Accounts payable automation proposal: Free template

Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free accounts payable automation proposal with Cobrief

Open this free accounts payable automation proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on the client’s finance stack, company size, and internal bottlenecks. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching AP automation to finance leaders at startups, mid-market companies, or scaling back offices. Whether you’re implementing a new tool or optimizing an existing system, this version gives you a structured head start and removes the guesswork.

What is an accounts payable automation proposal?

An accounts payable automation proposal outlines your plan to streamline invoice intake, approval, and payment processes by integrating or improving automation tools. It typically includes system design, platform selection or configuration, policy alignment, workflow optimization, and compliance checks.

This type of proposal is commonly used:

- When companies are drowning in manual invoice processing or approval delays

- To reduce errors, fraud risk, and late payments

- To centralize financial records ahead of audits or ERP transitions

- When a finance team is scaling and needs to operate leaner

It helps businesses eliminate low-leverage tasks, improve payment accuracy, and close books faster — all while staying compliant.

A strong proposal helps you:

- Map current vs. ideal-state workflows across intake, approvals, and reconciliation

- Choose and configure tools like Ramp, Bill.com, Tipalti, Airbase, or custom solutions

- Automate recurring payments and vendor records with audit-friendly practices

- Reduce invoice cycle times, manual entry, and approval friction

Why use Cobrief to edit your proposal

Cobrief helps you build a sharp, professional proposal without wasting cycles on formatting or phrasing.

- Edit the proposal directly in your browser: Skip doc toggling — just write, refine, and structure in one place.

- Rewrite sections with AI: Tailor tone for CFOs, controllers, or operations managers instantly.

- Run a one-click AI review: Let AI catch unclear workflows, vague scope items, or inconsistent formatting.

- Apply AI suggestions instantly: Accept edits line by line or apply all improvements across the doc.

- Share or export instantly: Send the proposal through Cobrief or download a clean PDF or DOCX version for delivery.

You’ll go from draft to done faster — without letting clarity or structure slip.

When to use this proposal

Use this accounts payable automation proposal when:

- A company is manually processing invoices across email, spreadsheets, or disconnected systems

- The finance team is growing and wants better visibility and control over spend

- You’re introducing a new AP tool or helping implement platform integrations

- A client wants to reduce payment errors, late fees, and time spent on reconciliation

- The business is prepping for due diligence, a system migration, or a process audit

It’s especially useful when finance is stretched thin and wants automation that actually works without introducing risk.

What to include in an accounts payable automation proposal

Use this template to walk the client through your implementation process — from discovery to execution — in plain-smart, structured language.

- Project overview: Explain the business need (e.g., too much manual entry, long approval chains) and how your automation plan simplifies AP from intake to payment.

- Current state review: Map out the existing process — invoice intake, approval flow, vendor setup, payment method — and where inefficiencies live.

- System and tool selection: Recommend tools if needed (e.g., Ramp, Bill.com, Tipalti, QuickBooks integrations), or improve how the client uses what they already have.

- Workflow design: Outline the new process — how invoices are received, routed, approved, paid, and reconciled. Include approval logic and exception handling.

- Roles and permissions: Clarify who approves what, thresholds for auto-approval, and how user access is managed.

- Compliance and controls: Show how your setup enforces proper documentation, audit readiness, and reduces fraud risk.

- Implementation support: Detail what you’ll configure — vendor mapping, integrations, templates, reporting, user training.

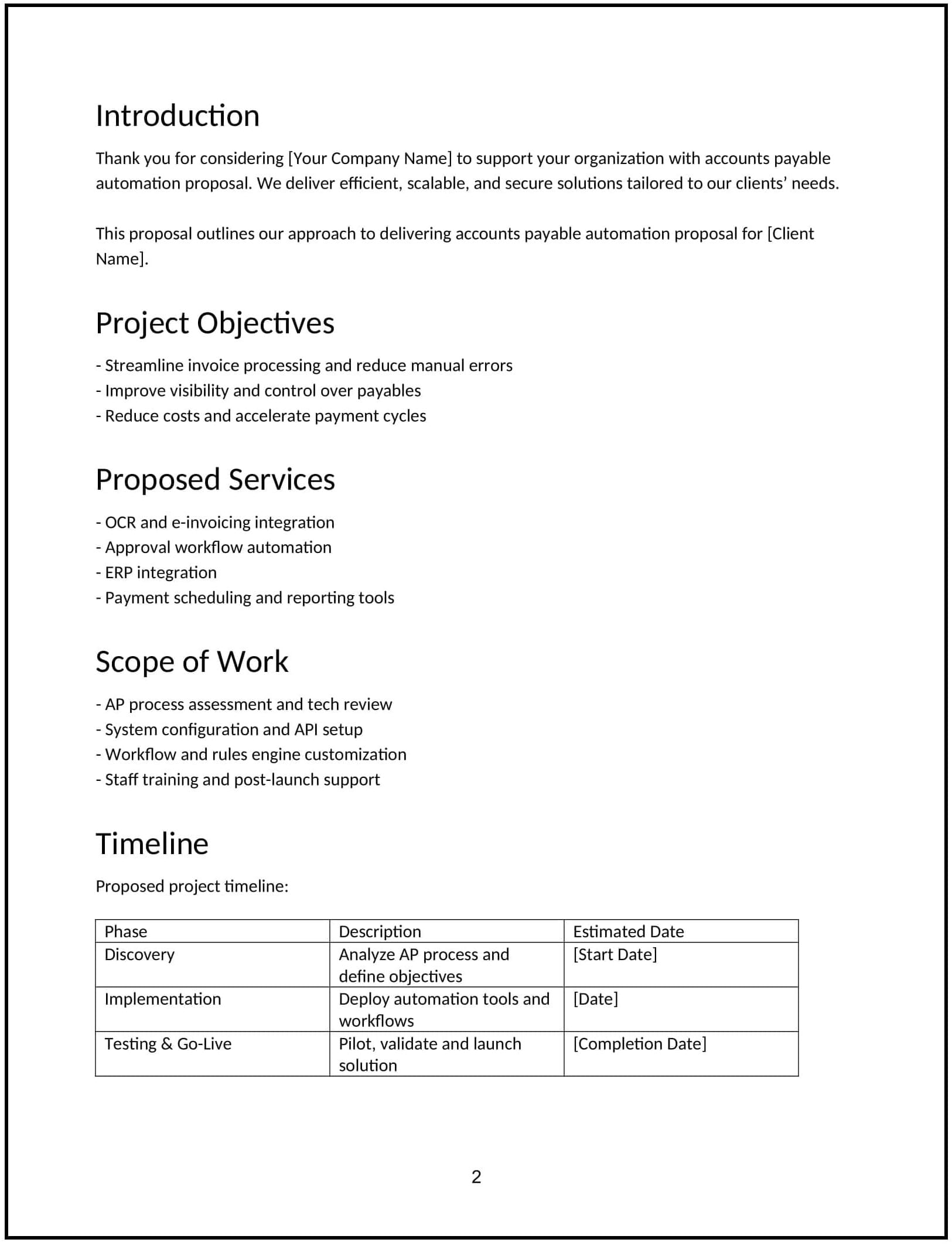

- Timeline and phases: Break into phases — discovery, design, build, test, deploy — with rough durations for each.

- Pricing: Offer a clear model — fixed implementation fee, per-phase pricing, or optional ongoing support.

- Next steps: End with a clear CTA — such as reviewing current tools, sharing sample workflows, or booking a kickoff.

How to write an effective accounts payable automation proposal

This proposal should feel credible, streamlined, and ROI-focused — especially for CFOs and ops leads who want clarity over complexity.

- Emphasize time and cost savings: Show how automation cuts manual hours, late fees, and approval delays.

- Avoid jargon: Keep the language clean — not buried in finance-speak or software buzzwords.

- Don’t oversell tools: Position platforms as enablers, not magic bullets. Workflow clarity matters more than tool features.

- Make risk mitigation clear: Highlight how your setup strengthens controls and supports audits.

- Connect to business goals: If they’re scaling or prepping for diligence, show how AP automation fits that agenda.