US export and trade compliance policy (Utah): Free template

US export and trade compliance policy (Utah)

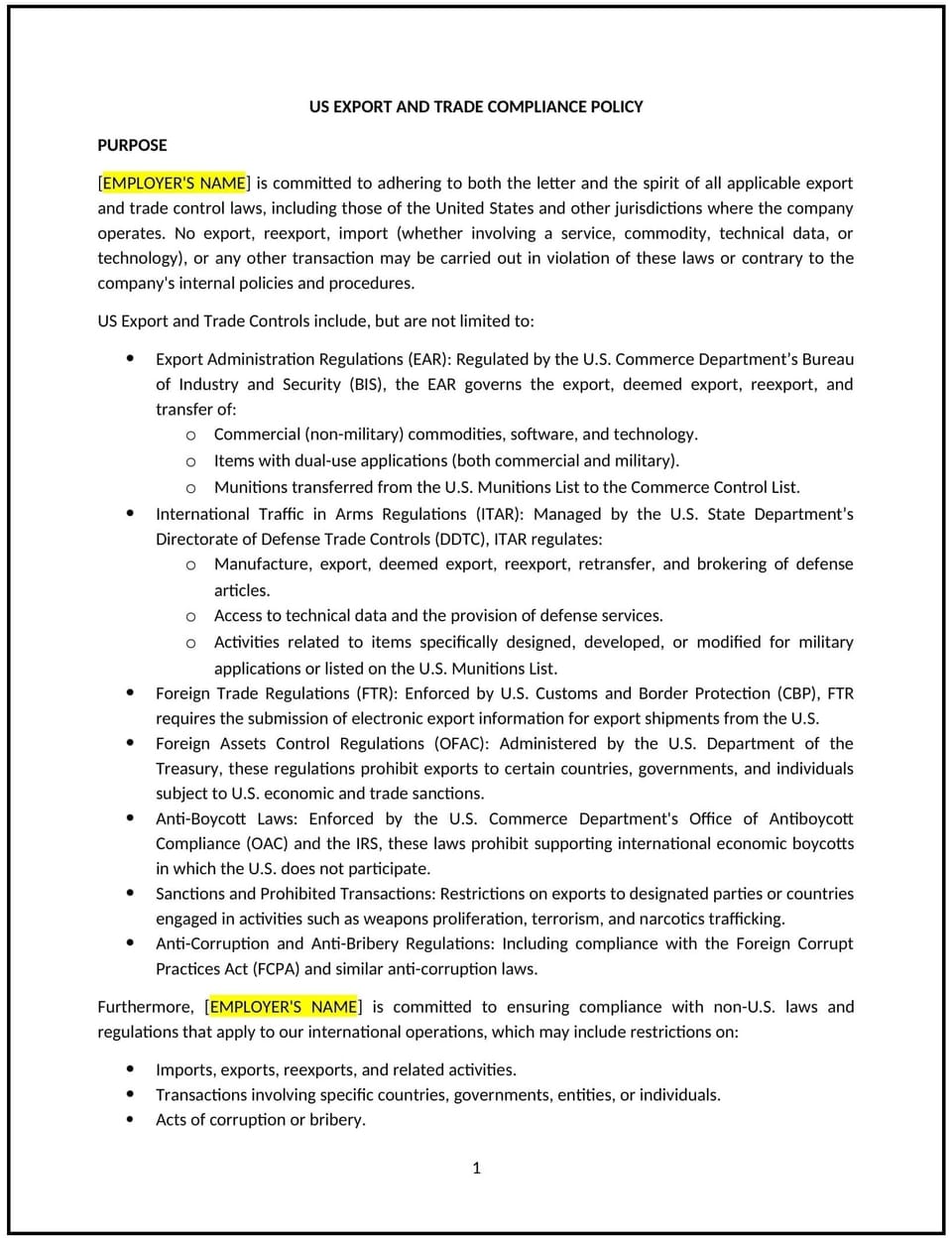

This US export and trade compliance policy is designed to help Utah businesses establish guidelines for complying with federal export and trade regulations. It outlines procedures for classifying products, obtaining licenses, and ensuring compliance with international trade laws.

By adopting this policy, businesses can reduce legal risks, avoid penalties, and align with general best practices for export and trade compliance.

How to use this US export and trade compliance policy (Utah)

- Define scope: Explain what constitutes export and trade activities, such as shipping goods internationally or sharing technical data.

- Establish classification procedures: Provide steps for classifying products and determining export control requirements.

- Address licensing: Specify when and how to obtain export licenses or other authorizations.

- Ensure compliance: Align export and trade practices with federal regulations, such as the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR).

- Train employees: Educate employees on export and trade compliance, including restricted parties and prohibited transactions.

- Monitor compliance: Regularly review export and trade activities to ensure adherence to the policy.

- Review and update: Assess the policy annually to ensure it aligns with evolving federal regulations and business needs.

Benefits of using this US export and trade compliance policy (Utah)

This policy offers several advantages for Utah businesses:

- Reduces legal risks: Ensures compliance with federal export and trade regulations, minimizing the risk of penalties or fines.

- Avoids penalties: Helps businesses avoid costly fines or sanctions for non-compliance with export laws.

- Aligns with best practices: Provides a structured approach to managing export and trade compliance.

- Enhances reputation: Demonstrates a commitment to ethical and compliant business practices.

- Supports international trade: Facilitates smooth and compliant international business operations.

Tips for using this US export and trade compliance policy (Utah)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate employees on export and trade compliance, including restricted parties and prohibited transactions.

- Monitor compliance: Regularly review export and trade activities to ensure adherence to the policy.

- Address issues promptly: Take corrective action if export or trade activities violate the policy or federal regulations.

- Update regularly: Assess the policy annually to ensure it aligns with evolving federal regulations and business needs.

Q: How does this policy benefit businesses?

A: By ensuring compliance with export and trade regulations, businesses can reduce legal risks, avoid penalties, and support international trade.

Q: What types of activities are typically covered under this policy?

A: Covered activities may include shipping goods internationally, sharing technical data, or engaging in transactions with foreign entities.

Q: How can businesses ensure compliance with export regulations?

A: Businesses should classify products accurately, obtain necessary licenses, and screen transactions against restricted party lists.

Q: What should businesses do if they discover a compliance violation?

A: Businesses should investigate the violation, take corrective action, and report it to the appropriate authorities if required.

Q: How often should businesses review this policy?

A: Businesses should review the policy annually or as needed to ensure it aligns with evolving federal regulations and business needs.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.