US export and trade compliance policy (Vermont): Free template

US export and trade compliance policy (Vermont)

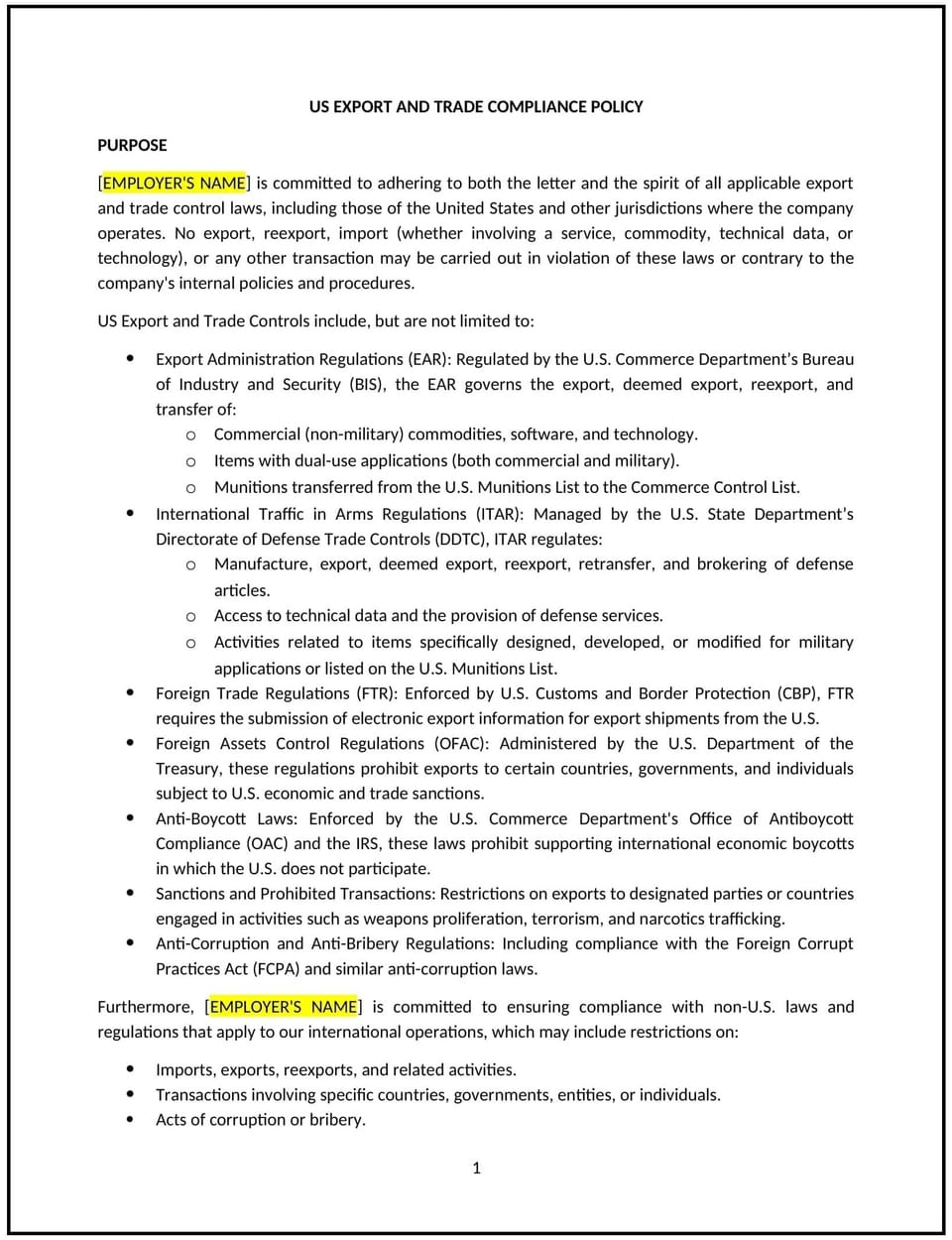

This US export and trade compliance policy is designed to help Vermont businesses ensure adherence to federal and international laws governing exports and trade activities. It outlines procedures for managing export controls, trade sanctions, and compliance requirements to minimize legal and financial risks.

By adopting this policy, businesses can navigate complex trade regulations, protect their operations, and maintain good standing with regulatory authorities.

How to use this US export and trade compliance policy (Vermont)

- Define covered activities: Specify the trade activities subject to this policy, such as exporting goods, transferring technology, or engaging with restricted entities.

- Identify applicable laws: List the key laws and regulations governing trade compliance, such as the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and Office of Foreign Assets Control (OFAC) rules.

- Include due diligence steps: Provide procedures for screening customers, suppliers, and business partners against restricted party lists.

- Establish recordkeeping practices: Outline the documentation requirements for trade transactions, including invoices, shipping records, and export licenses.

- Address training requirements: Require regular training for employees involved in export and trade activities to ensure understanding of compliance obligations.

- Include violation reporting procedures: Specify how employees should report suspected violations and the steps the company will take to address them.

- Monitor compliance: Conduct periodic audits of trade activities to ensure adherence to federal regulations and company policies.

Benefits of using this US export and trade compliance policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Reduces legal risks: Helps achieve compliance with federal export and trade laws to avoid fines, penalties, or sanctions.

- Protects reputation: Demonstrates the company’s commitment to ethical and lawful trade practices.

- Improves efficiency: Establishes clear procedures for managing export and trade activities.

- Supports transparency: Provides guidelines for documenting and tracking trade transactions.

- Minimizes disruptions: Helps businesses identify and address potential compliance issues before they escalate.

Tips for using this US export and trade compliance policy (Vermont)

- Communicate the policy: Share the policy with employees during onboarding and include it in the employee handbook or internal resources.

- Invest in technology: Use compliance software to screen transactions and maintain up-to-date records of trade activities.

- Engage experts: Consult with trade compliance specialists or legal counsel to ensure alignment with federal and Vermont-specific regulations.

- Track updates: Monitor changes to export and trade laws that may affect the company’s operations.

- Update regularly: Revise the policy to reflect regulatory changes, company practices, or industry developments.

Q: What trade activities are covered under this policy?

A: This policy covers activities such as exporting goods, transferring technology, re-exporting items, and engaging in transactions with international customers or suppliers.

Q: How can businesses identify restricted parties?

A: Businesses should use screening tools to check customers, suppliers, and partners against restricted party lists maintained by the US government, such as the OFAC Specially Designated Nationals list.

Q: What steps should businesses take to secure export licenses?

A: Businesses should determine if their products or services require an export license and follow federal guidelines to submit applications and obtain approvals.

Q: How should businesses handle suspected compliance violations?

A: Suspected violations should be reported immediately to the compliance officer or designated personnel. The company will investigate and take corrective action as needed.

Q: What training is required under this policy?

A: Employees involved in export and trade activities should receive regular training on compliance requirements, recordkeeping, and screening practices.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever significant changes occur in export and trade regulations.

Q: Does this policy apply to online transactions?

A: Yes, the policy applies to all export and trade activities, including online transactions, that involve the transfer of goods, technology, or services.

Q: What recordkeeping practices are required under this policy?

A: Businesses should maintain records such as shipping documentation, export licenses, and customer communications for a minimum period specified by federal regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.