Fundraising strategy proposal: Free template

Customize this free fundraising strategy proposal with Cobrief

Open this free fundraising strategy proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on the startup’s stage, target investors, and capital goals. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for helping startups plan and execute a capital raise, whether it’s pre-seed, seed, or Series A. Whether you’re an external advisor or part of the founding team, this version gives you a structured head start and removes the guesswork.

What is a fundraising strategy proposal?

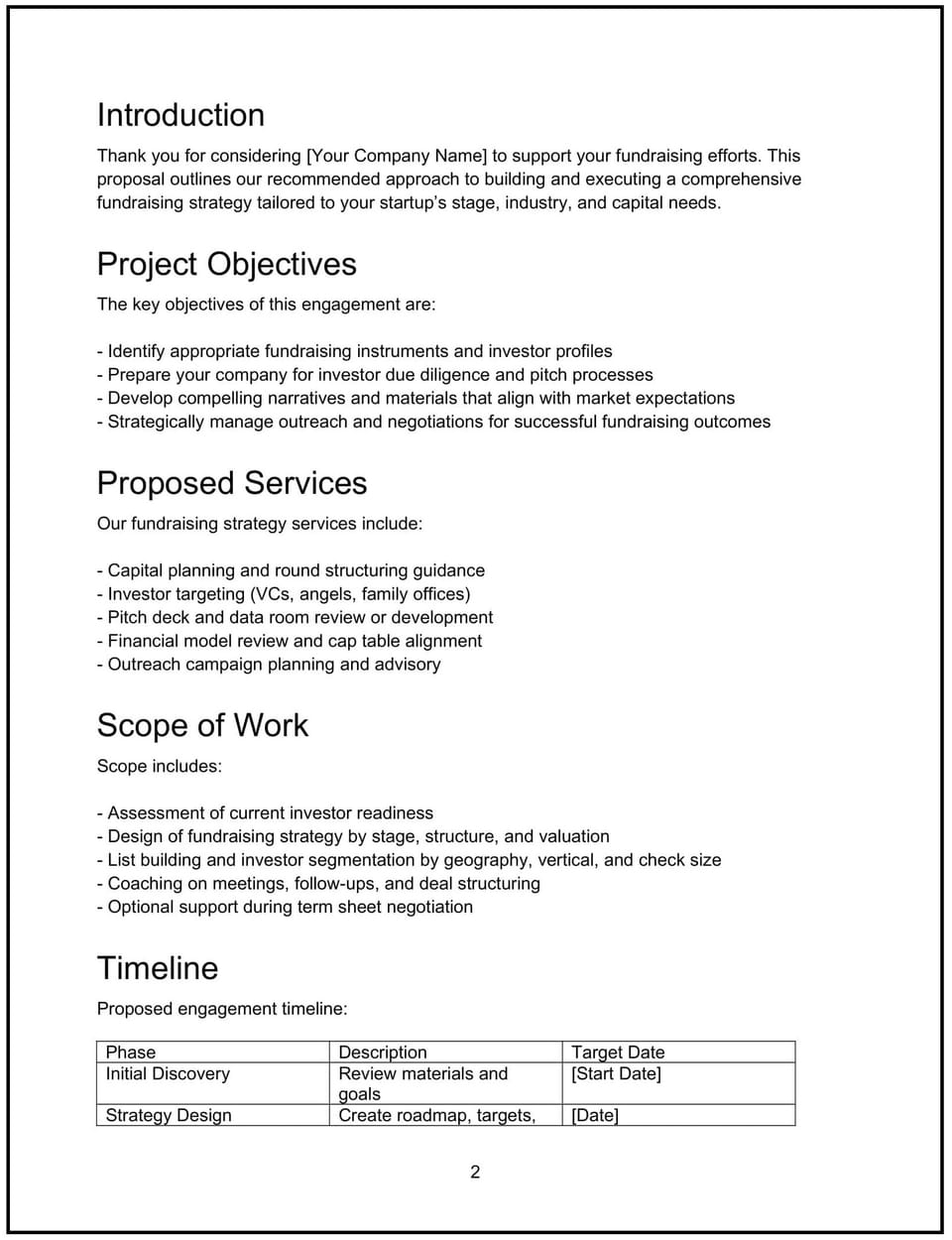

A fundraising strategy proposal is a document that outlines how you’ll support a startup’s capital raise — including preparation, positioning, investor targeting, and execution. It helps align expectations around deliverables like pitch materials, financials, outreach lists, and timelines.

Typically sent after a discovery call or strategy session, this proposal explains the scope of work, key milestones, and how your support will improve fundraising outcomes — from speed and credibility to round size and valuation.

A strong fundraising strategy proposal helps you:

- Frame the capital raise with structure, not guesswork

- Build alignment around messaging, materials, and sequencing

- Reduce founder distraction during the raise

- Position you as a high-leverage strategic partner

Use this proposal when a startup needs more than a deck — they need a full go-to-market plan for capital.

Why use Cobrief to edit your proposal

Cobrief makes it easy to turn your fundraising support into a structured, investor-ready proposal — with built-in AI to help refine and improve each section.

- Edit the proposal directly in your browser: No docs or slides required — just write, refine, and send.

- Rewrite sections with AI: Adjust tone, simplify language, or tailor the pitch to different founder types.

- Run a one-click AI review: Catch vague promises, tighten value props, or fill in weak transitions.

- Apply AI suggestions instantly: Accept all edits or review them one-by-one.

- Share or export instantly: Export as a clean PDF or DOCX or send a live link straight from Cobrief.

Spend less time on formatting — more on fundraising.

When to use this proposal

This fundraising strategy proposal is ideal for scenarios like:

- Supporting a founder preparing to raise their first round

- Formalizing your work as a fractional CFO, COO, or advisor

- Helping a portfolio company or accelerator participant get investor-ready

- Planning a rebrand or repositioning ahead of fundraising

- Packaging a roadmap for a bridge, SAFE, or Series A raise

Use this proposal whenever you want to provide structured, high-impact fundraising support.

What to include in a fundraising strategy proposal

This template helps you explain your support clearly, position your value, and lay out a focused fundraising plan. Here's how to structure it:

- Executive summary: Briefly outline the raise context (e.g., “You’re preparing to raise $1.2M seed in Q3 to accelerate GTM”). Reaffirm the startup’s momentum and your proposed role.

- Scope of services: Detail what’s included — e.g., pitch deck review/creation, narrative development, investor list building, financial model cleanup, email scripts, CRM setup, warm intros, and calendar strategy.

- Timeline: Break it into phases — e.g., Week 1: Audit; Weeks 2–3: Materials + list build; Weeks 4–8: Outreach + live support.

- Fees: State your fee structure (flat rate, retainer, milestone-based). Clarify what's included and if additional rounds or decks are separate.

- Terms and expectations: Clarify your role (e.g., strategic advisor vs. hands-on support), founder responsibilities, weekly syncs, and availability.

- Next steps: Close with a simple CTA — “Reply to confirm,” “Schedule kickoff call,” or “Review agreement to begin engagement.”

How to write an effective fundraising strategy proposal

Founders are under pressure during a raise — your proposal should make their life easier, not harder. Here’s how to do that:

- Position yourself as an operator, not a pitch consultant: Make it clear you understand how fundraising fits into the business

- Anchor your support to outcomes: Speed, quality, focus — not just documents

- Avoid vague promises: Be clear about what deliverables are included (and not)

- Keep formatting simple: Use clear headers, bullets, and short sections so it’s easy to digest

- Speak their language: If the founder is technical, simplify finance. If they’re commercial, dial up investor psychology.

- End with clarity: Don’t let a great proposal stall — give them a clean next step.

Frequently asked questions (FAQs)

Is this just a deck-writing service?

No — this proposal includes full fundraising strategy support, from messaging and investor targeting to execution sequencing.

Can I use this for SAFE or priced rounds?

Yes — you can adapt the strategy to match the raise structure. Just tailor the messaging and investor targets accordingly.

Do you make investor introductions?

Only if stated in scope. You can clarify whether you’ll provide warm intros, curated outreach lists, or CRM setup.

What if the startup isn’t ready to raise yet?

You can adjust the proposal to focus on readiness — e.g., cleaning up the model, refining GTM narrative, or prepping for a future raise.

Is this a legally binding agreement?

No — this is a proposal. You can follow up with a formal agreement or SOW if needed.

Can I export this as a PDF?

Yes — Cobrief lets you download a clean, professionally formatted PDF or DOCX version in seconds.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.