Financial statement audit proposal: Free template

Customize this free financial statement audit proposal with Cobrief

Open this free financial statement audit proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on industry, reporting standards, regulatory context, and internal accounting maturity. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching audit services to finance leaders, boards, or founders preparing for external reporting. Whether you’re delivering a first-time audit or a recurring engagement, this version gives you a structured head start and removes the guesswork.

What is a financial statement audit proposal?

A financial statement audit proposal outlines your plan to independently assess a company’s financials in accordance with relevant accounting standards. It typically includes scope, methodology, compliance references (e.g., GAAP or IFRS), timelines, deliverables, and stakeholder communication.

This type of proposal is commonly used:

- When companies need audited financials for lenders, investors, or regulators

- As part of annual reporting, M&A readiness, or IPO preparation

- When a board or external party requires assurance of internal controls and accuracy

- For first-time audits or when transitioning between firms

It helps establish clear expectations on documentation, review procedures, deadlines, and how findings will be communicated.

A strong proposal helps you:

- Clarify scope and responsibilities across all parties

- Map the audit process to client systems, tools, and timelines

- Address industry-specific risks, standards, or compliance areas

- Reduce ambiguity around documentation, access, and materiality thresholds

Why use Cobrief to edit your proposal

Cobrief helps you create a polished, structured proposal fast — without wasting cycles on formatting or overwriting.

- Edit the proposal directly in your browser: Structure, revise, and collaborate without switching tools.

- Rewrite sections with AI: Tailor the language for CFOs, controllers, or founders in one click.

- Run a one-click AI review: Let AI catch vague responsibilities, unclear audit phases, or legalese overload.

- Apply AI suggestions instantly: Accept line-by-line changes or revise the whole proposal in one step.

- Share or export instantly: Send the proposal via Cobrief or download a clean PDF or DOCX version.

You’ll move from draft to signature-ready without friction.

When to use this proposal

Use this financial statement audit proposal when:

- A company is seeking an external audit to meet lender, investor, or regulatory requirements

- The client needs assurance ahead of fundraising, acquisition, or IPO

- You’re replacing a prior firm or conducting a company’s first-ever audit

- Internal financial processes are maturing and leadership wants formal validation

- You’re helping a client shift from reviewed or compiled statements to full audits

It’s especially useful when timeframes are tight or accounting systems are partially manual.

What to include in a financial statement audit proposal

Use this template to walk the client through your audit process — from planning to final report — in clear, plain-smart language.

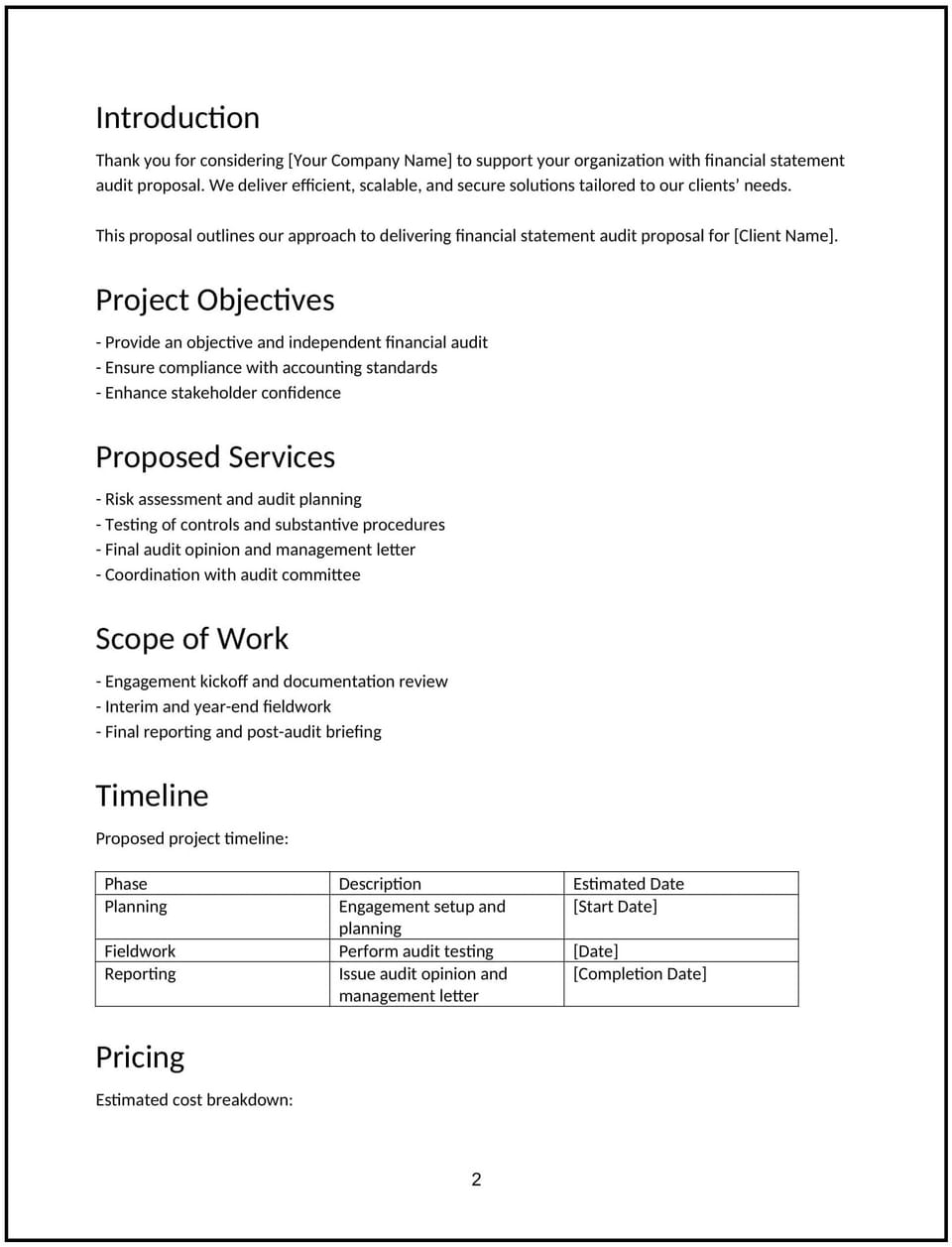

- Project overview: Summarize why the audit is being conducted (e.g., fundraising, lender requirement, regulatory deadline) and how you’ll meet that need.

- Scope of audit: Define which statements are covered — balance sheet, income statement, cash flow, footnotes — and specify the fiscal year(s).

- Standards and compliance: State whether the audit follows GAAP, IFRS, or another framework. Include any applicable regulatory or industry guidance.

- Methodology and process: Outline phases — planning, risk assessment, internal control testing, substantive testing, review, and final reporting.

- Roles and responsibilities: Clarify what your team handles and what the client needs to prepare (e.g., trial balances, reconciliations, contracts).

- Communication flow: Set expectations for status updates, issue escalation, and board/audit committee involvement if relevant.

- Deliverables: List what the client will receive — audit report, management letter, control recommendations, or financial disclosures.

- Timeline: Provide an estimated schedule — including planning, fieldwork, draft delivery, and sign-off.

- Pricing: Offer a clear model — fixed fee, hourly cap, or tiered based on entity complexity or revenue.

- Next steps: End with a clear CTA — such as providing preliminary financials, confirming access, or scheduling kickoff.

How to write an effective financial statement audit proposal

This proposal should feel precise, trustworthy, and execution-ready — especially for clients facing regulatory deadlines or investor pressure.

- Lead with clarity: Avoid audit jargon unless required. Help clients understand the process and their role.

- Emphasize independence: Reassure clients that you follow audit standards strictly — and won’t blur lines with advisory.

- Set expectations: Clients underestimate how much work audits require. Spell it out without overwhelming them.

- Include deliverable timelines: Many audits run late because no deadlines are locked. Include target dates to show control.

- Address risk professionally: Flag that your work provides reasonable, not absolute, assurance — and that certain misstatements may still go undetected.

Frequently asked questions (FAQs)

Should I include regulatory references like PCAOB or GAAS?

Only if they’re relevant to the client. For private companies, stick to GAAP or IFRS. Use PCAOB/GAAS language if the client has SEC ties or public company plans.

What if the client doesn’t have clean books or a dedicated controller?

Be honest about limitations. Offer audit-readiness or pre-audit cleanup as a separate phase or partner referral.

How should I handle multi-entity audits?

Clarify scope per entity. Include whether consolidations are required and if you’re auditing individual or combined financials.

Should I include materiality thresholds in the proposal?

Mention that thresholds will be set during planning — but don’t hard-code them unless already agreed. Materiality is judgment-based and evolves.

Is it worth including sample deliverables or report excerpts?

Yes — including a sample audit report or anonymized management letter helps demystify the output and build trust.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.