Tuition assistance policy (Virginia): Free template

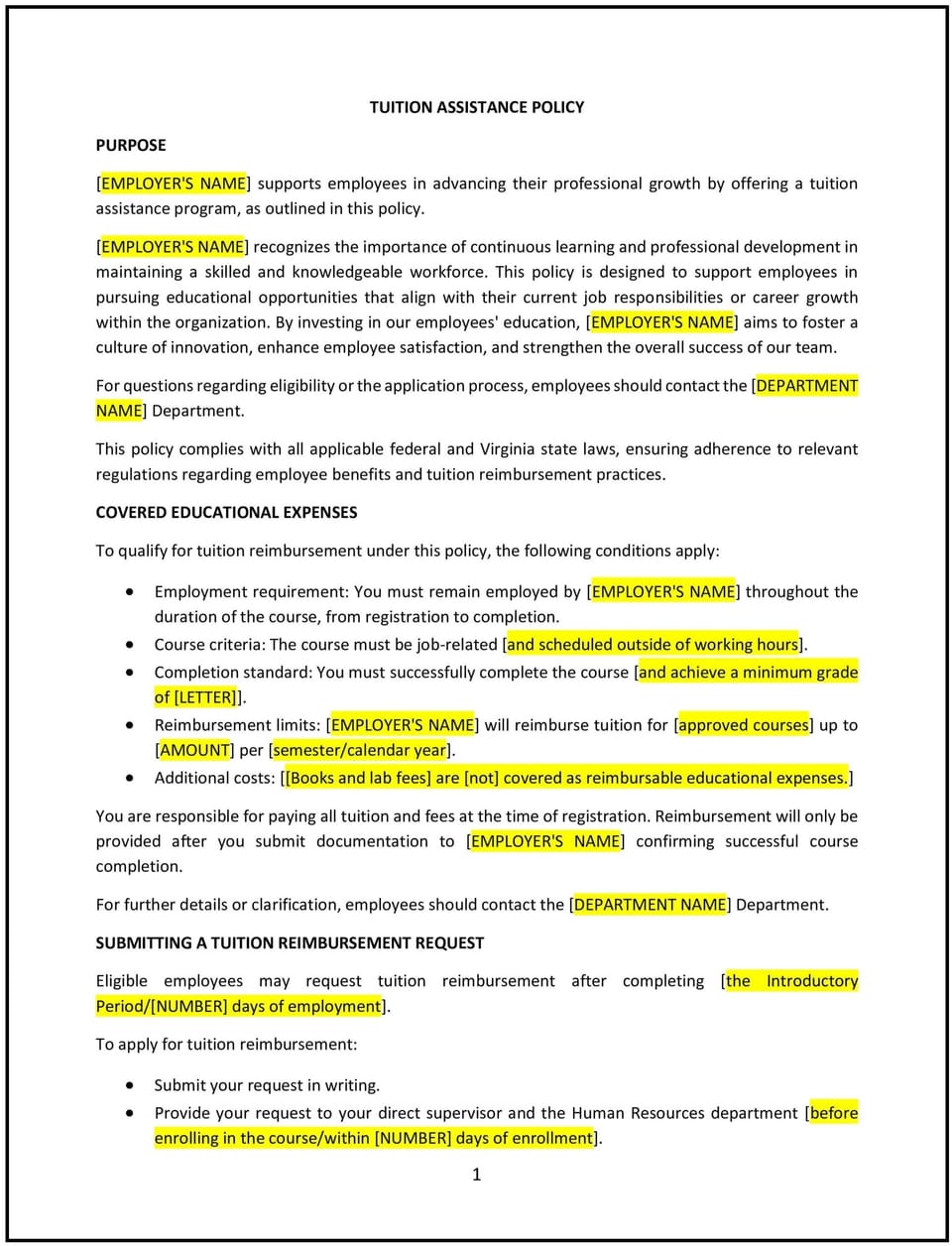

This tuition assistance policy is designed to help Virginia businesses support employees who wish to pursue further education or professional development by offering financial assistance for tuition, course fees, and related educational expenses. The policy outlines the eligibility criteria, application process, and reimbursement structure for employees seeking to enhance their skills or qualifications through education.

By adopting this policy, businesses can encourage professional growth, improve employee retention, and foster a culture of continuous learning, ultimately benefiting both employees and the organization.

How to use this tuition assistance policy (Virginia)

- Define eligibility criteria: The policy should outline the eligibility requirements for employees seeking tuition assistance, such as length of service, job role, and performance criteria. It should also specify whether the assistance applies to full-time, part-time, or temporary employees.

- Specify covered expenses: The policy should define what educational expenses are eligible for reimbursement, such as tuition fees, books, supplies, and exam fees. It should also set limits on the amount of assistance employees can receive per year or per course.

- Detail the application process: The policy should establish a clear process for employees to apply for tuition assistance, including the required forms, deadlines for submission, and any necessary supporting documentation (e.g., course enrollment proof, cost breakdown).

- Set reimbursement guidelines: The policy should explain how and when employees will be reimbursed for educational expenses. This may include partial or full reimbursement after successful completion of the course, as well as any conditions for reimbursement, such as maintaining a certain grade point average or relevant work commitments.

- Address job-related relevance: The policy should specify that the tuition assistance is intended for courses that are job-related or beneficial to the employee's current role within the company. The company may also outline how employees can demonstrate the relevance of their coursework to their job responsibilities.

- Include retention agreement: To protect the company’s investment in employee education, the policy may require a retention agreement, specifying that employees who receive tuition assistance must remain employed with the company for a certain period following the completion of the course. If the employee leaves the company before the agreed-upon time, they may be required to repay part or all of the tuition assistance.

- Address tax implications: The policy should note any tax implications related to tuition assistance. For example, while tuition assistance may be tax-free up to a certain amount, any assistance above the IRS limit may be considered taxable income.

- Ensure compliance with Virginia state and federal laws: The policy should comply with Virginia state laws and federal regulations related to educational benefits and tax rules. It should also be consistent with any collective bargaining agreements or other company-specific provisions regarding employee benefits.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations or educational funding options. Regular updates will help keep the policy relevant and effective.

Benefits of using this tuition assistance policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Supports employee development: Tuition assistance helps employees pursue higher education, certifications, or specialized training, enhancing their skills and knowledge in ways that benefit their current job performance.

- Increases employee retention: By offering financial assistance for education, businesses show that they are invested in employees’ long-term growth. This can increase job satisfaction and reduce turnover.

- Promotes a culture of learning: A clear and accessible tuition assistance policy encourages employees to pursue ongoing learning and professional development, helping foster a culture of knowledge-sharing and innovation within the organization.

- Enhances recruitment efforts: Offering tuition assistance is a valuable perk that can attract top talent, particularly those who prioritize continuous education and development in their careers.

- Supports business growth: Well-educated employees can contribute to the overall growth and success of the company by applying new skills and knowledge to their work. This can improve productivity, creativity, and problem-solving capabilities.

- Complies with regulatory requirements: By adhering to relevant state and federal laws, the policy reduces the risk of non-compliance issues related to educational benefits or tax treatments.

Tips for using this tuition assistance policy (Virginia)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy and understand how to apply for benefits. Include the policy in the employee handbook and discuss it during onboarding.

- Set realistic expectations: Be clear about the amount of financial assistance available, the eligibility requirements, and the process for requesting reimbursement. This helps employees plan their educational goals accordingly.

- Track usage: Keep track of tuition assistance applications, approvals, and reimbursements to ensure that the program is being used fairly and that employees are meeting the terms of the policy.

- Offer support for course selection: Employees may benefit from guidance on which courses or programs align with the company’s needs. Consider offering career development support or discussing education options with employees to ensure the program aligns with business objectives.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

Q: Who is eligible for tuition assistance?

A: The policy outlines eligibility based on factors such as length of service, job role, and performance criteria. Typically, full-time employees who meet certain requirements are eligible, but the company may also offer assistance to part-time employees depending on the policy.

Q: What educational expenses are covered?

A: The policy specifies the types of educational expenses that are eligible for reimbursement, such as tuition, books, supplies, and exam fees. The company may have limits on the total reimbursement per employee or per course.

Q: How do employees apply for tuition assistance?

A: Employees must follow the application process outlined in the policy, which may involve submitting a form, providing proof of enrollment, and submitting the costs associated with the course or program they wish to take.

Q: Do employees need to pay the tuition upfront?

A: In most cases, employees will need to pay for the courses or programs upfront and will be reimbursed once they provide proof of completion. The policy outlines how and when reimbursements will be made.

Q: Are there any conditions for reimbursement?

A: The policy may require that employees achieve a minimum grade or pass certain exams in order to receive reimbursement. It may also stipulate that employees must remain employed with the company for a specified period after completing their education.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.