Equipment leasing analysis proposal: Free template

Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free equipment leasing analysis proposal with Cobrief

Open this free equipment leasing analysis proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on your client’s industry, asset type, and financial objectives. You can also use AI to review your draft — tighten scope, clarify benefits, and spot gaps before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for businesses evaluating whether to lease or purchase equipment, optimize current lease terms, or streamline capital expenditures. Whether you're advising on cost modeling, lifecycle planning, or lease structure, this proposal helps you present a clear path forward.

What is an equipment leasing analysis proposal?

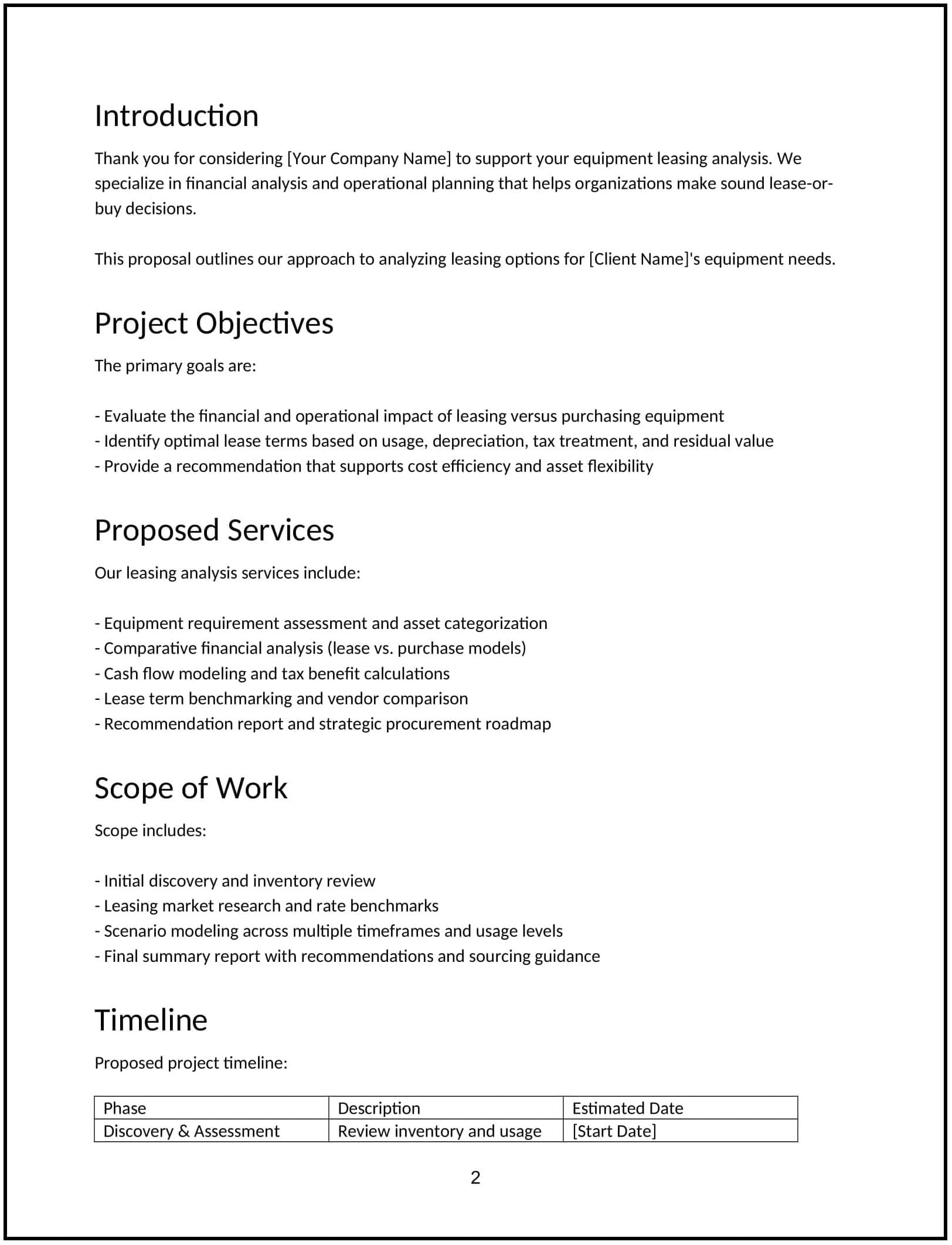

An equipment leasing analysis proposal outlines how you’ll help a business evaluate its current or potential leasing arrangements for machinery, vehicles, technology, or other capital assets. It typically includes financial modeling, scenario comparisons, and recommendations based on cash flow, tax treatment, and strategic flexibility.

This proposal is used by financial consultants, CFO advisors, procurement professionals, and asset managers across industries such as construction, manufacturing, logistics, and healthcare.

Unlike a generic finance or procurement proposal, this version focuses specifically on lease-versus-buy decisions, cost efficiency, and maximizing value across asset lifecycles.

Why use Cobrief to edit your proposal

- Edit the full proposal instantly: No formatting tools needed — just open, tailor, and send.

- Use AI to customize scope: Adjust based on asset type, deal size, or industry standards.

- Run an AI-powered review: Catch vague assumptions, unclear ROI language, or missing modeling factors.

- Apply edits in one click: Accept all or section-by-section suggestions instantly.

- Save, send, or download: Export a professional version of your proposal in seconds.

When to use this proposal

- When helping a client compare leasing vs. purchasing for new equipment acquisitions

- When reviewing existing leases to assess cost-effectiveness or renegotiation opportunities

- When assisting with budgeting or CapEx planning across multiple sites or asset categories

- When preparing financial analysis as part of a broader operations, procurement, or finance strategy

- When supporting leadership with investment decisions that require clear ROI modeling

What to include in an equipment leasing analysis proposal

- Project overview: Explain the objective — such as evaluating lease terms, assessing total cost of ownership (TCO), or advising on strategic leasing structures. Tailor this to the client’s goals and operational context.

- Scope of work: List what you’ll review — such as current lease agreements, usage metrics, payment schedules, asset lifespans, depreciation rates, financing options, and buyout terms. Clarify whether site visits, vendor negotiations, or tax modeling are included.

- Timeline: Provide a delivery schedule — from data collection and baseline modeling to final analysis and recommendations. Include checkpoints for client input or leadership reviews.

- Deliverables: Specify what the client will receive — typically a lease vs. buy analysis, cost breakdowns, ROI projections, risk assessment, and a clear recommendation memo.

- Pricing: Present your pricing clearly — flat fee, hourly consulting, or per-asset/project pricing. Note if updates or re-analysis are included post-delivery.

- Call to action / next steps: Close with a direct next step — approve the proposal, schedule a kickoff, or provide asset documentation. Keep it actionable and professional.

How to write an effective equipment leasing analysis proposal

- Speak to financial impact: Show how the analysis drives better CapEx decisions, not just compliance.

- Break down lease structures: Explain how terms like residual value or early buyout affect long-term cost.

- Use real examples: Tailor assumptions to the client’s industry — e.g., forklift lease cycles or imaging equipment depreciation.

- Highlight total value: Show the benefits of operational flexibility, tax advantages, or cash flow control.

- Keep it visual and precise: Clients often respond well to dashboards, graphs, and summary tables.

- Close with clarity: Include a strong CTA that moves the decision-making process forward.