US export and trade compliance policy (South Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

US export and trade compliance policy (South Carolina)

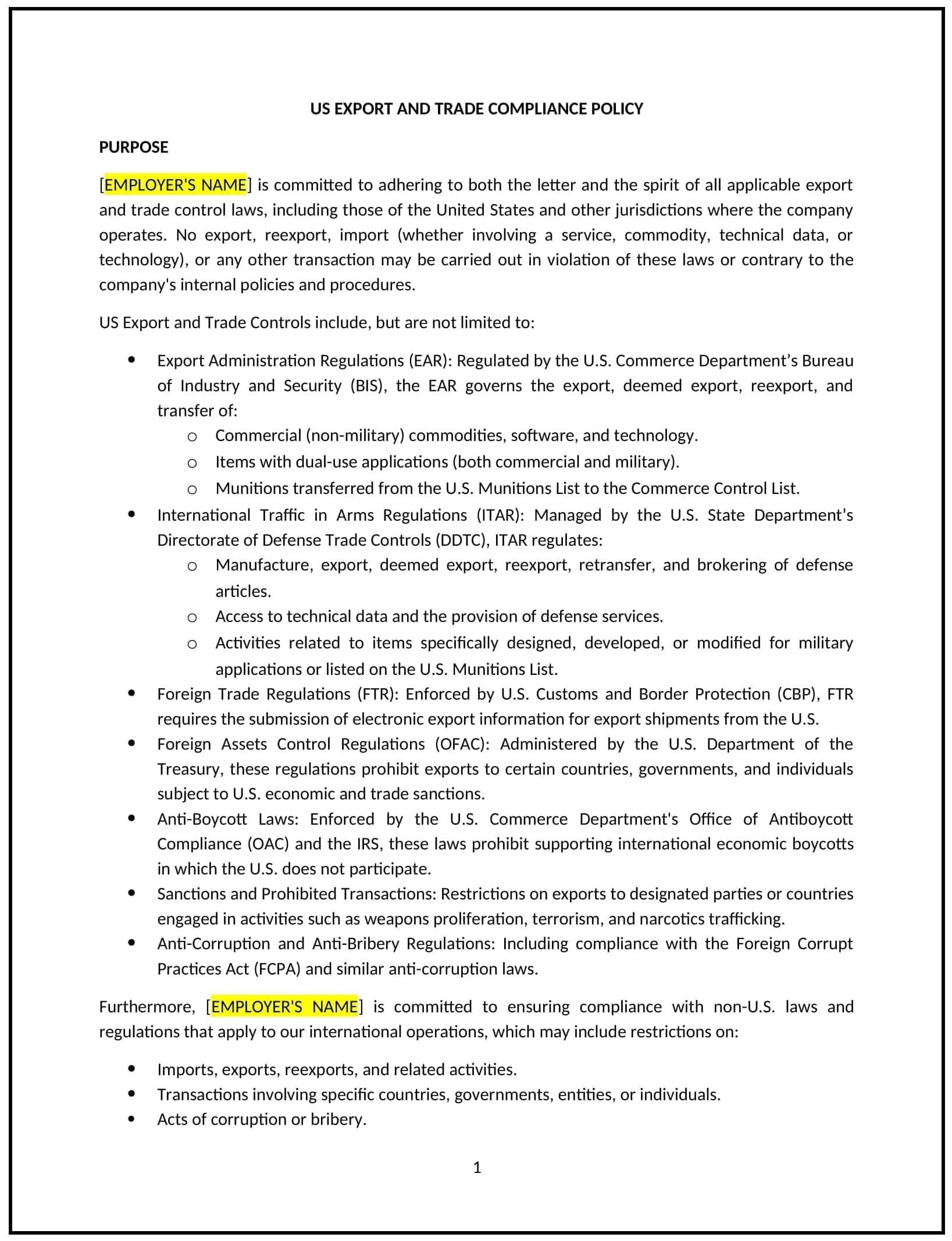

This US export and trade compliance policy is designed to help South Carolina businesses establish guidelines for adhering to federal export control laws and regulations. It outlines procedures for classifying products, screening transactions, and maintaining records to ensure compliance with international trade requirements.

By adopting this policy, businesses can minimize legal risks, protect sensitive information, and align with general best practices for export and trade compliance.

How to use this US export and trade compliance policy (South Carolina)

- Define export controls: Explain what constitutes export-controlled items, such as goods, technology, or software subject to federal regulations.

- Establish classification procedures: Provide steps for classifying products and determining export control requirements.

- Address screening processes: Outline procedures for screening customers, partners, and transactions to ensure compliance with trade restrictions.

- Set recordkeeping requirements: Specify how export-related records will be maintained and for how long.

- Train employees: Educate staff on their responsibilities for adhering to export control laws and regulations.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and regulatory requirements.

Benefits of using this US export and trade compliance policy (South Carolina)

This policy offers several advantages for South Carolina businesses:

- Minimizes legal risks: Reduces the potential for penalties or sanctions related to export control violations.

- Protects sensitive information: Ensures that export-controlled items are handled and shared appropriately.

- Aligns with best practices: Provides a structured approach to managing export and trade compliance.

- Enhances reputation: Demonstrates a commitment to ethical and lawful business practices.

- Supports international trade: Facilitates smooth and compliant cross-border transactions.

Tips for using this US export and trade compliance policy (South Carolina)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate staff on their responsibilities for adhering to export control laws and regulations.

- Monitor adherence: Regularly review export transactions and compliance practices to ensure alignment with the policy.

- Address issues promptly: Take corrective action if export control violations occur or if compliance processes are inadequate.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs and regulatory requirements.