US export and trade compliance policy (Texas): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

US export and trade compliance policy (Texas)

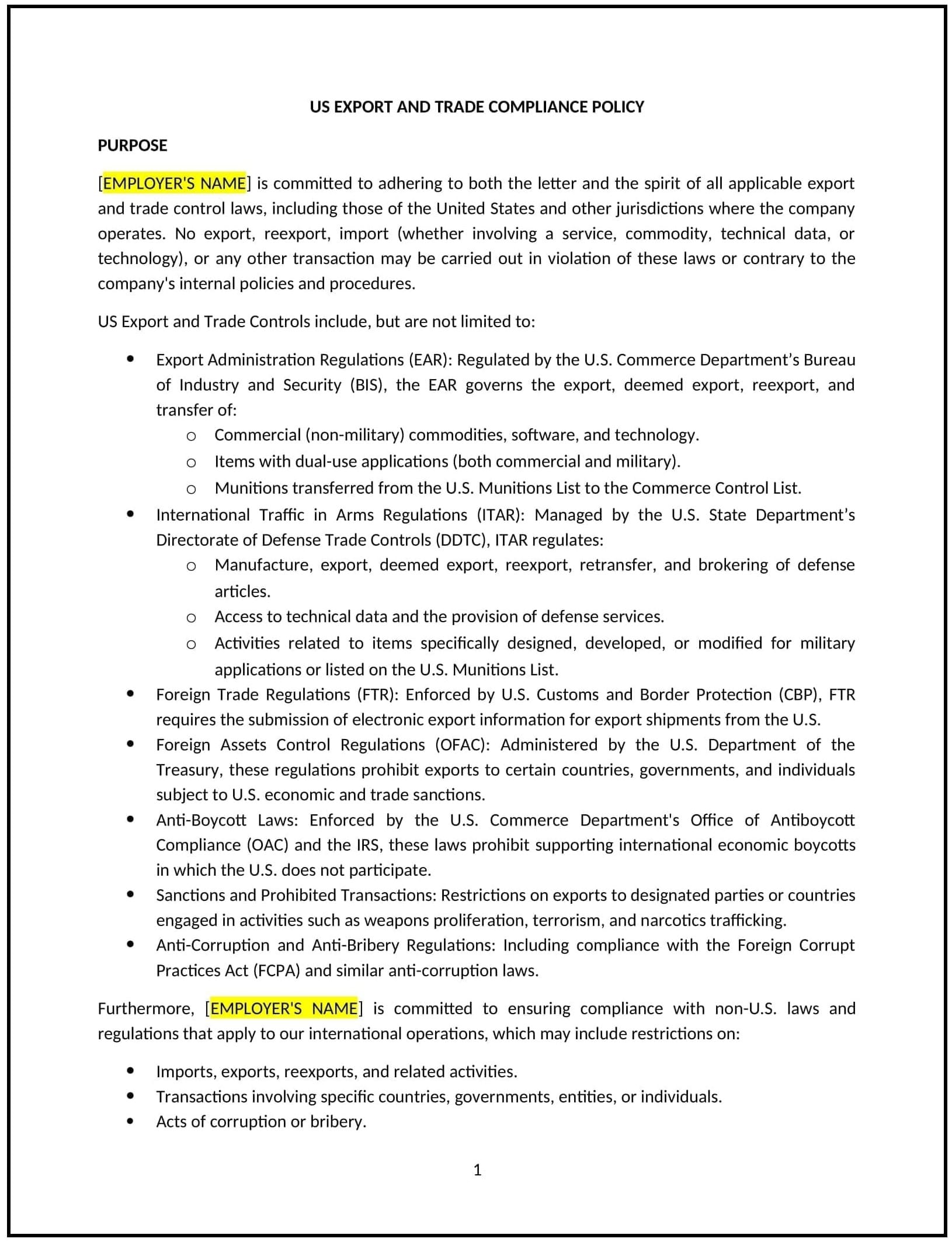

This US export and trade compliance policy is designed to help Texas businesses comply with US federal laws and regulations governing the export of goods, services, and technologies. The policy outlines the company’s responsibilities to adhere to export control laws, including the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and other relevant trade compliance requirements.

By adopting this policy, businesses can help ensure that they are not involved in the illegal export of controlled items, prevent inadvertent violations, and promote responsible business practices in international trade.

How to use this US export and trade compliance policy (Texas)

- Define compliance requirements: Clearly outline the company’s obligations under US export control laws, such as the EAR, ITAR, and the Office of Foreign Assets Control (OFAC) regulations. Explain what constitutes a controlled item or service and the requirements for obtaining export licenses.

- Set internal procedures for assessing export compliance: Outline how the company will assess whether specific transactions or products require export licenses or approvals, including the steps for verifying the classification of goods or services and determining if a license is needed.

- Address restricted parties and destinations: Specify that the company must not engage in business transactions with prohibited entities, individuals, or countries. The policy should include guidelines for screening customers, business partners, and destinations against lists of restricted parties, such as the Denied Persons List, Entity List, and Specially Designated Nationals List (SDN).

- Implement training and awareness programs: Provide training to employees involved in the export process, ensuring that they understand their responsibilities under US export laws. The policy should require regular training and updates on export compliance.

- Set up recordkeeping procedures: Specify the records that must be kept for each export transaction, including export licenses, documentation of compliance checks, and shipping records. The policy should outline how long these records need to be maintained and the procedures for secure storage.

- Develop reporting mechanisms: Establish procedures for employees to report any suspected violations or compliance concerns, ensuring that they can do so confidentially and without fear of retaliation.

- Implement audits and monitoring: Specify how the company will monitor and audit its export activities to ensure ongoing compliance. This may include regular internal audits and reviews of transactions to detect potential violations or gaps in the compliance process.

- Clarify the consequences of non-compliance: Define the penalties for failing to comply with US export laws, including legal and financial consequences for the company and employees. The policy should make it clear that violations may result in disciplinary actions, including termination or legal action.

Benefits of using this US export and trade compliance policy (Texas)

This policy offers several benefits for Texas businesses:

- Reduces legal and financial risks: By ensuring compliance with US export laws, businesses can avoid costly fines, penalties, and reputational damage associated with violations of trade regulations.

- Protects the company’s reputation: A robust export and trade compliance policy demonstrates the company’s commitment to legal and ethical business practices, enhancing its reputation among customers, partners, and regulators.

- Improves operational efficiency: Clear compliance guidelines streamline export processes and reduce the risk of delays or disruptions caused by compliance violations or misunderstandings.

- Promotes responsible business practices: Adhering to US export regulations helps businesses operate ethically and responsibly, preventing the inadvertent export of items that could pose national security risks or violate international agreements.

- Enhances global market access: By complying with export control laws, businesses are better positioned to expand into international markets, as they demonstrate their commitment to following legal and regulatory requirements in global trade.

- Protects employees and partners: The policy helps safeguard employees from involvement in illegal activities and protects business partners from potential legal exposure by ensuring that the company only engages in legitimate and lawful transactions.

Tips for using this US export and trade compliance policy (Texas)

- Communicate the policy clearly: Ensure that all employees involved in export activities are fully aware of the company’s export compliance obligations. This can be communicated through training sessions, internal communications, and employee handbooks.

- Regularly update training: Export regulations can change frequently, so it’s essential to provide regular training and updates to employees involved in the export process to keep them informed of any changes in laws or procedures.

- Perform routine compliance checks: Regularly review and audit export transactions to ensure compliance with US laws. Any discrepancies or irregularities should be addressed promptly to prevent violations.

- Screen all third parties: Screen all business partners, suppliers, and customers against restricted party lists to ensure compliance with the regulations governing exports to prohibited entities or countries.

- Ensure proper documentation: Maintain accurate and complete records of all export transactions, including export licenses, invoices, and shipping documents. These records should be easily accessible in case of audits or inquiries from regulators.

- Foster a culture of compliance: Encourage employees to prioritize compliance and report any concerns or suspicious activities. A culture of compliance helps prevent violations and promotes responsible business practices across the organization.