Tuition assistance policy (Vermont): Free template

Tuition assistance policy (Vermont)

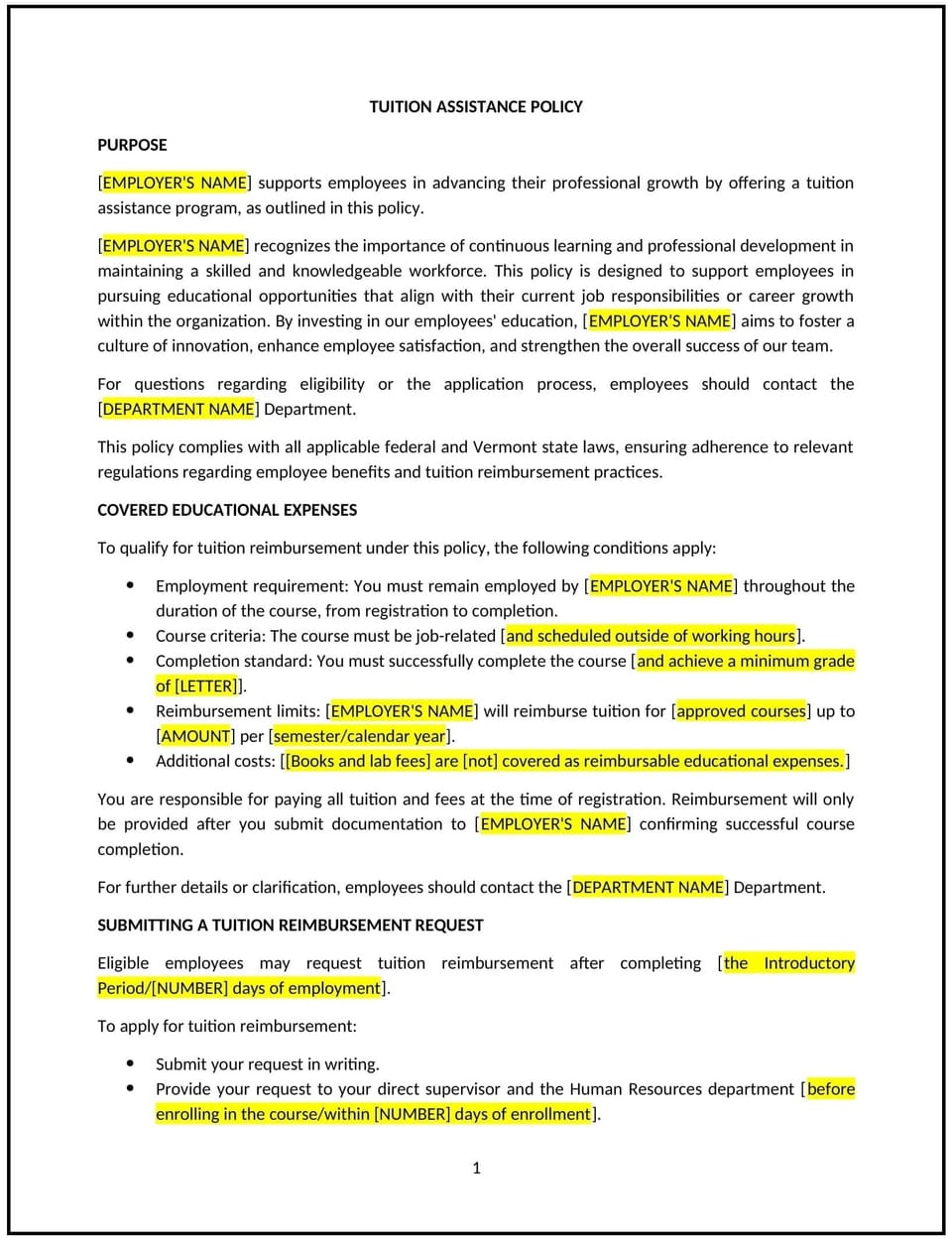

This tuition assistance policy is designed to help Vermont businesses provide financial support to employees pursuing education or training that enhances their skills and contributes to the organization's success. It outlines eligibility, application procedures, and reimbursement terms to ensure fairness and alignment with company goals.

By adopting this policy, businesses can invest in employee development, improve retention, and maintain compliance with Vermont labor regulations.

How to use this tuition assistance policy (Vermont)

- Define eligible programs: Specify which educational programs, certifications, or training courses qualify for assistance, such as job-related degrees or industry-recognized certifications.

- Set eligibility criteria: Outline employee eligibility requirements, such as length of service, full-time or part-time status, or performance history.

- Include application procedures: Detail how employees can apply for tuition assistance, including required documentation and deadlines for submission.

- Address reimbursement terms: Specify reimbursement rates, caps, and conditions, such as successful course completion or maintaining a minimum grade.

- Emphasize tax compliance: Ensure the policy aligns with Vermont tax laws and federal guidelines regarding tuition benefits.

- Clarify repayment obligations: Include terms for repayment if the employee leaves the company within a specified period after receiving assistance.

- Monitor compliance: Regularly review the program to ensure it aligns with Vermont laws, company objectives, and industry standards.

Benefits of using this tuition assistance policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Enhances workforce skills: Supports employee development in areas that directly benefit the organization.

- Improves retention: Encourages employees to stay with the company by investing in their education.

- Promotes compliance: Aligns with Vermont labor laws and federal tax regulations.

- Demonstrates commitment: Shows the company’s dedication to employee growth and career advancement.

- Reduces hiring costs: Develops internal talent, minimizing the need for external hiring for advanced roles.

Tips for using this tuition assistance policy (Vermont)

- Communicate the policy: Share the policy with employees and include it in internal resources, such as the employee handbook.

- Plan budgets: Allocate a specific budget for tuition assistance to manage costs effectively.

- Evaluate applications: Establish a review process to assess the relevance of proposed education to business needs.

- Track outcomes: Monitor the impact of supported education programs on employee performance and organizational success.

- Update regularly: Revise the policy to reflect changes in Vermont laws, tax regulations, or company priorities.

Q: What types of educational programs should businesses approve for tuition assistance?

A: Businesses should approve programs that directly align with company goals, such as job-related degrees, certifications, or skills training that enhances employee performance.

Q: How can businesses ensure tax compliance for tuition benefits?

A: Businesses should adhere to Vermont and federal tax guidelines, such as ensuring annual tuition assistance stays within tax-free limits or reporting amounts exceeding thresholds.

Q: What factors should be considered when setting reimbursement caps?

A: Consider the company budget, typical program costs, and the potential ROI from employee development when setting reimbursement limits.

Q: How should businesses handle repayment obligations?

A: Establish clear repayment terms in cases where employees leave the company shortly after receiving assistance, typically within one to two years.

Q: How can businesses measure the effectiveness of tuition assistance?

A: Track employee performance improvements, retention rates, and overall contributions to company objectives post-education.

Q: What should businesses do if an employee fails to complete an approved course?

A: Businesses can include conditions requiring employees to repay assistance if they fail to complete the course or achieve the required grade.

Q: How often should this policy be reviewed?

A: Review the policy annually or whenever significant changes occur in Vermont tax laws, workplace needs, or educational standards.

Q: Does this policy apply to part-time employees?

A: Businesses should specify eligibility for part-time employees, potentially prorating assistance based on their employment status.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.