Got contracts to review? While you're here for proposals, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Customize this free startup funding advisory proposal with Cobrief

Open this free startup funding advisory proposal in Cobrief and start editing it instantly using AI. You can adjust the tone, structure, and content based on your fundraising approach, startup stage, and investor network. You can also use AI to review your draft — spot gaps, tighten language, and improve clarity before sending.

Once you're done, send, download, or save the proposal in one click — no formatting or setup required.

This template is fully customizable and built for real-world use — ideal for pitching investor readiness support, pitch deck development, financial modeling, investor outreach, or end-to-end fundraising advisory. Whether you're a solo advisor, CFO-for-hire, or startup consultant, this version gives you a structured head start and removes the guesswork.

What is a startup funding advisory proposal?

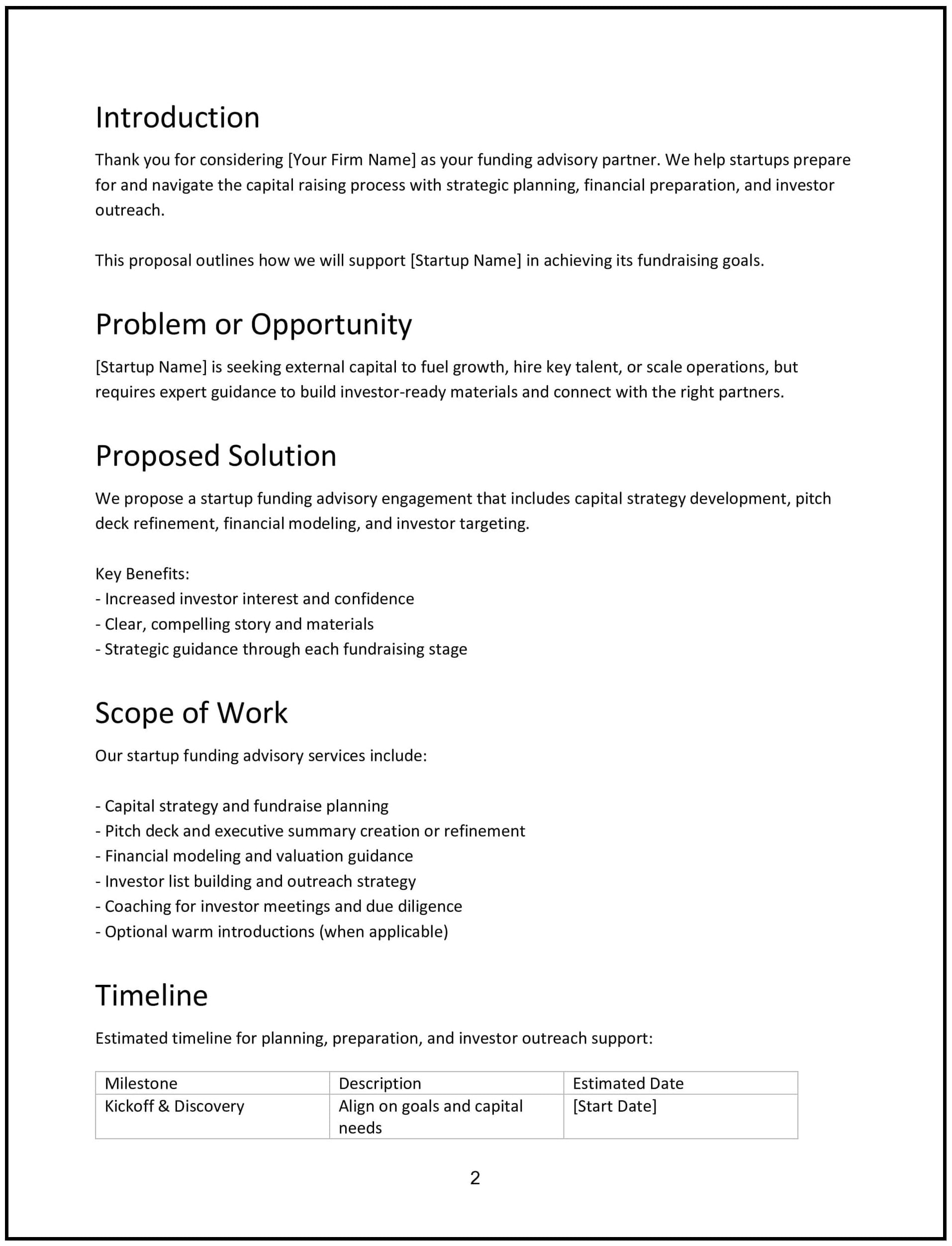

A startup funding advisory proposal outlines how you’ll support a startup in preparing for and securing external capital. It typically includes scope around pitch material preparation, investor targeting, financial modeling, valuation guidance, term sheet review, and strategic fundraising planning.

This type of proposal helps founders understand how your expertise will help them raise faster, smarter, and with better investor alignment.

A strong funding advisory proposal helps you:

- Clarify where the startup is today and what they need to raise.

- Define the advisory services you’ll provide and the fundraising strategy.

- Build trust by showing structure, speed, and credibility.

- Set clear expectations around timeline, deliverables, and pricing.

Why use Cobrief to edit your proposal

Cobrief helps you draft, review, and send polished proposals — with AI that speeds up every section of the process.

- Edit the proposal directly in your browser: No formatting or setup needed.

- Rewrite sections with AI: Refine messaging, clarify technical points, or improve structure instantly.

- Run a one-click AI review: Spot vague language or repetitive copy and improve it instantly.

- Apply AI suggestions instantly: Accept edits one-by-one or apply all changes in one click.

- Share or export instantly: Send via Cobrief or download a clean PDF or DOCX version.

Deliver high-trust proposals in less time — and win more mandates.

When to use this proposal

Use this startup funding advisory proposal for:

- Supporting pre-seed to Series B fundraising rounds.

- Helping founders develop investor-ready materials.

- Guiding startups through valuation, dilution, and cap table modeling.

- Coaching founders on pitch delivery and investor Q&A.

- Acting as a fractional CFO or advisor during the raise.

It works for one-time projects or ongoing fundraising support.

What to include in a startup funding advisory proposal

Each section helps the founder understand what you’ll do, how you’ll help, and what comes next:

- Executive summary: Outline the company’s funding goal, where they are in the process, and how your support will help them raise faster and with more investor confidence.

- Scope of work: Define what’s included — e.g., pitch deck refinement, financial modeling, investor targeting strategy, term sheet review, cap table guidance, and outreach planning.

- Process and timeline: Break down your process into phases — e.g., assessment, material preparation, investor outreach, negotiations — with timelines for each.

- Deliverables: List what the startup will receive — deck drafts, model outputs, investor lists, email templates, or fundraising tracker.

- Pricing: Present your structure — fixed fee, monthly retainer, or milestone-based. Include add-ons like active outreach, pitch coaching, or post-close support.

- Terms and conditions: Cover confidentiality, data access, termination, and payment terms.

- Next steps: End with a clear CTA — such as “Reply to confirm,” “Schedule a discovery call,” or “Sign to proceed.”

How to write an effective startup funding advisory proposal

This proposal should feel strategic, focused, and credible:

- Speak to founder pain: Clarify how your help avoids wasted time and mismatched investors.

- Be practical: Frame your advice as structured and focused on real outcomes.

- Offer proof of expertise: Mention previous raises, roles, or investor connections (if applicable).

- Avoid jargon: Use language that is strategic, not overly financial or legalistic.

- Use clean formatting: Headings, short sections, and bullet points aid readability.

- Include a clear next step: Help the founder move forward confidently.