.

- Monitor academic progress: Track the academic progress of employees who are receiving tuition assistance to ensure they are meeting the academic standards required for continued support.

- Provide clear repayment guidelines: Clearly explain any repayment conditions in the policy, such as if an employee leaves the company within a specified time frame after receiving tuition assistance.

- Offer support for application and reimbursement: Ensure that employees have access to the resources and support they need to apply for and process tuition assistance claims, such as assistance with paperwork or guidance on eligible courses.

- Review the policy periodically: Regularly review the policy to ensure it remains up-to-date with Ohio state laws, federal regulations, and evolving business needs. Adjust the policy as necessary to reflect changes in educational practices or company priorities.