Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free credit risk assessment proposal with Cobrief

Open this free credit risk assessment proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on the client’s industry, data sources, and risk exposure. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching credit-risk evaluations to finance teams, lenders, fintech operators, or B2B platforms offering trade credit. Whether you’re building a scoring model, reviewing credit policies, or running a portfolio analysis, this version gives you a structured head start and removes the guesswork.

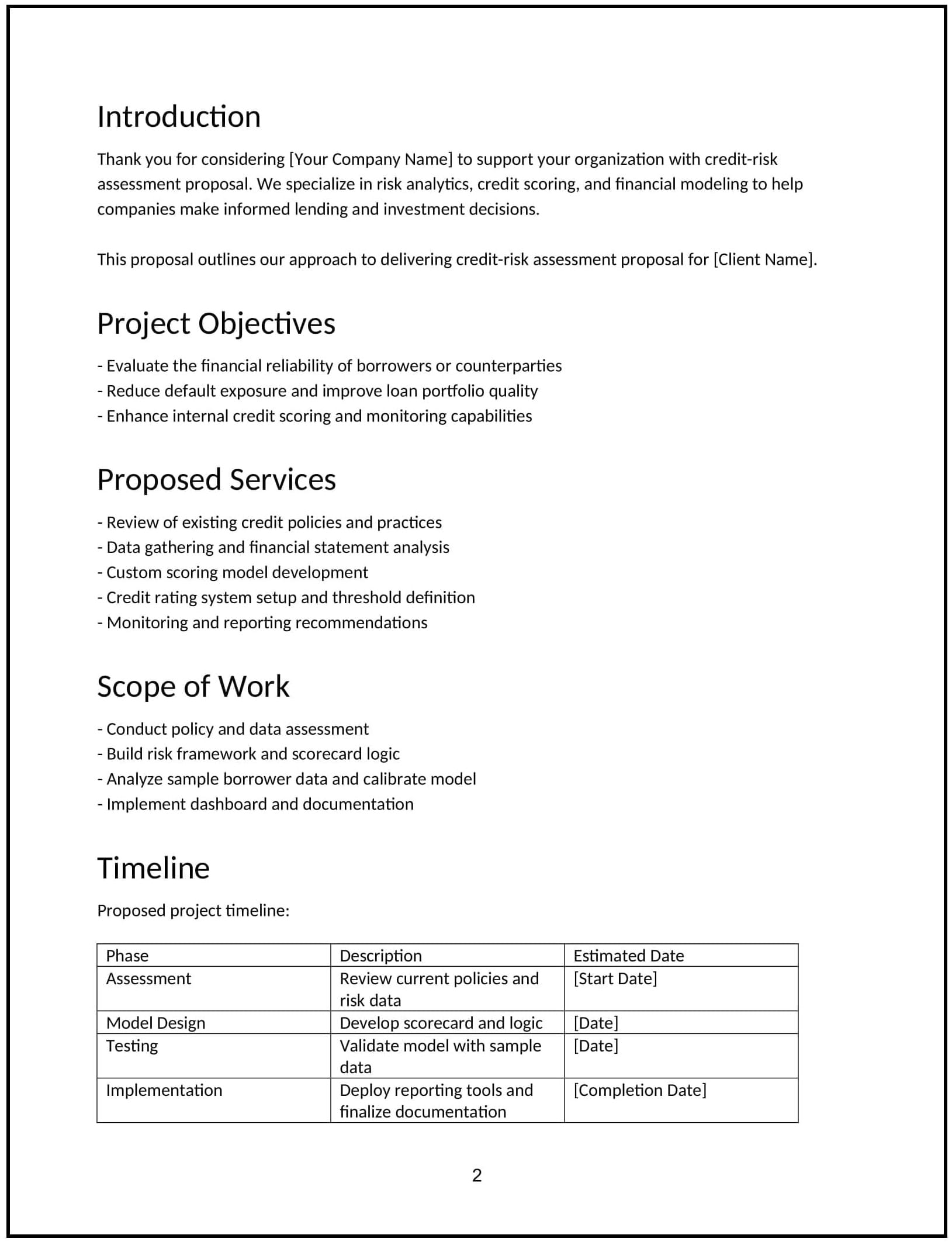

What is a credit risk assessment proposal?

A credit risk assessment proposal outlines your plan to evaluate a company’s exposure to credit losses and develop methods to score, monitor, and mitigate that risk. It typically includes data review, scoring criteria, policy evaluation, and workflow recommendations.

This type of proposal is commonly used:

- When companies are extending credit to customers (e.g., net-30 terms, financing, BNPL)

- To reduce defaults, late payments, or bad-debt write-offs

- Ahead of launching a new credit product or expanding into new markets

- When existing credit decisions feel inconsistent or overly manual

It helps clients make more informed decisions, improve collections, and align credit strategy with business goals.

A strong proposal helps you:

- Define and quantify credit risk by segment or product

- Design or improve scoring models (rule-based or ML-based)

- Recommend internal controls, approval flows, and limits

- Reduce credit losses while supporting growth

Why use Cobrief to edit your proposal

Cobrief helps you move from rough ideas to structured, professional proposals fast — with zero formatting hassle and smart AI assistance.

- Edit the proposal directly in your browser: No doc wrangling — just focus on what matters.

- Rewrite sections with AI: Instantly tailor tone for CFOs, risk teams, or fintech operators.

- Run a one-click AI review: Let AI flag unclear risk logic, vague deliverables, or loose language.

- Apply AI suggestions instantly: Accept edits line by line or revise the entire document in one step.

- Share or export instantly: Send your proposal via Cobrief or download a polished PDF or DOCX file.

You’ll go from scratch to client-ready in less time — with sharper messaging and cleaner structure.

When to use this proposal

Use this credit risk assessment proposal when:

- A company is offering trade credit, invoice financing, or B2B BNPL

- A lender or fintech platform wants to refine their underwriting model

- Finance or operations teams are seeing rising late payments or defaults

- The client is building a credit-scoring product or launching a new lending feature

- There’s no clear framework for approving, rejecting, or monitoring credit decisions

It’s especially useful when the client wants to grow lending volume without increasing bad debt.

What to include in a credit-risk assessment proposal

Use this template to walk the client through how you’ll evaluate and improve their credit decisioning — in plain-smart, execution-ready language.

- Project overview: Explain the problem (e.g., inconsistent approvals, rising defaults, no scoring logic) and how your approach solves it.

- Scope of review: Define what’s in scope — e.g., credit policies, approval workflows, scoring models, portfolio segmentation, collections inputs.

- Data requirements: List what you’ll need — historical payment data, customer segments, financial statements, external bureau or open banking data.

- Risk segmentation: Show how you’ll group customer or borrower profiles to tailor risk rules or scorecards.

- Scoring methodology: Outline how you’ll assess creditworthiness — e.g., rule-based logic, weighted scoring, statistical or machine learning models.

- Risk thresholds and decisioning: Recommend how to set credit limits, define auto-approvals vs. manual reviews, and flag high-risk cases.

- Policy and workflow improvements: Identify where approvals, reviews, or limits need to be tightened or restructured.

- Reporting and monitoring: Include dashboards or reporting structures for ongoing credit exposure tracking.

- Timeline and phases: Break down into discovery, data review, model design, policy recommendations, and rollout — with time estimates.

- Pricing: Offer a clear structure — fixed fee for analysis, optional add-ons for implementation or model automation.

- Next steps: End with a clear CTA — such as booking a kickoff call, sharing sample data, or reviewing current policies.

How to write an effective credit risk assessment proposal

This proposal should feel rigorous, commercial, and no-nonsense — especially for finance and risk teams managing real exposure.

- Make risk feel actionable: Show how your work reduces actual defaults — not just theoretical risk.

- Tailor to decision flow: Whether it’s underwriting, trade credit, or partner onboarding — align with how credit decisions happen in their business.

- Simplify the model where needed: Not every client wants machine learning — sometimes rules and thresholds work best.

- Emphasize speed-to-value: Most clients don’t want a 6-month risk transformation. Offer fast wins with clear ROI.

- Call out red flags: If current approval logic or policy gaps are high-risk, make it clear and quantifiable.

Frequently asked questions (FAQs)

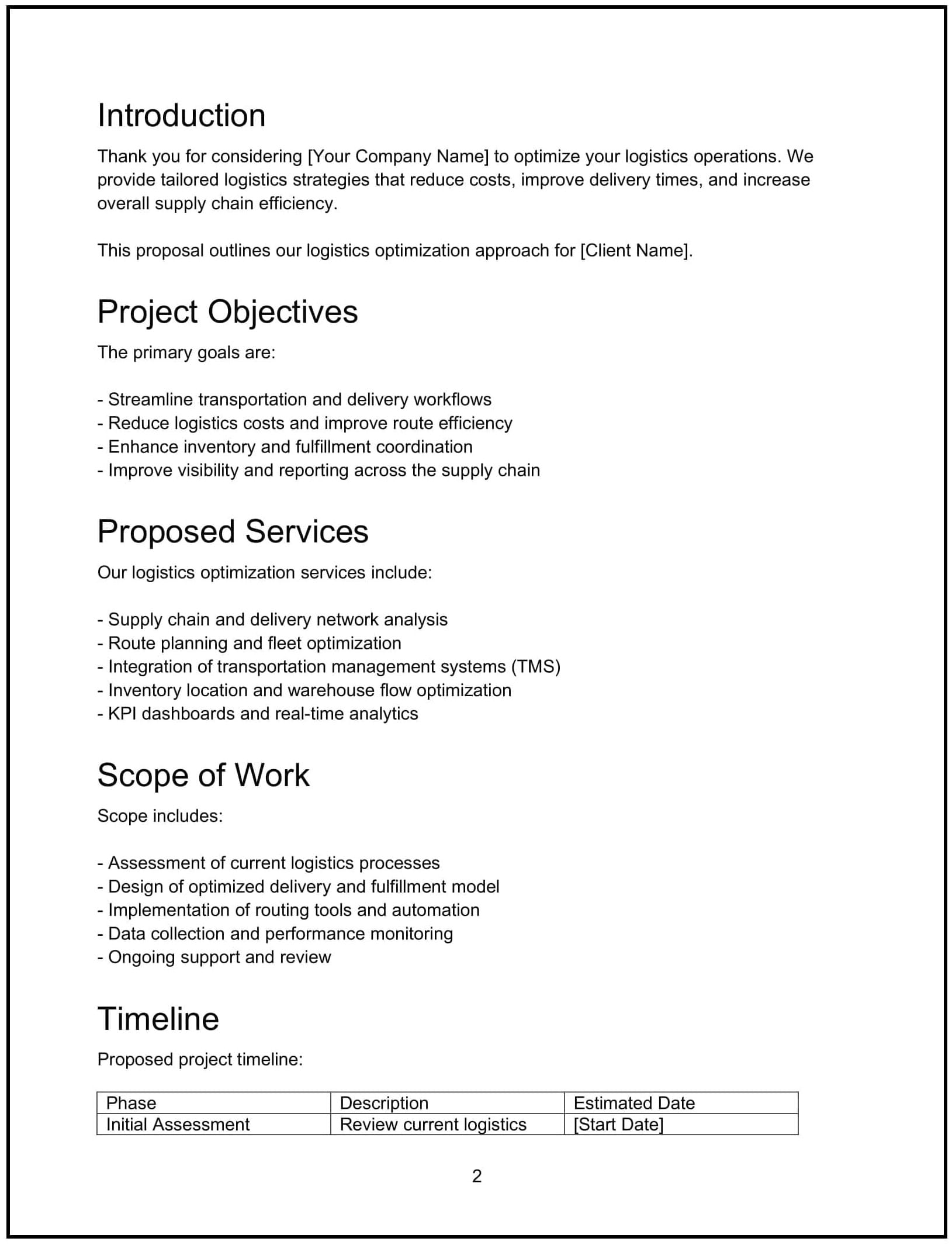

Proposes a logistics optimization plan, detailing route planning, inventory flow improvements, cost reduction strategies, and technology integration to enhance supply chain efficiency.

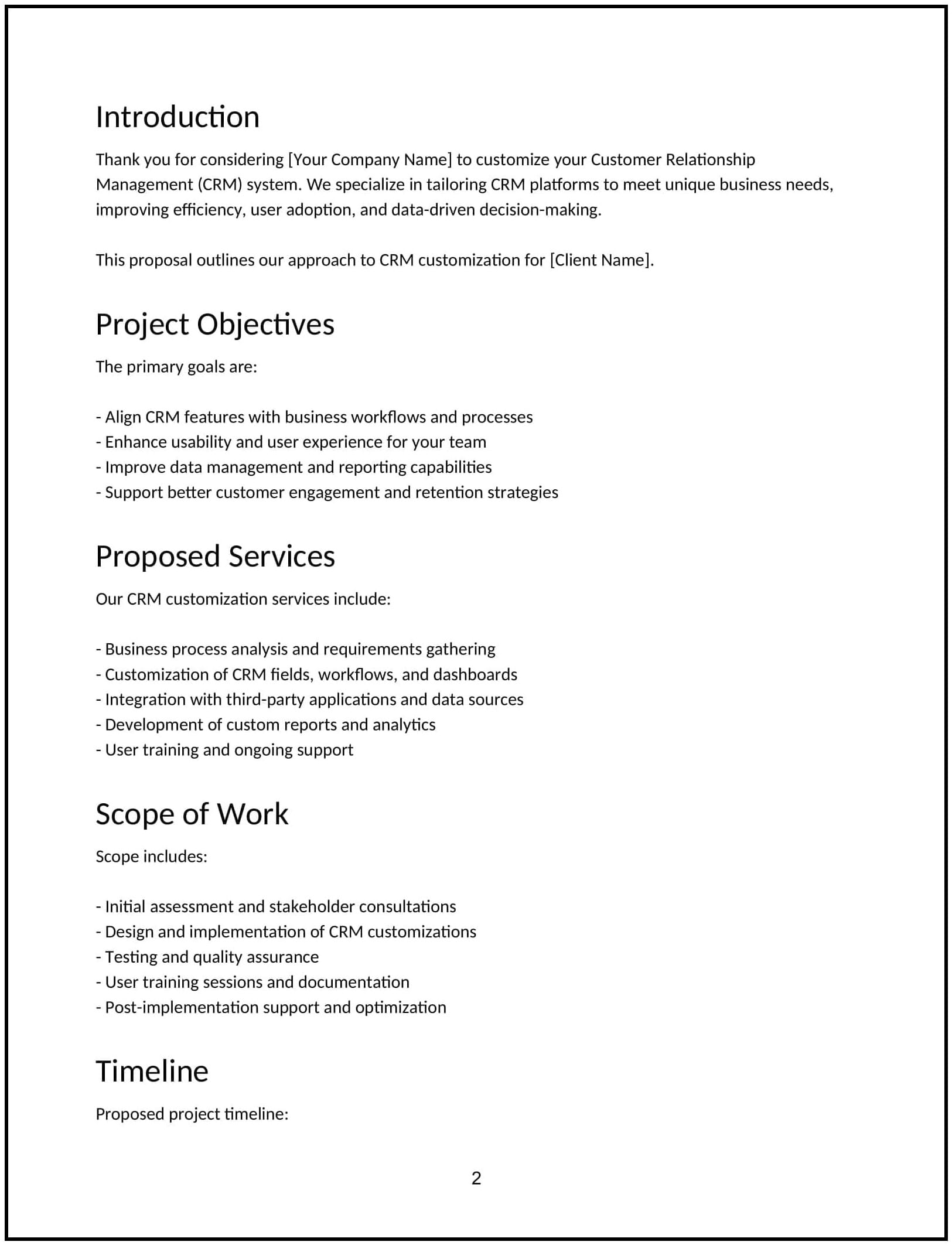

Proposes a CRM customization plan, outlining workflow adjustments, feature enhancements, data migration, and user training to align the system with business needs.

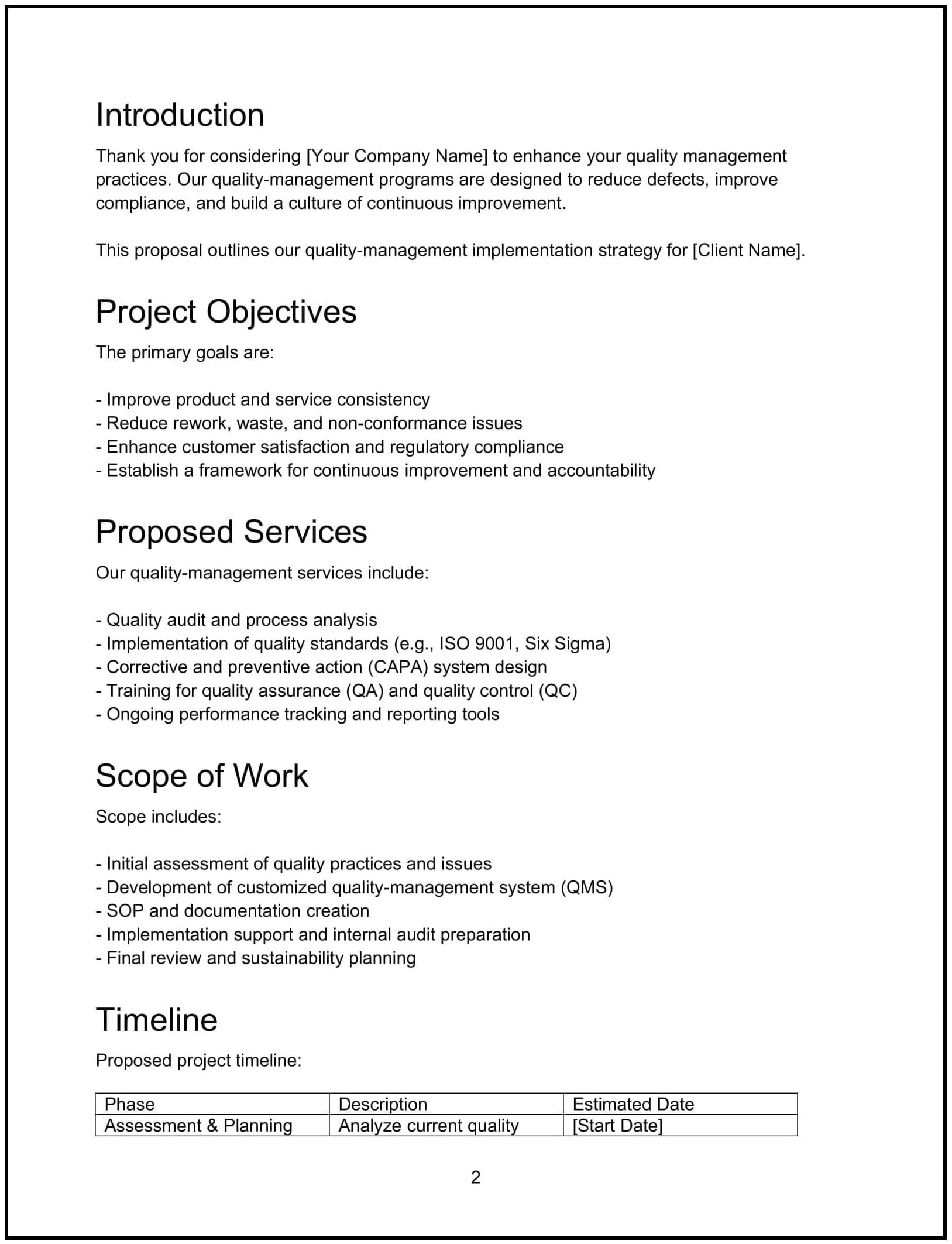

Proposes a quality management plan, outlining standards implementation, process monitoring, continuous improvement strategies, and audit procedures to ensure consistent product and service excellence.