Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Texas)

This tuition assistance policy is designed to help Texas businesses establish guidelines for providing financial assistance to employees pursuing higher education, certifications, or other professional development programs. The policy outlines eligibility requirements, the process for applying for tuition assistance, and the terms and conditions for reimbursement, ensuring that the company supports its employees' growth while maintaining financial responsibility.

By adopting this policy, businesses can promote continuous learning, enhance employee skills, and contribute to the personal and professional development of their workforce.

How to use this tuition assistance policy (Texas)

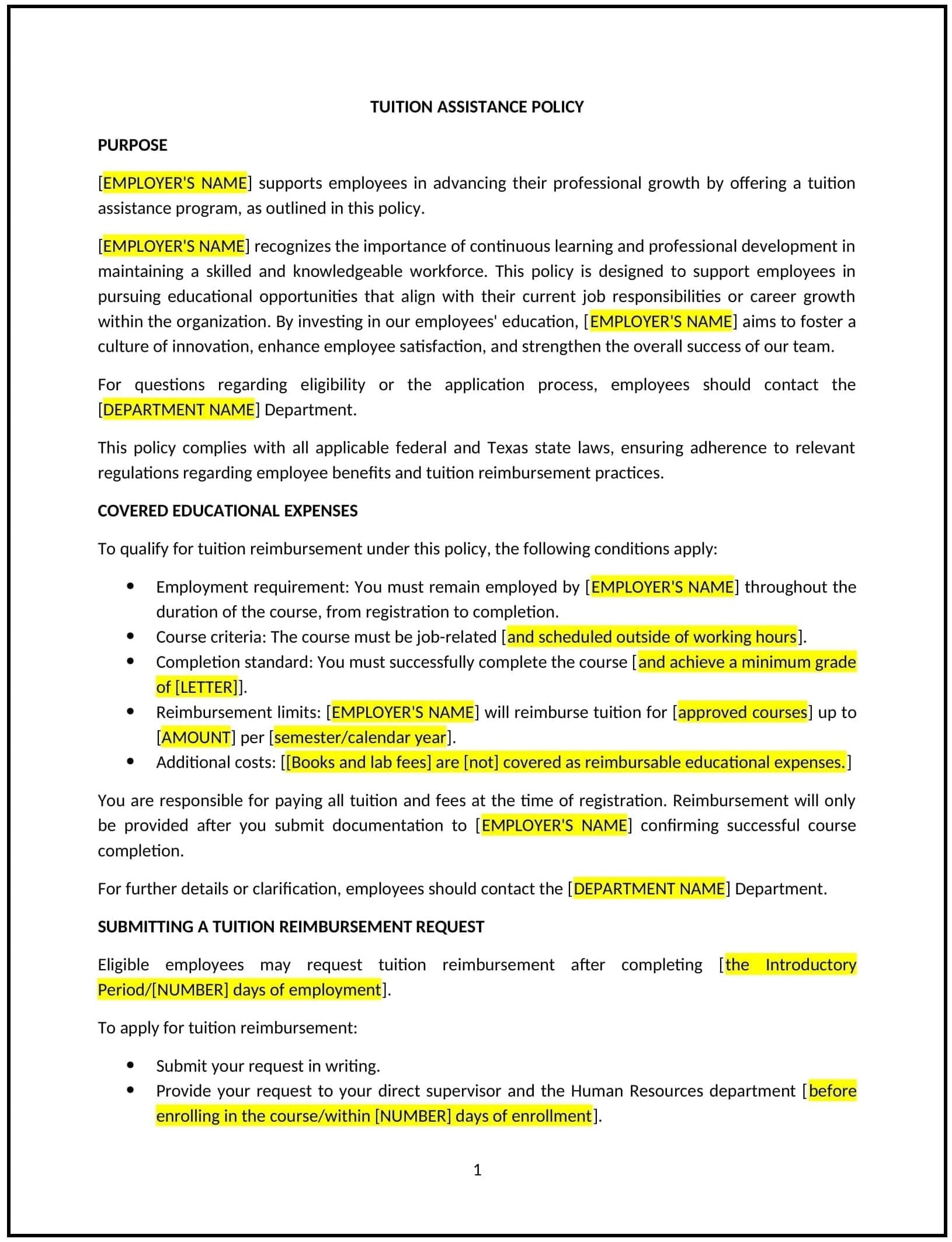

- Define eligibility: Clearly outline the eligibility criteria for employees to participate in the tuition assistance program. This could include minimum tenure, job performance requirements, and the relevance of the educational program to the employee's role or career development.

- Specify covered expenses: Outline which tuition-related expenses will be covered under the policy, such as tuition fees, textbooks, course materials, and registration fees. The policy should clarify any exclusions or limits on the amounts covered.

- Set reimbursement limits: Specify the maximum amount that will be reimbursed annually or per course, including any caps on individual course or degree program costs. The policy should include any stipulations for reimbursement rates based on grades or completion.

- Establish application procedures: Provide clear instructions for employees on how to apply for tuition assistance, including any required documentation, deadlines, and approval processes. Employees should be encouraged to submit their applications well in advance of the course start date.

- Outline repayment terms: Specify any repayment terms if an employee leaves the company within a certain time frame after receiving tuition assistance. This clause should address how the company will handle repayment if the employee voluntarily separates from the company before a specified period (e.g., one year after completing the course).

- Define performance requirements: Clarify whether there are any academic performance requirements tied to tuition assistance, such as earning a minimum grade to qualify for reimbursement. This ensures that employees are committed to completing their courses successfully.

- Promote continuous learning: Encourage employees to take advantage of available educational opportunities, emphasizing how ongoing development aligns with both their career growth and the company’s objectives.

Benefits of using this tuition assistance policy (Texas)

This policy offers several benefits for Texas businesses:

- Enhances employee skills: By offering financial support for education, businesses help employees enhance their skills and knowledge, contributing to improved job performance and higher productivity.

- Increases employee retention: Providing tuition assistance shows the company’s commitment to employee growth and development, which can lead to increased employee satisfaction and retention.

- Supports career development: The policy encourages employees to pursue educational opportunities that align with their career aspirations, fostering a more engaged and motivated workforce.

- Improves business performance: As employees gain new knowledge and expertise, the company benefits from their enhanced capabilities, improving overall business performance and competitiveness.

- Attracts top talent: Offering tuition assistance can help attract highly skilled candidates who value continuous learning and professional development opportunities.

- Strengthens company reputation: A company that invests in the education of its employees is viewed positively by both current and potential employees, as well as the community, enhancing its reputation as a responsible employer.

Tips for using this tuition assistance policy (Texas)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy, including the eligibility requirements, application process, and reimbursement guidelines. This can be communicated during onboarding, through the employee handbook, or via email updates.

- Encourage employees to plan ahead: Employees should be encouraged to apply for tuition assistance well in advance of their educational program start dates to allow time for approvals and processing.

- Track and monitor usage: Keep track of tuition assistance requests and reimbursements to ensure that the program is being used consistently and fairly across the organization.

- Review eligibility periodically: Regularly review and update the eligibility criteria to ensure the policy continues to meet the company’s goals and employees’ needs.

- Review academic performance: If academic performance is a condition for reimbursement, ensure that the policy is clear on the grade requirements and that employees are aware of how their grades will impact reimbursement.

- Strengthen compliance with Texas state laws: Periodically review the policy to ensure it is compliant with Texas state laws and federal regulations regarding employee benefits and tuition assistance programs.