Tuition assistance policy (Wisconsin): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Tuition assistance policy (Wisconsin)

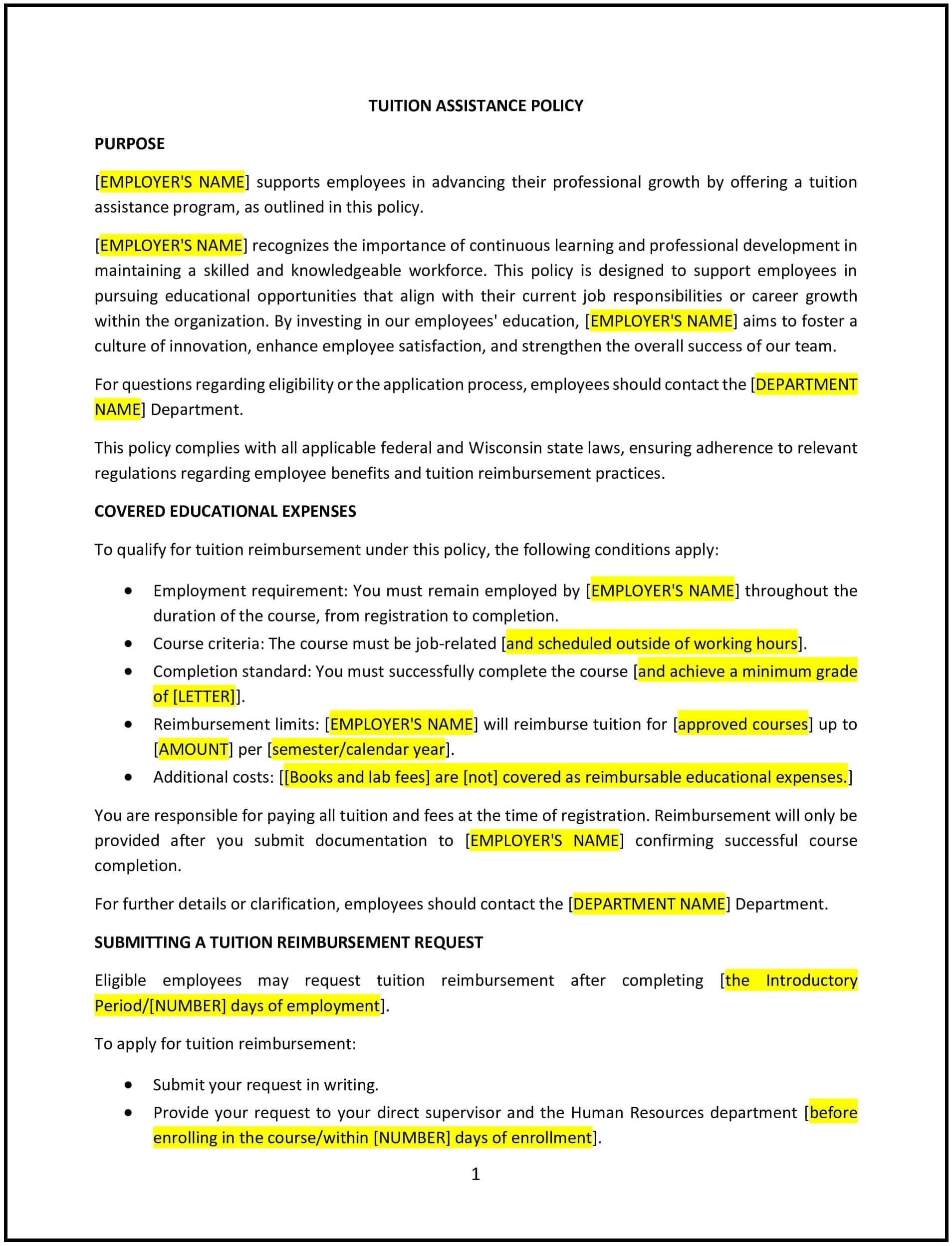

In Wisconsin, a tuition assistance policy provides financial support for employees pursuing education or training programs that align with their job responsibilities or career development within the organization. This policy helps businesses enhance workforce skills, improve employee retention, and foster a culture of continuous learning while maintaining clear guidelines for eligibility and reimbursement.

This policy outlines the eligibility criteria, reimbursement process, and expectations for employees participating in educational programs.

How to use this tuition assistance policy (Wisconsin)

- Define eligibility: Clearly specify which employees and types of educational programs qualify for tuition assistance, such as certifications, degree programs, or job-related training.

- Outline the application process: Provide instructions for employees to apply for tuition assistance, including the required forms, deadlines, and approval process.

- Clarify reimbursement terms: Specify the percentage or amount of tuition costs covered by the company, as well as any conditions for reimbursement (e.g., achieving a minimum grade or completing the course).

- Set retention requirements: Include guidelines on employee retention, such as requiring employees to remain with the company for a certain period after completing the program.

- Support compliance: Ensure the policy adheres to Wisconsin labor laws and IRS guidelines regarding educational assistance programs.

Benefits of using a tuition assistance policy (Wisconsin)

- Encourages employee development: Supports employees in gaining new skills and knowledge, enhancing overall workforce capabilities.

- Improves retention: Demonstrates the company’s investment in employees, leading to higher satisfaction and reduced turnover.

- Enhances competitiveness: Helps businesses stay competitive by fostering a highly skilled and educated workforce.

- Promotes fairness: Provides a clear framework for offering tuition assistance consistently to all eligible employees.

- Supports compliance: Aligns with Wisconsin labor laws and federal regulations, such as IRS rules for tax-free educational benefits.

Tips for using a tuition assistance policy (Wisconsin)

- Communicate the policy: Share the policy with employees during onboarding and ensure it is accessible for reference throughout their employment.

- Monitor employee progress: Track employees’ participation and performance in educational programs to ensure alignment with policy requirements.

- Provide flexibility: Consider offering assistance for a range of programs, including part-time or online courses, to accommodate diverse employee needs.

- Align with business goals: Prioritize educational programs that directly contribute to the organization’s strategic objectives and workforce needs.

- Review periodically: Update the policy as needed to reflect changes in Wisconsin laws, IRS regulations, or company goals.