Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free financial advisory proposal with Cobrief

Open this free financial advisory proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on your services, client goals, and regulatory context. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching business financial planning, investment advisory, cash flow optimization, or M&A support. Whether you're an independent advisor, CPA, or part of a financial consultancy, this version gives you a structured head start and removes the guesswork.

What is a financial advisory proposal?

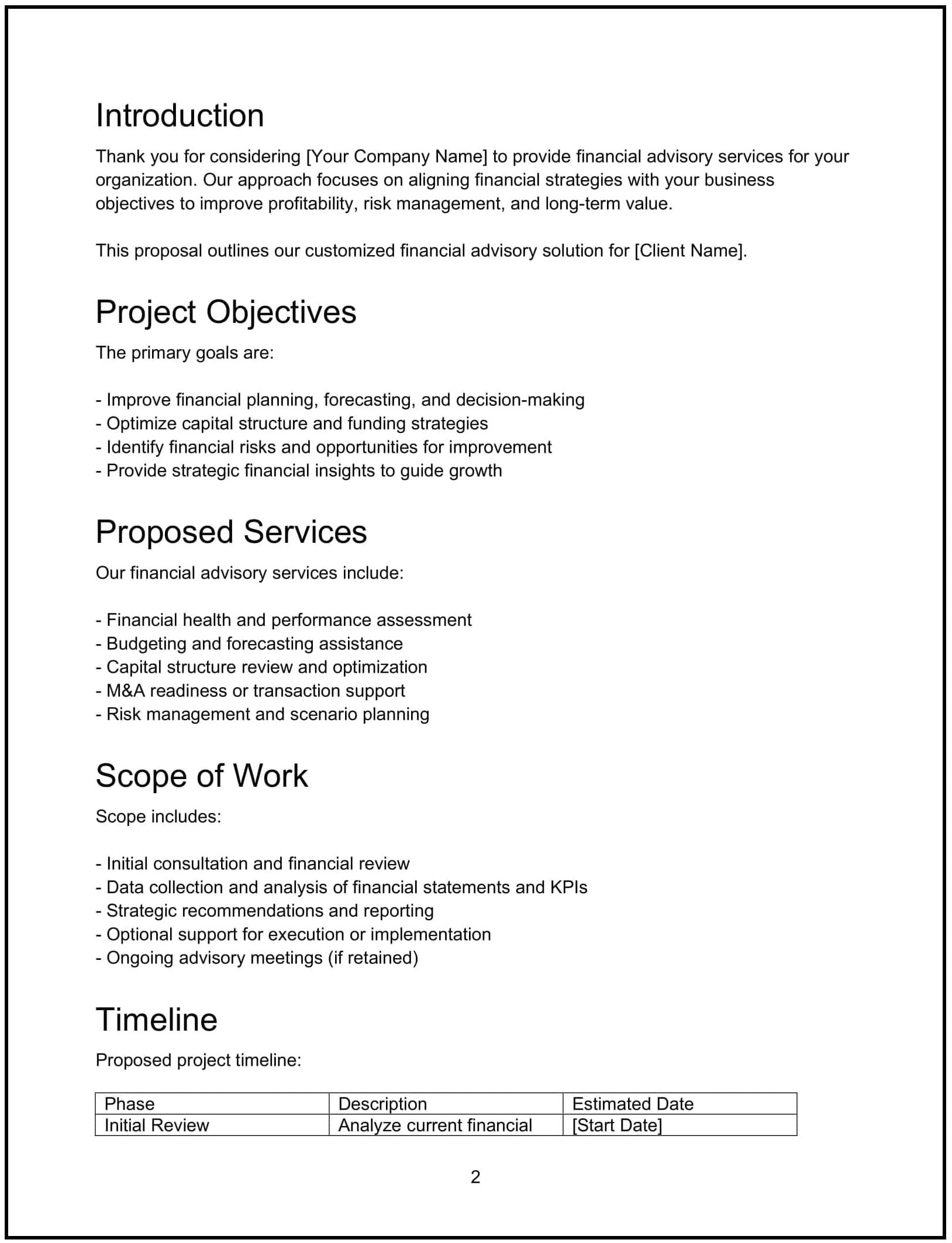

A financial advisory proposal outlines the guidance and services you'll provide to help a business manage its finances, make investment decisions, or achieve long-term financial goals. It typically includes your scope, methodology, pricing, and any fiduciary or regulatory considerations.

This proposal helps clarify expectations, define deliverables, and build trust in your role as a strategic financial partner.

A well-written financial advisory proposal helps you:

- Define the scope of financial planning or advisory work.

- Build trust through professional presentation and transparency.

- Align timelines, responsibilities, and regulatory disclosures.

- Position your services as a driver of financial clarity and growth.

Why use Cobrief to edit your proposal

Cobrief lets you create, refine, and finalize financial proposals with ease — using built-in AI assistance.

- Edit the proposal directly in your browser: No formatting needed — just open and start customizing.

- Rewrite sections with AI: Clarify your recommendations, simplify technical language, or adjust tone.

- Run a one-click AI review: Spot vague or confusing content and fix it instantly.

- Apply AI suggestions instantly: Accept individual edits or apply all improvements in one click.

- Share or export instantly: Send via Cobrief or download a clean PDF or DOCX version instantly.

Save time, look sharp, and focus on delivering financial value.

When to use this proposal

Use this financial advisory proposal for:

- Business financial planning or budgeting support.

- Cash flow and working capital management engagements.

- Investment strategy and capital allocation consulting.

- Fundraising or M&A advisory.

- Financial reporting or board-level strategy support.

This structure works across industries and company sizes.

What to include in a financial advisory proposal

Each section helps your client understand what you’ll deliver, how you’ll work, and what they can expect:

- Executive summary: Briefly highlight the client’s financial goals or challenges and how your expertise will help clarify decisions, reduce risk, or improve growth.

- Scope of work: Define the advisory services you’ll provide — forecasting, capital planning, investor reporting, liquidity analysis, valuation, financial modeling, etc.

- Approach and methodology: Describe how you’ll gather information, perform analysis, and deliver recommendations — including frameworks or tools used (e.g., DCF models, KPI dashboards, Excel templates).

- Timeline: Outline your process in stages (e.g., discovery, analysis, strategy development, delivery), with estimated timelines for each.

- Pricing: Clearly state whether you charge hourly, per project, or on retainer. Include optional services or phases if relevant.

- Terms and conditions: Cover payment terms, confidentiality, data access, disclaimers, and fiduciary or licensing notes if applicable.

- Next steps: End with a clear call to action — like “Reply to confirm” or “Schedule a kickoff call.”

How to write an effective financial advisory proposal

The proposal should feel trustworthy, analytical, and easy to understand:

- Focus on outcomes: Frame your services around clarity, risk reduction, and better decision-making.

- Keep financial language clear: Avoid jargon where possible — make it easy for non-financial stakeholders to follow.

- Be transparent: Define exactly what’s included and what’s out of scope to avoid misalignment.

- Show credibility: Mention relevant credentials, client experience, or industry expertise.

- Format cleanly: Use bullet points, subheadings, and short sections for easy reading.

- Provide a clear next step: Help the client move forward confidently and quickly.